Check out our final recap of industry research for the 2022 holiday season below!

The 2022 holiday season was impacted by rates of inflation, heavy promotional activity due to high inventory levels, and a discerning, discount-hunting shopper – yet, in spite of these challenges, consumers spent more than they did last year! According to Mastercard SpendingPulse, sales increased 7.6% over Nov 1 through Dec 24 compared to the same period in 2021. (Source: Total Retail)

Competition for wallet share also influenced sales as consumers diversified their holiday spending, investing on experiences and festive gatherings. Although the shadow of a potential recession continues to concern retailers, most categories are expected to revert to pre-pandemic levels of growth as we look to the year ahead.

2022 Holiday Season Results

Shoppers spent record-breaking $211.7B online during 2022 holiday season: report Retail Dive (1/6/23)

(Read more…)

- Shoppers spent a record-breaking $211.7B on e-commerce between Nov 1 and Dec 31, a 3.5% bump from 2021

- During Cyber Week, shoppers spent $35.5B online

- Online toy sales saw the greatest increase compared to October 2022 at 206%, followed by video games (115%) and apparel and accessories (94%). Watches also saw a sharp increase at 108%, followed by baby toys (101%), gift cards (98%), cosmetics (90%) and outdoor grills (86%)

- Across major e-commerce categories, discounts hit record highs this holiday season. Retailers discounted toys the most at 34%, followed by electronics (25%)

- Higher prices and greater consumer demand fueled the spike and e-commerce sales. Big deals drew in consumers and drove volume, helping retailers who were challenged with oversupply issues

- While buy now, pay later orders saw a 4% bump YOY during the 2022 holiday season, revenue from those purchases dipped by 2%, possibly due to shoppers using installment payment platforms for smaller purchases

- Nearly half of online sales came via smartphones this year, with Christmas Day setting a new mobile shipping record, driving the majority (61%) of online sales

- Leading up to the 2022 holiday season, shoppers increased their online shopping – October saw consumers spend $72.2B in e-commerce transactions, up 10.9% from September 2022 but about the same as the $72.4B they spent in October 2021

- Home décor and outerwear sales increased exponentially by 189% and 142% respectively

2022 U.S. Holiday Sales Increase Despite Inflation, New Report Shows Total Retail (1/3/23)

(Read more…)

- Black Friday saw the highest spending of the period, with a 12% increase that day over the same time in 2021

- Online sales grew 10.6% compared to the same roughly two-month period the year before

- The inflation rate slowed toward the end of 2022, which could explain the higher holiday spending over 2021. Also, with prices generally higher in 2022 than in the year prior, it is expected that overall sales numbers would increase as well, especially with consumers returning to more in-person gift-giving gatherings

Total holiday spend grew nearly 7% in 2022: report Retail Dive (1/4/23)

(Read more…)

- According to a new GlobalData survey, consumer holiday-related spending rose by 6.7% compared to 2021, in line with the NRF’s November prediction that retail sales would increase between 6% and 8% in that period

- Shoppers spent 8.4% more on Thanksgiving, 6.9% more during Black Friday and Cyber Week, and 6.5% more during Christmas and other purchases during the holiday season

- Inflation played a large part in that growth. Thanksgiving volumes only rose 0.2%, and Black Friday and Cyber Week volumes dipped by 1.1% while Christmas and other holiday season volume declined by 1.6%

- Over the holiday season, online sales rose by 7.4% and physical store sales increased by 6.6%, however while online sales were helpful, the elevated costs of fulfilling online orders cut into retailers’ profits

- The NRF said 196.7M consumers shopped in store and online between Thanksgiving and Cyber Monday, up 17M from 2021

- On the other hand, Placer.ai noted that Black Friday in-store shopping at malls and big-box retailers saw a drop compared to 2021

- Meanwhile, Adobe Analytics found that shoppers spent $11.3B during Cyber Monday sales, a 5.8% bump from 2021

- On average, American shoppers bought gifts for about four people in 2022, down from roughly six people in 2021

- Nearly two-thirds of shoppers (63.1%) set aside a budget for their holiday gift purchases in 2022, up from less than half (45.6%) in 2021

- More consumers searched for discounts during the 2022 holiday seasons – the share of consumers who bought some holiday items at a discount increased from 38.4% in 2021 to 56.3% in 2022

Data Shows 189 Million U.S. Consumers Shopped on Super Saturday Total Retail (12/20/22)

(Read more…)

- Over 189M people, over 73% of US consumers, shopped on Super Saturday – 71% of shoppers purchased holiday gifts, while 40% spent on dining and 22% spent on entertainment

- The top reason consumers shopped on Super Saturday was to take advantage of deals and promotions for lower prices (39%), followed by still having more people to buy gifts for (37%), and buying additional gifts for people (33%)

- 70% of consumers shopped in a physical store on Super Saturday, while 29% shopped at Amazon.com or other pure-play online retailers

- 50% of shoppers took advantage of buying online and picking up in-store

- Shoppers identified the lowest prices (51%), in-stock products (46%), and ease of checkout (36%) as the primary factors in choosing where to shop

- Majority (54%) of shoppers noted they spent more than planned, 56% used debit cards, 47% used credit cards, and 46% used cash

- Overall, 90% of shoppers said inflation impacted their shopping on Super Saturday

- Discount and dollar stores were Super Saturday’s winning retail segment, seeing visits up 1.1% YOY and 7.8% compared to 2019

US shoppers took on over $1,500 in holiday debt: report Retail Dive (1/6/23)

(Read more…)

- More than a third (35%) of consumers took on debt to pay for their holiday purchases in 2022, a slight decrease from 36% in 2021. However, consumers accumulated $1549 in debt on average, up 24% from $1249 in 2021

- 37% said they expect to take five months or more to pay off their debt, an increase from 28% in 2021

- 24% had used buy now, pay later to finance their 2022 holiday shopping, a decrease from 33% last year

- BNPL platforms came second to credit card usage (59%), and store credit cards (24%) took the third spot for top sources of holiday spending debt

2023 Outlook and Predictions

Estimating the Long-Term Impact of Major Events: Evidence from COVID-19 Earnest Research (1/5/23)

(Read more…)

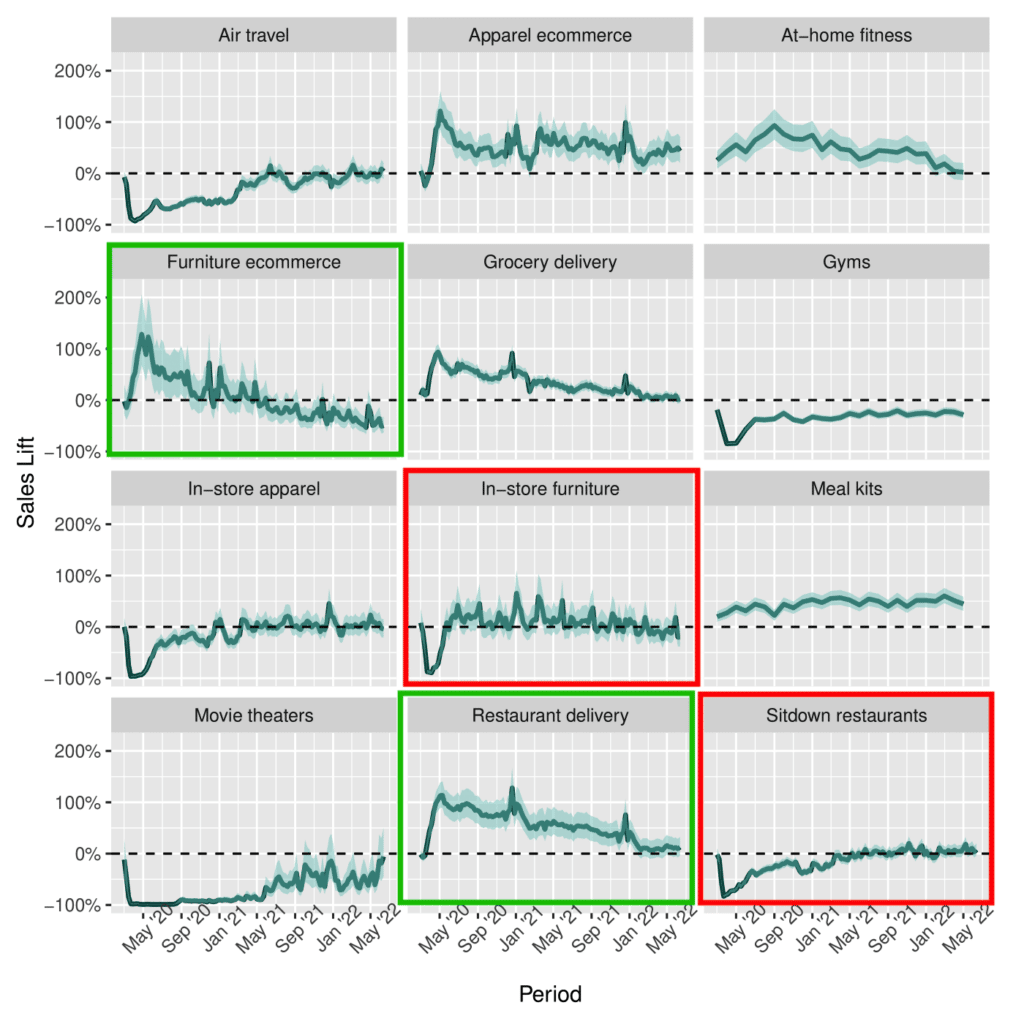

- The pandemic caused sales to more than double in the short-run in the furniture, e-commerce, and restaurant delivery categories

- Conversely, COVID caused declines in excess of 80% at their non-digital counterparts, in-store furniture and sit-down restaurants

- However, by June 2022, sales in most categories reverted back to their pre-pandemic baselines

- Furniture e-commerce passed through this baseline, with sales cratering to 50% of its non-pandemic baseline, this is likely due to poor performance as people who bought furniture for their work from home offices in 2020 and 2021 no longer needed to purchase in 2022

- According to Earnest Research, while recession may push all categories downwards, the “light at the end of the tunnel” for most categories is what they expected in a normal no-pandemic world

How D2C retail brands are evolving in 5 charts Insider (12/19/22)

(Read more…)

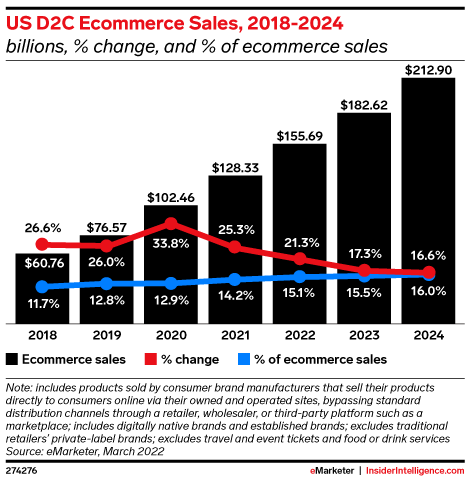

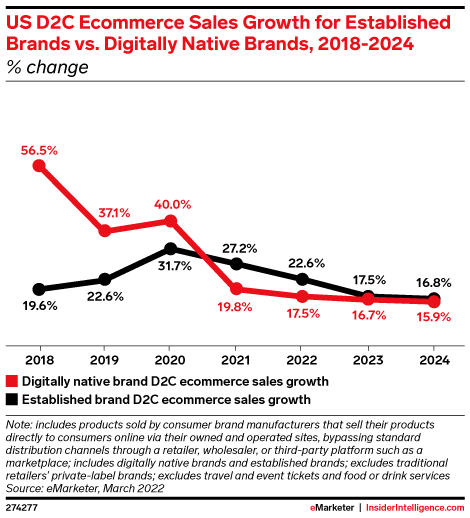

- Insider forecasts that DTC ecommerce sales will see double-digit increases through 2024, when they will hit nearly $213B, making up 16.6% of all ecommerce sales – this growth may be driven in part by an increase in the number of digital DTC brand buyers, which will grow to reach 11M next year, representing 40% of the US population

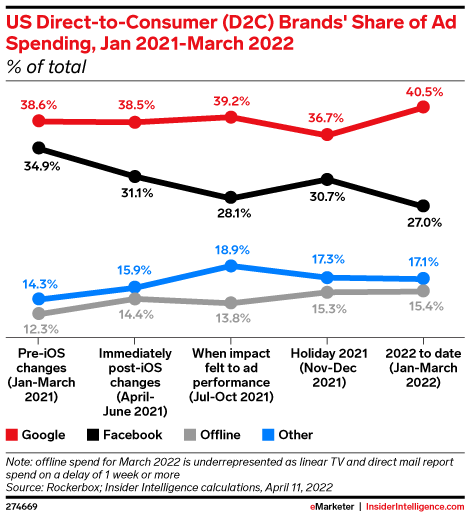

- Google and TikTok are continuing to benefit from Meta’s backslide

Why 2023 Will Set a New Baseline for Retail Business of Fashion (1/6/23)

(Read more…)

- Supply chain disruptions have largely been resolved, meaning most goods will arrive on schedule

- The cost of shipping clothes from factories is almost back to pre-pandemic levels

- E-commerce continues to increase as a share of overall sales, but at the relaxed pace seen in the 2010s, creating new opportunities for in-person shopping and multi-brand retail

- Brands that in 2020 were contemplating an all-digital future are back to striking a balance between brick-and-mortar retail, online, and wholesale

- Establishing a sense of post-pandemic normalcy means fixing LY’s mistakes – consumers kept spending last year but not to the same degree as they ran through their pandemic spendings; many retailers were stuck with too much inventory

- Economists predict that consumer sentiment will remain tepid well into 2023. Coresight Research forecasts a 2% decline in the apparel and footwear market size this year

- Controlling costs and adding flexibility in the supply chain will be the “recipe for growth in 2023” – Coresight Research expects the market to fully normalize by 2024

The Year Ahead: The DTC Reckoning Is Coming For Fashion Business of Fashion (1/5/23)

(Read more…)

- Unprecedented e-commerce growth rates are normalizing. E-commerce sales are expected to grow at a CAGR of 10% between 2022 and 2025, far slower than the 30% growth seen from 2019 to 2020, and more in line with the pre-pandemic rates of 15% and 14% from 2016 to 2019

- Digital marketing costs continue to grow alongside online return rates, costing brands between $21 and $46 per returned product on average

- In 2022, physical store openings outpaced closures for the first time in over three years. Brands are doubling down on physical touchpoints!

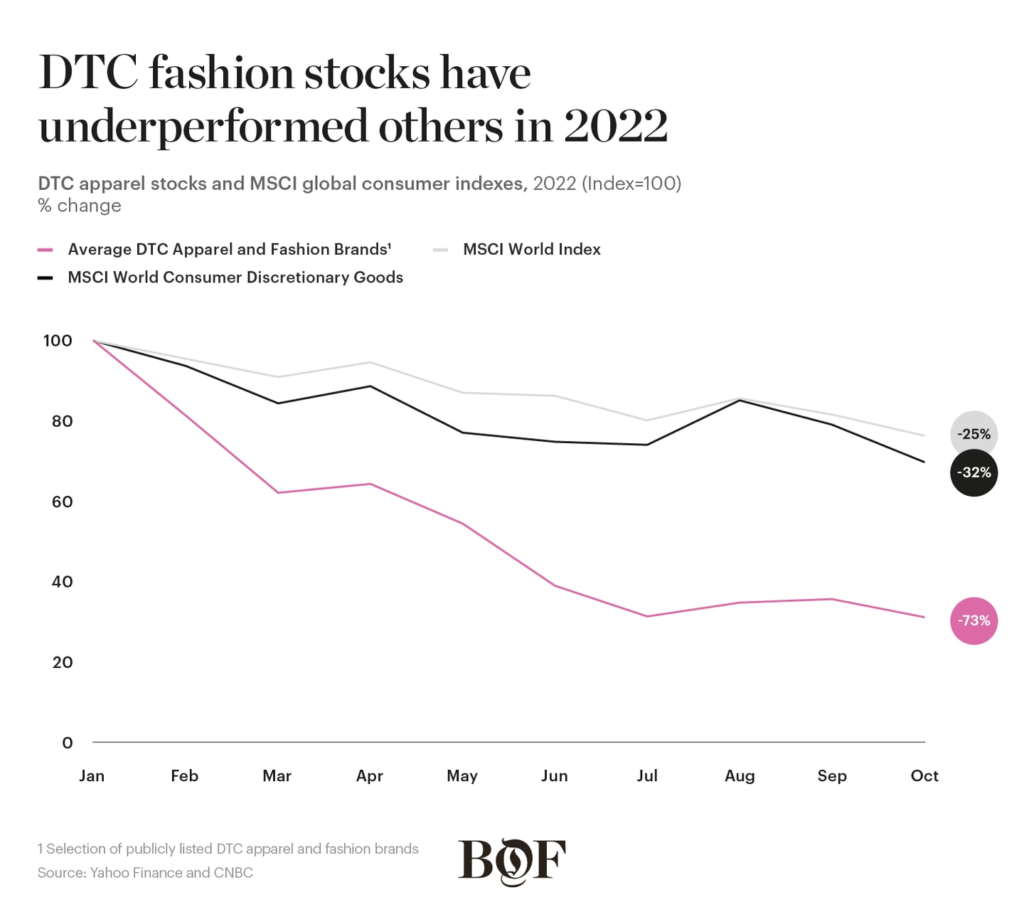

- The share prices of 10 apparel DTC brands fell by around 70% in the first three quarters of 2022, compared with the MSCI World Consumer Discretionary Goods Index’s decline of 32% over the same period

- Though retail foot traffic remains between 10% to 20% lower than in 2019, the productivity of stores has risen: sales per square foot increased 13% YOY in 2021

- The role of brick-and-mortar is evolving – to generate higher revenue, stores should be digitally enabled and fit seamlessly into the overall physical-digital multichannel strategy. Strategies like integrating mobile apps to optimize in-store experiences can drive greater sales in each store

- Carefully selected partnerships with high-quality wholesalers and multi-brand retailers can generate value for brands. Before, retailers were dictating term; now, it’s a collaboration, a partnership between brands and retailers

Why so many apparel retailers are shaking up their C-suites in 2023 Modern Retail (1/6/23)

(Read more…)

- Trends are changing quickly and people are spending less on discretionary items. Last quarter, ChainStoreAge reported that 41% of shoppers forwent buying apparel to purchase products in other categories

- Companies continue to grapple with supply chain challenges, as many retailers also stuck with too much inventory and have turned to discounting to drive up sales

- There’s also been a “collapse in the middle” in recent years; higher-end apparel and value-oriented fashion have done well, but the “brand and retailers that are in the middle have lost a tremendous amount of market share”

- The apparel industry is undergoing a “digital rethinking of physical retail” as buy online, pick-up in store has now become the norm, and others are banking on mobile check-out and visibility into inventory to drive customers to physical stores

Why retailers will focus on localized neighborhood models in 2023 Modern Retail (12/30/22)

(Read more…)

- Some retailers are starting to ditch the standardized approach to physical stores by tailoring each store (adjusting their assortment and altering their store designs) to the surrounding community. This approach allows retailers to increased their relevance to the local community and possibly gain a competitive advantage over other retailers in the area

- Shoppers are demanding more than a transactional relationship from brands – 62% said they expect a personalized experience from brands

- The shift towards a more local assortment also coincides with the shift in spending power across demographics

Messaging Examples

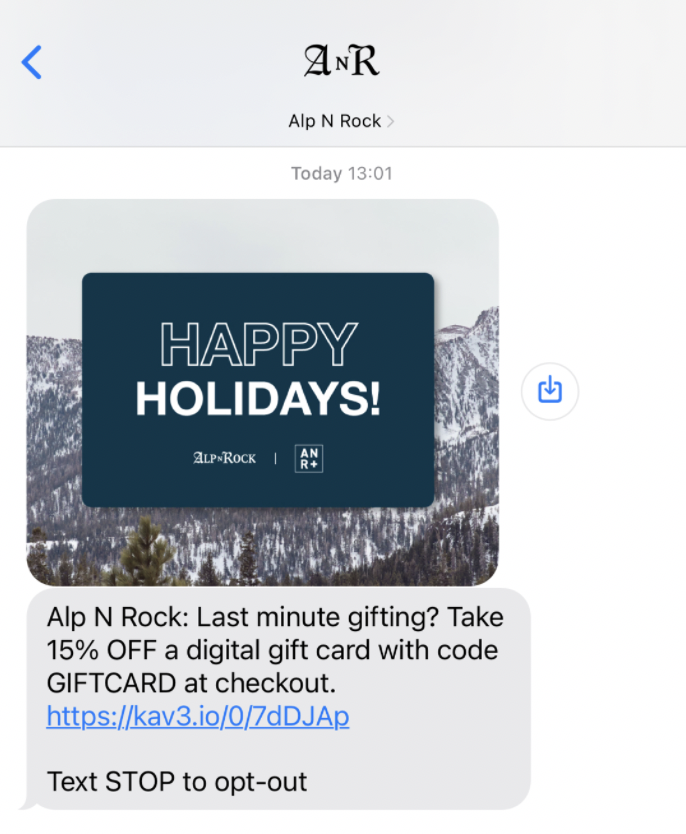

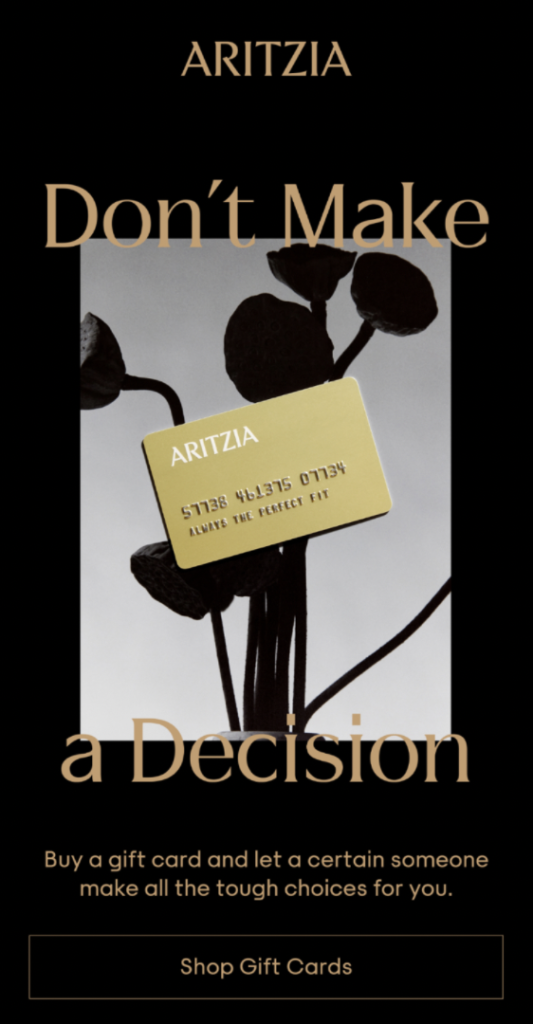

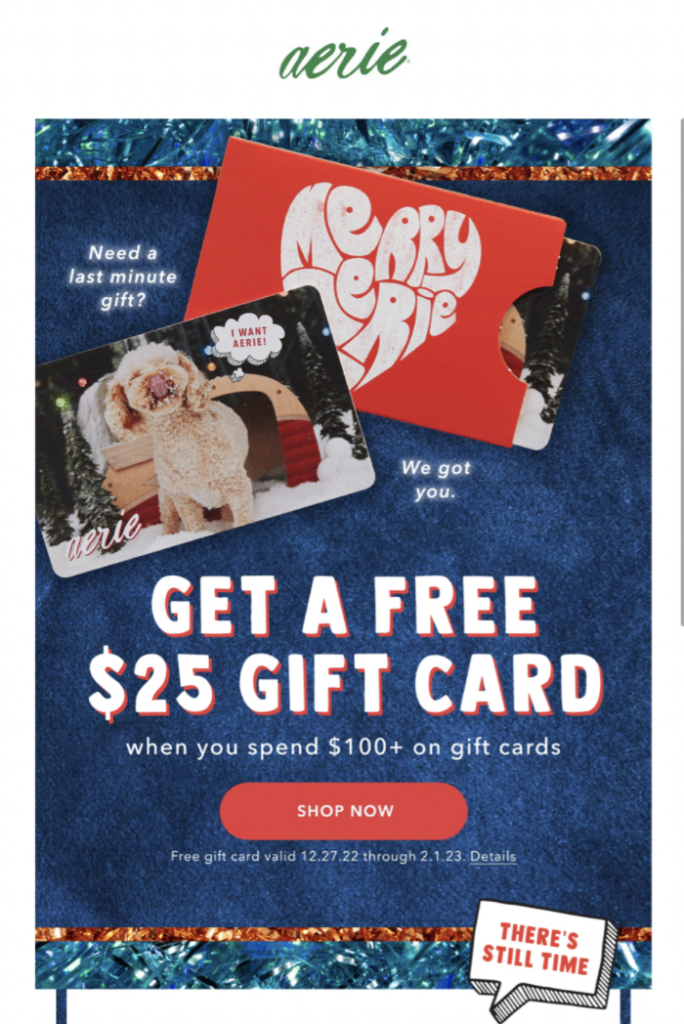

Give A Gift Card!

Post-Holiday / End of Year Promos

Please reach out to your account team if you have any questions – we are here as a resource and hope you found this helpful.

We wish you a great start to 2023 – we’re in this together!