In Q1, retail sales stabilized as consumers resumed spending on passion areas such as travel, live entertainment, indoor dining, and other in-person activities.

January saw retail sales rebound, climbing to $650B, a 3.8% growth over December 2021, signaling optimism for retailers in the new year. (Source: Total Retail) Consumer spending rose 2% in January and prices climbed faster despite the Omicron wave of Covid infections; however, the conflict in Ukraine could curb growth. (Source: WSJ)

Despite news on high inflation, consumers don’t believe it will be long-lasting. An NRF survey in January found that consumers expect inflation to rise 5.8% over the next year, but only 3.5% over the next three years. (Source: NRF)

In March, we saw consumers slow down their travel spending, a reversal from previous months, suggesting that they could be putting off future discretionary spending and adopting more conservative spending outlooks based on uncertainty around the Ukraine-Russia war. (Source: NRF) We also so consumers slow spending in March with many of our clients seeing YOY declines in ecommerce revenue for the month.

Consumers Reassess Priorities

After a transformational and tumultuous time, shoppers are more conscious of health, wellness, and financial stability than ever before.

Top goals of consumers include exercising more, eating healthier, supporting mental health, and seeking financial well-being. Consumer brands should consider repositioning their rewards programs to become “power tools” in their customers’ wellness journeys. (Source: Total Retail)

Sustainability is top of mind for industry leaders as consumers express concerns around climate change and the importance of diversity and inclusion. (Source: NRF) Nike, Asos, and Old Navy are some of the brands leading the way on inclusivity and challenging gender stereotypes. 61% of Gen Z think brands could be doing more to prove that “style should not have a gender” and 87% believe strongly there should be better gender equality and inclusion within fashion. (Source: Marketing Dive)

According to a survey by Gartner, 8 in 10 people want to see brands take action, but typical moves like making a statement or pausing marketing activity ranked low, (Source: Marketing Dive)

Metaverse Updates

The metaverse is not expected to take shape for a few years, but consumers are somewhat aware of the forthcoming digital environment – 38% have heard of the metaverse concept. A Gartner report predicts that 25% of people will spend at least one hour a day in the metaverse to work, shop, attend school, socialize or consume entertainment by 2026.

Like choosing a marketing channel or retail outlet, different metaverse platforms cater to different audiences and purposes. The prevailing idea is that the metaverse will be like a parallel virtual reality, where people will be able to do everything, they currently do online – work, shop, play, socialize – but in 3D. (Source: Retail Dive)

TikTok Takes Over

Interest in TikTok for influencer marketing has skyrocketed since early 2020, with nearly two-thirds of influencer marketers planning to use the app in 2022.

In 2020, 36% of marketers used TikTok for influencer marketing. This number rose to 42% in 2021 and is forecasted to continue to rise in 2022. By 2025, 55% of marketers are expected to collaborate with TikTok influencers, and 66% of influencer marketers will make use of the app.

TikTok ads break through more than TV and digital video – TikTok In-Feed Ads reach detail memory 23% better than TV ads. 55% of users feel closer to brands they see on TikTok. While brands are still figuring out their TikTok strategy, the app is popular for use on an experimental basis, in combination with campaigns on Instagram and Facebook. (Source: eMarketer)

Supply and Labor Shortages – Updates

Q1 saw the supply chain issues stretch further from geopolitical issues, trade turmoil, and continued fallout from the Covid pandemic.

Russia’s invasion of Ukraine threatens to further upend international supply chains still reeling from the pandemic and other disruptions. The attack on Ukraine and Western sanctions on Russia could prompt key materials shortages, material cost increases, demand volatility, logistics and capacity constraints, and cybersecurity breaches. (Source: Supply Chain Drive)

Companies can try to navigate risks by improving their visibility beyond their immediate suppliers, stocking up on key materials, and diversifying sources and logistics routes where possible (Source: Supply Chain Drive)

What to Expect in 2022

The NRF issued its annual forecast, anticipating that retail sales will grow between 6-8%, amounting to more than $4.86T in 2022.

Overall, the household consumer picture looks optimistic, but Fed researchers advise that as pandemic protection programs wind down and prices and interest rates continue to climb, a new debt burden and cash flow picture may emerge. (Source: CNN)

Comfort with in-store shopping should continue as consumers are proving resilient against new Covid-19 variants. Although preference for in-store shopping is strengthening, the gains made in the adoption of online shopping aren’t going away. (Source: Morning Consult)

Personalization and real connection is the 2022 iteration of loyalty – an experience that is relevant across physical and digital channels matters to customers. We expect to see a continued rise in small-format stores used to drive wider adoptions and brand interest for well-established retailers looking to diversify their mix. Many digitally native brands will prioritize physical expansion. By 2025, they estimate that a physical location will fulfill 30.5% of all digital transactions (Source: Colliers)

We expect to see more competition for wallet share as consumers plan for their summer holidays. Expedia CEO predicts this summer to be the busiest travel season ever, as many pandemic-related travel barriers will recede, and airlines are expecting to return to pre-Covid levels of travel in August. (Source: Bloomberg)

Q1 Digital Creative

Despite challenges from the past two years, consumers started 2022 by demonstrating their resilience and optimism. Digital creative celebrated the start of a new season as shoppers began to experience life post-pandemic.

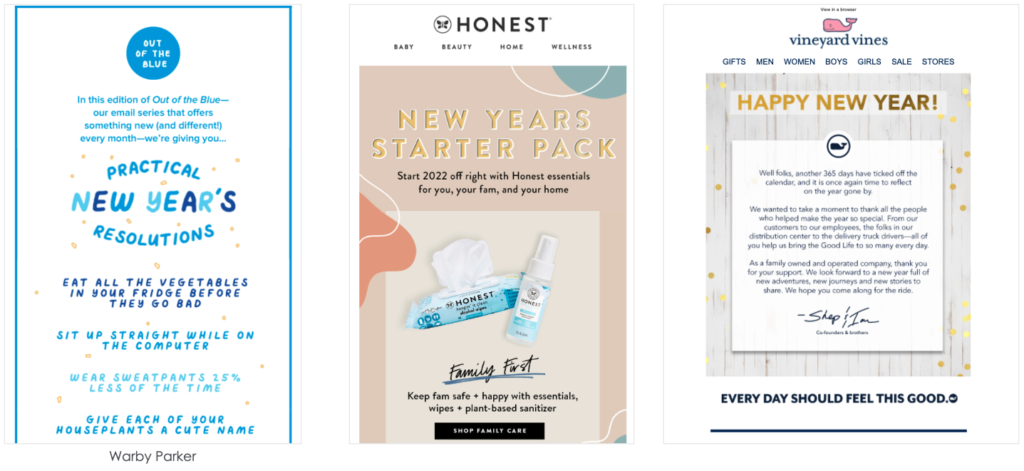

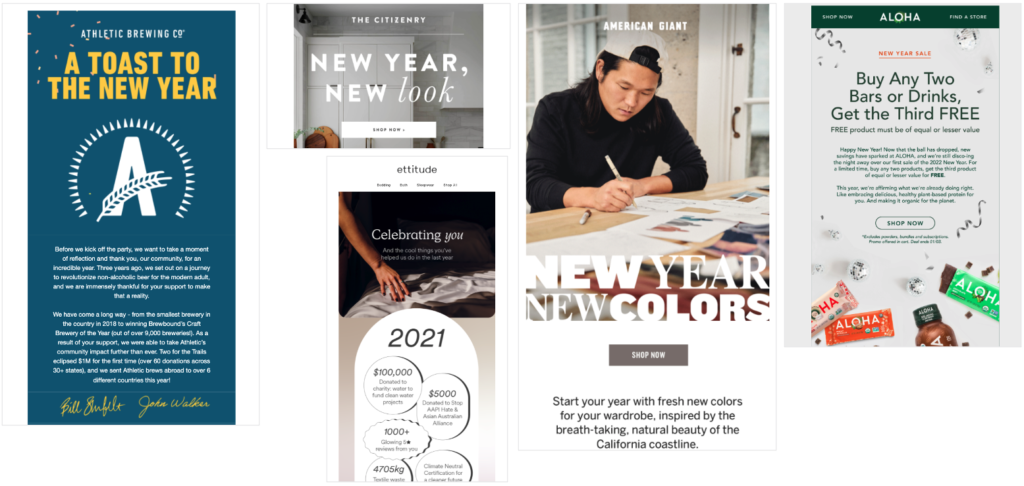

Kicking Off 2022

Digital creative in 2022 kicked off with resolutions and celebrations as consumers sought to start the year off on the right foot.

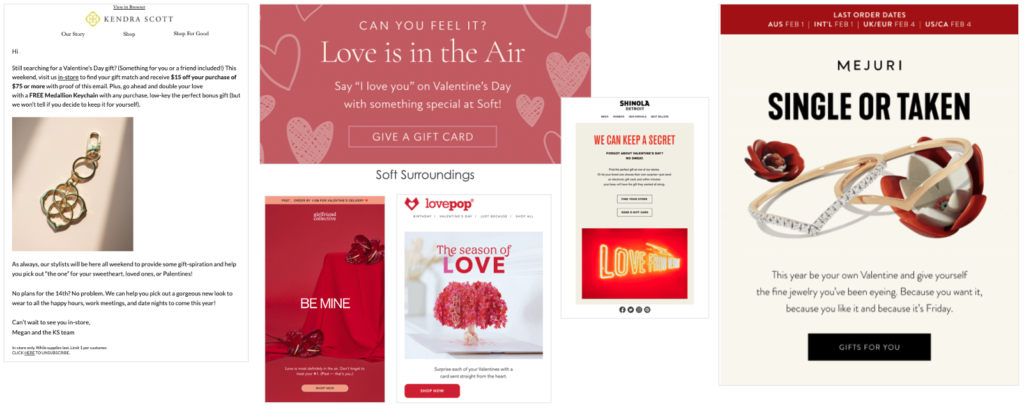

Let’s Celebrate Love

With love in the air, we saw brands share gifting inspiration (both as a gift to others and a gift to the consumer themselves) this Valentine’s Day.

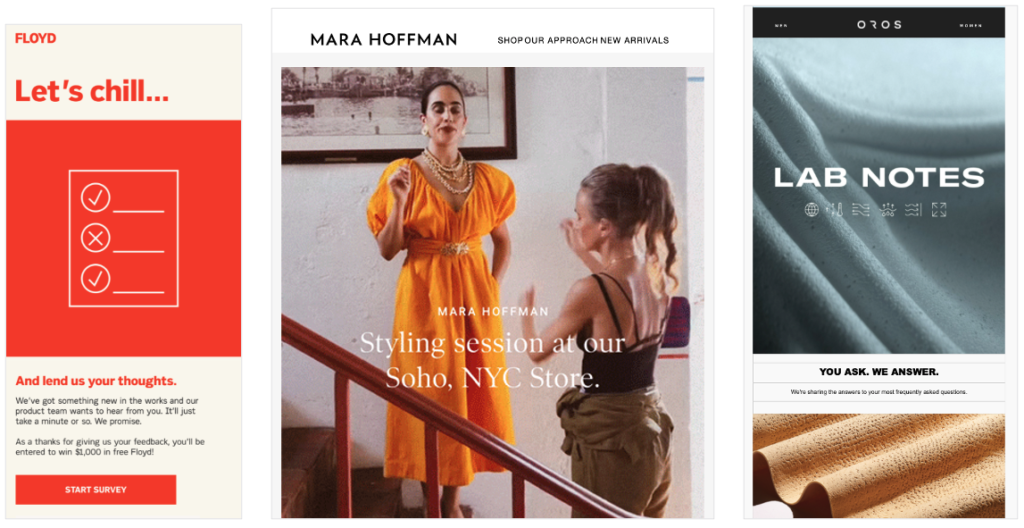

Personalized, Engaging Experiences

This quarter, brands stepped up offers of a personalized experience. Mara Hoffman invited shoppers to a styling session while Floyd and Oros utilized surveys to better understand their customers.

New Customer Acquisition

As digital costs increase, brands are going to need to shift focus on retention, not just acquisition. Kids clothing brand Primary offers new customers 20% off on their first two purchases.

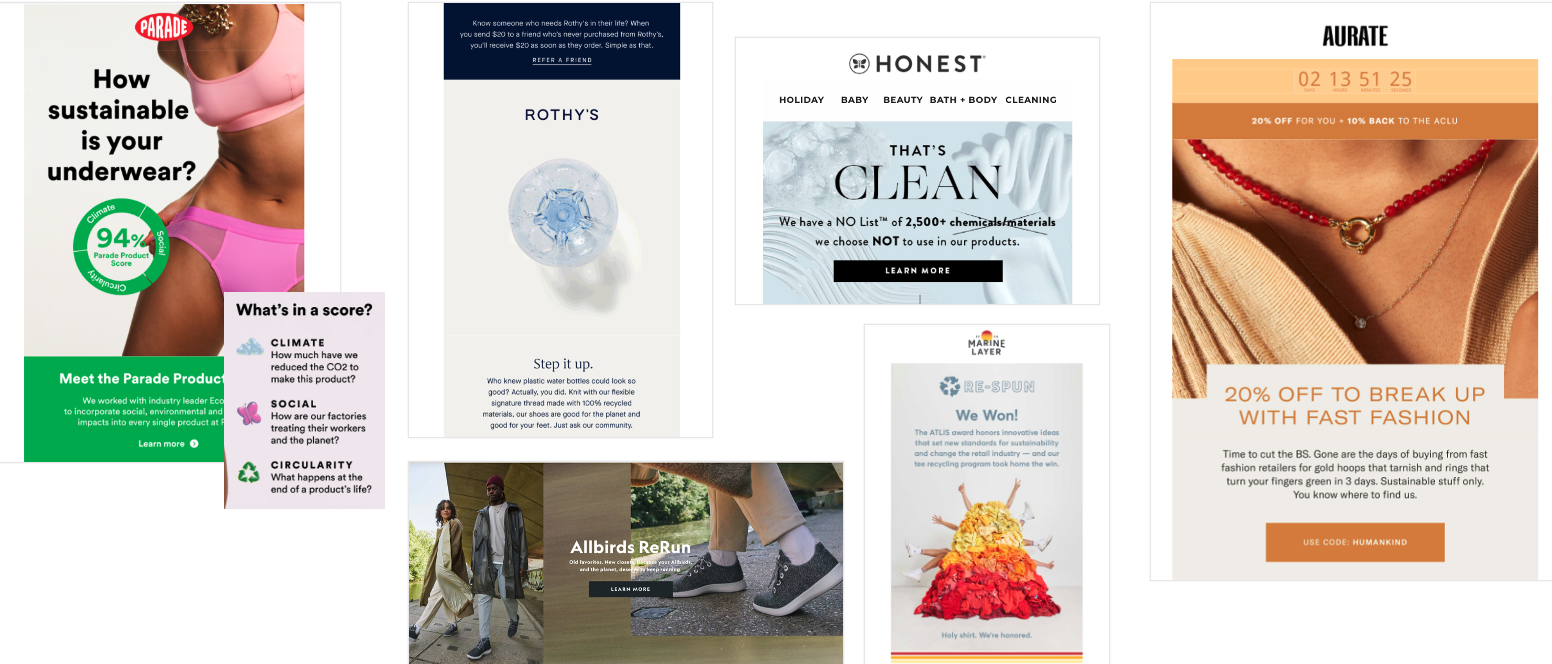

Sustainability and Transparency

Even more brands are emphasizing their commitment to sustainability. Aurate offered their customers a discount to “break up with fast fashion.”

Causes and Activism

Messaging around causes that matter to consumers gave a sense of involvement and agency through their purchases.

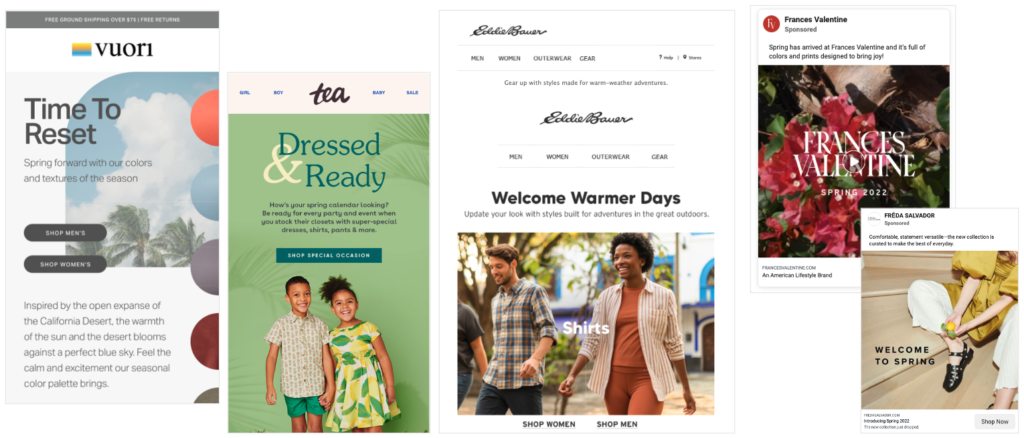

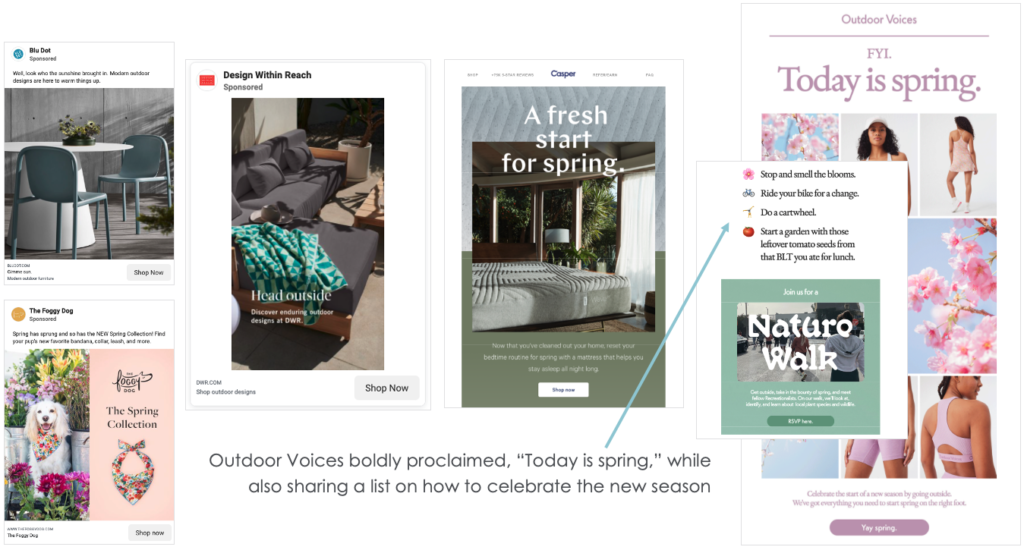

A Very Welcome Spring

Brands readily welcomed the spring season with new product offerings and promises of warmer days ahead.