Predicting and planning for Holiday 2020 is challenging to say the least. But as year over year (YOY) data is starting to normalize, there are key trends emerging. We hope this recap of industry data and digital marketing trends are helpful as you prepare for the critical holiday season.

Normalizing Consumer Behavior Despite June Spikes

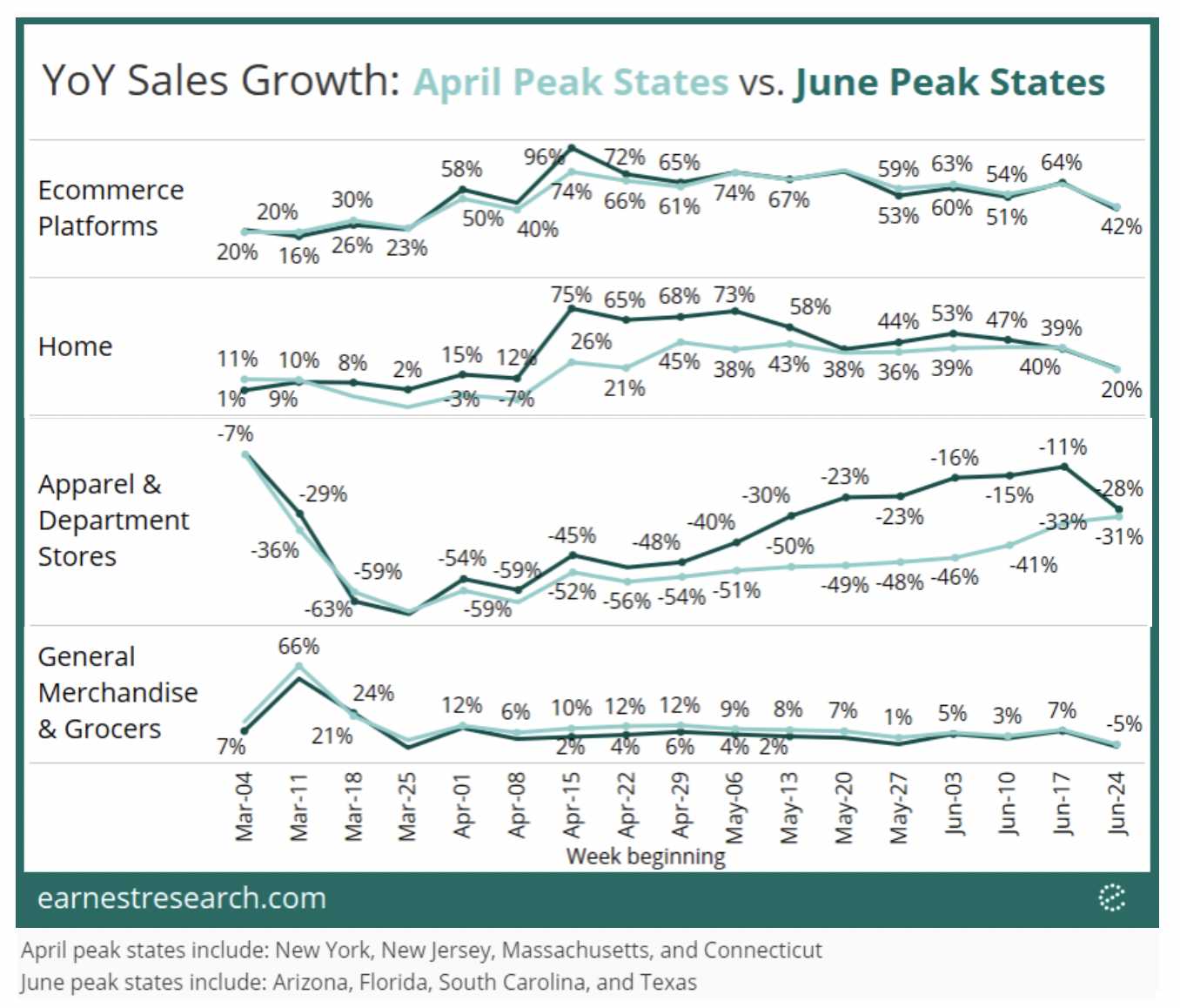

Data through late June shows that consumers in states seeing a June peak in virus cases are behaving similar to those in April peak states in terms of Ecommerce, Home, and General Merchandise. This potentially hints to consumer behavior normalizing in June, which begs the question: have we found our new normal?

YOY Sales Growth by Category Shows Clear Trends

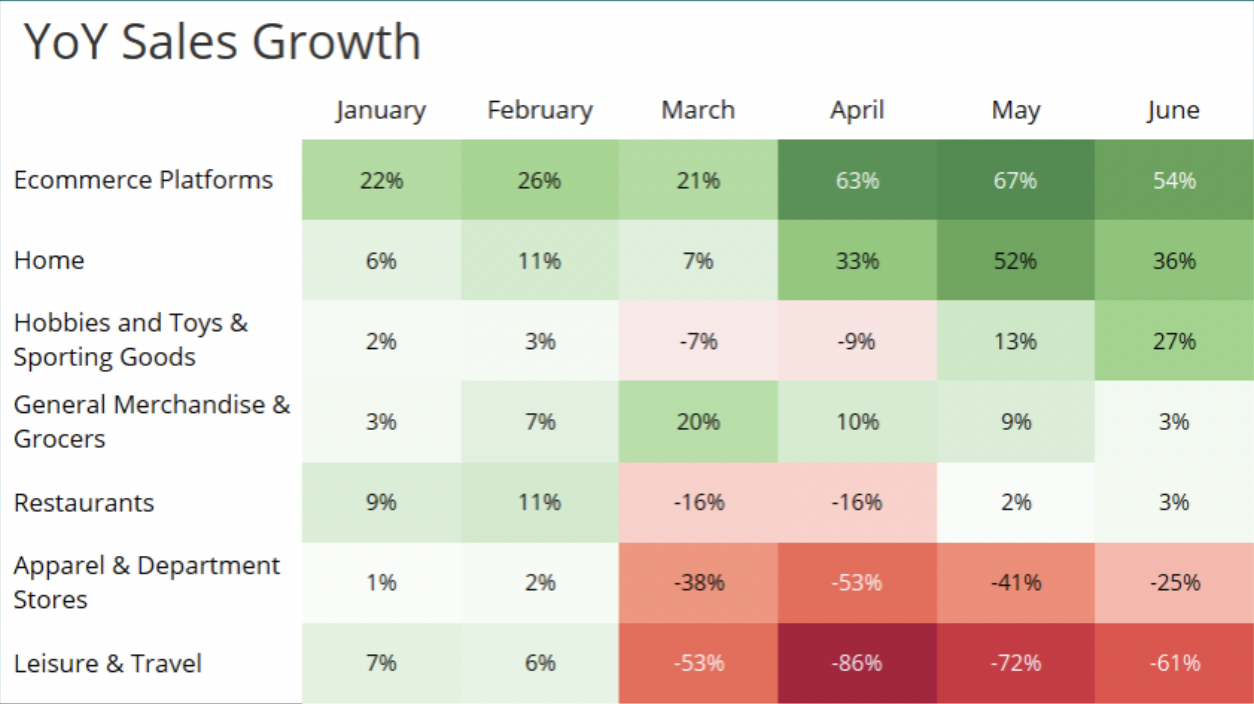

Clear trends have emerged in YOY growth by category for the first half of 2020:

- Ecommerce platforms skyrocketed

- Home, Hobbies, Toys and Sporting Goods saw strong growth

- Grocery saw a March stock-up spike

- Apparel and Department Stores took a hit (this data is for all retail both online and in-store). Many of our DTC high-ticket fashion brands continued to see strong results in Spring 2020

- Spending on Leisure and Travel halted

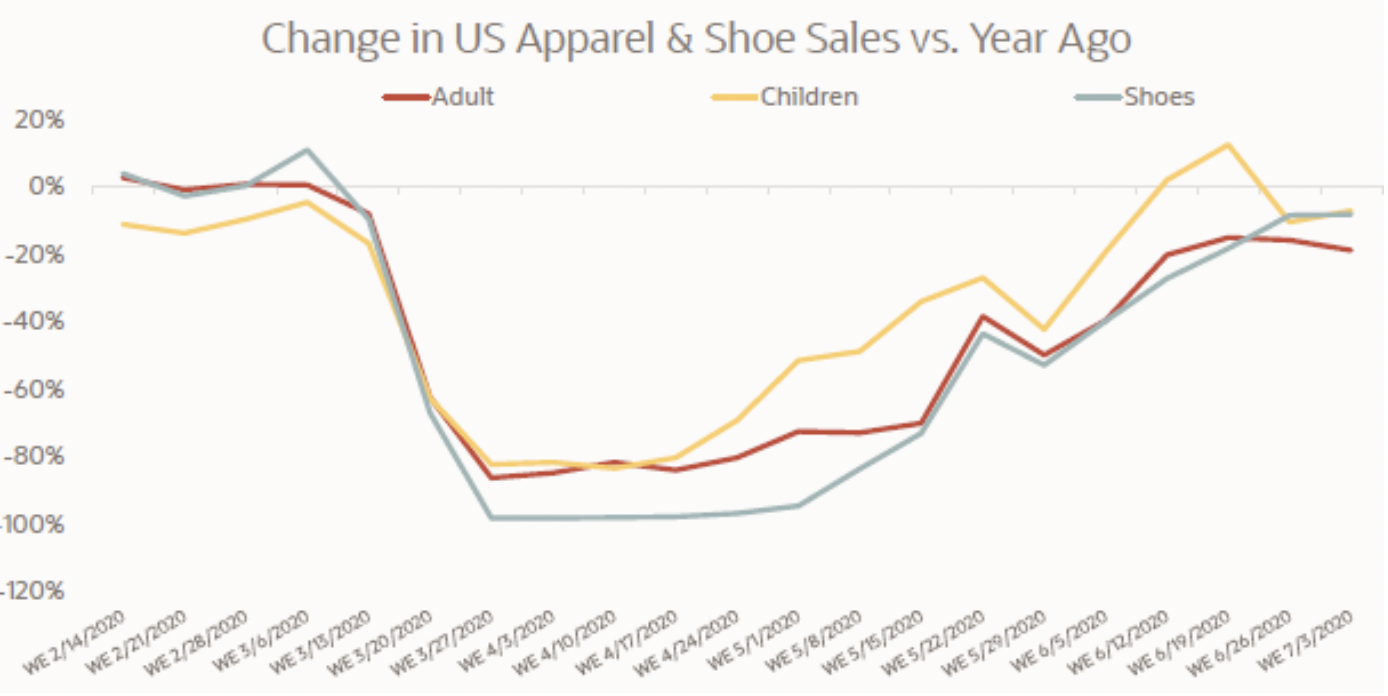

Children’s Apparel is Recovering in Terms of YOY Sales

Adult Apparel and Shoes continue to be down slightly YOY, but Children’s has begun to recover to 2019 levels. While back to school is different than we have ever known it to be, it’s evident that parents still want to maintain some normalcy for children, and likely this notable recovery are due to back to school purchases for children.

While we know many mass market brands and department stores saw steep declines in March and April, many of our high-ticket, DTC fashion brands have seen strength throughout the spring and summer.

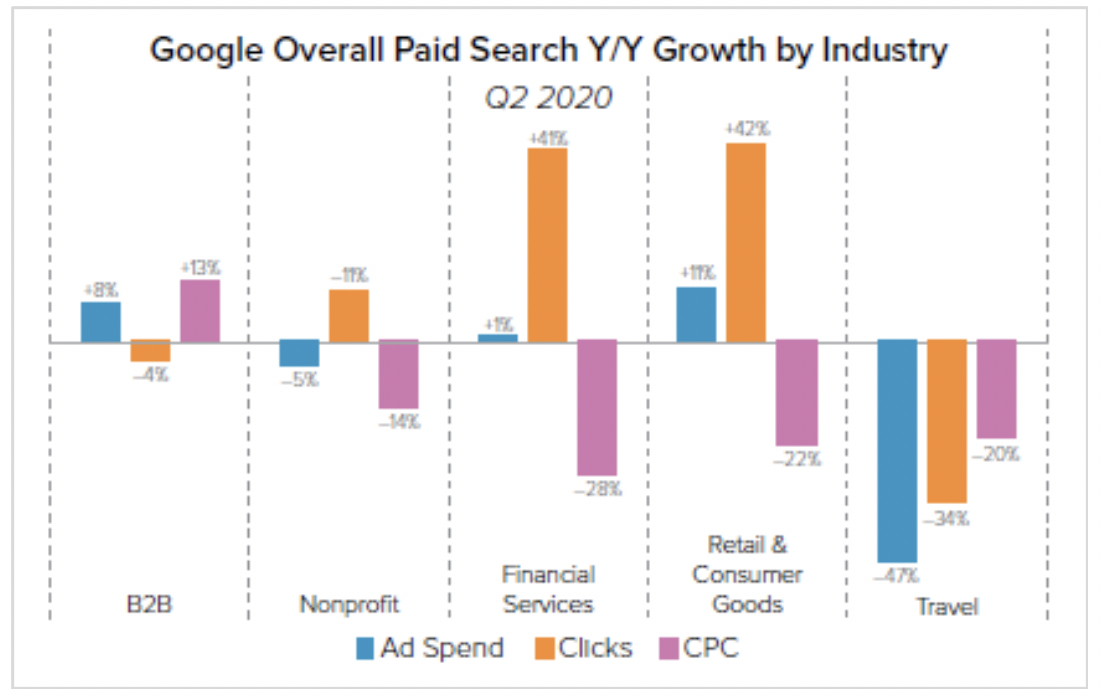

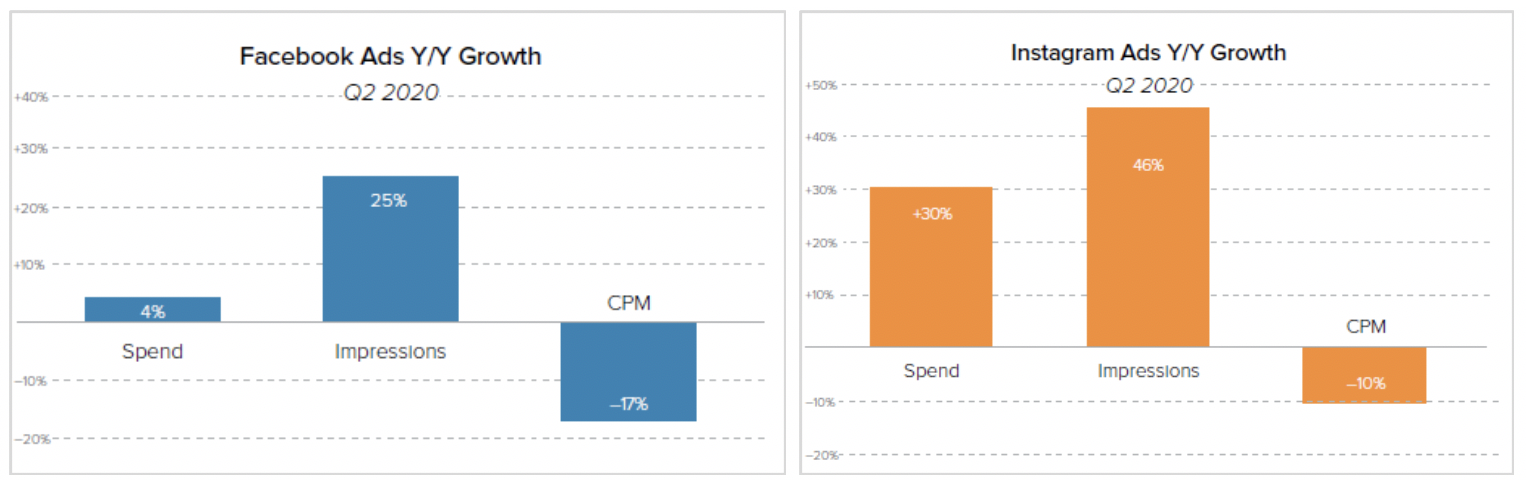

CPMs in Paid Social and CPCs in Paid Search Decreased YOY in Q2

As Amazon and travel companies pulled spend in March, YOY paid search spend growth slowed. But, strength in online conversion and ad clicks (+38% YOY in Q2) led to an overall 21% YOY decrease in CPCs and a 22% decrease in retail CPCs.

Due to considerable increases in impressions across Facebook and Instagram in Q2, CPMs were down 17% on Facebook and down 10% on Instagram. However, in Q4 2019, CPMs rose 20% across both platforms. With increased election spending this fall, we predict an increase in CPMs in Q3 and Q4.

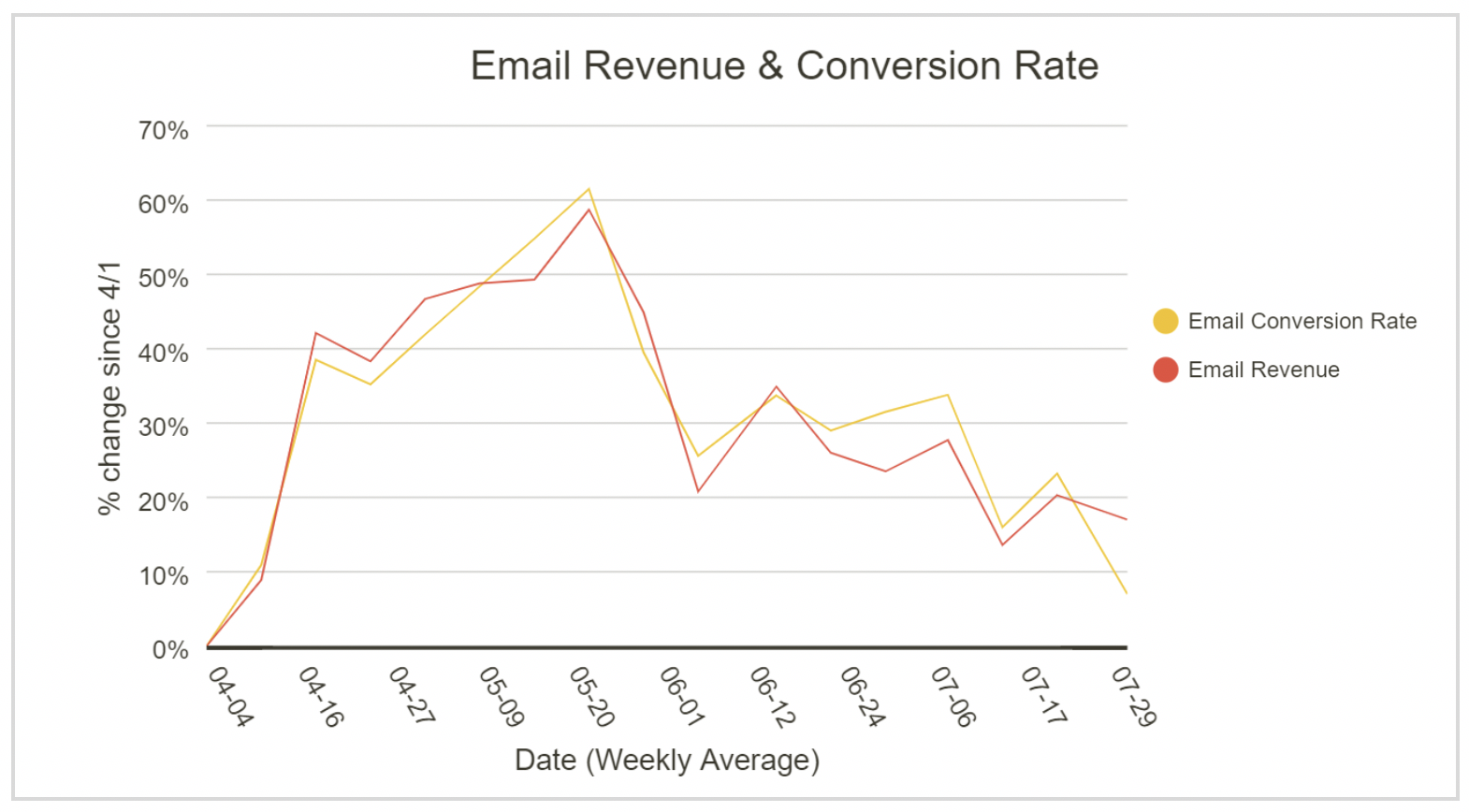

Email Performance Remains Strong

Email conversion rates remain above pre-COVID-19 benchmarks but are down from April and May peaks. This shows the importance of cutting through the noise this fall with personalization, triggered series, promotions, and valuable content.

Recommendations for Holiday Planning

- Ensure you understand your CPM and CPC benchmarks across core channels and watch for fluctuations. Fall and Holiday is not the time to run awareness campaigns (run those now!). Campaigns should instead focus on driving conversions.

- In email, be aware that customer behavior has changed and segment accordingly. Build personalization and core triggered series into your email strategy and begin testing now.

- Start building declared data or a CRM database. Even simple surveys asking subscribers for zip code, category preferences, or style quizzes can inform holiday segmentation.

- Test new channels (e.g., SMS, Connected TV, YouTube, Podcasts, Alternate Print Media) now to vet for holiday spend opportunities.