Digital continues to be a bumpy ride. However, we saw several recent indicators of improving performance and many of our clients are reporting an uptick in sales. So, hang in there! While there are surely more bumps ahead, there are numerous opportunities for smart digital investment today.

WHAT YOU NEED TO KNOW

The two types of retailers fairing the best are (1) omnichannel retailers who have invested heavily in e-commerce and (2) digitally savvy DTC retailers.

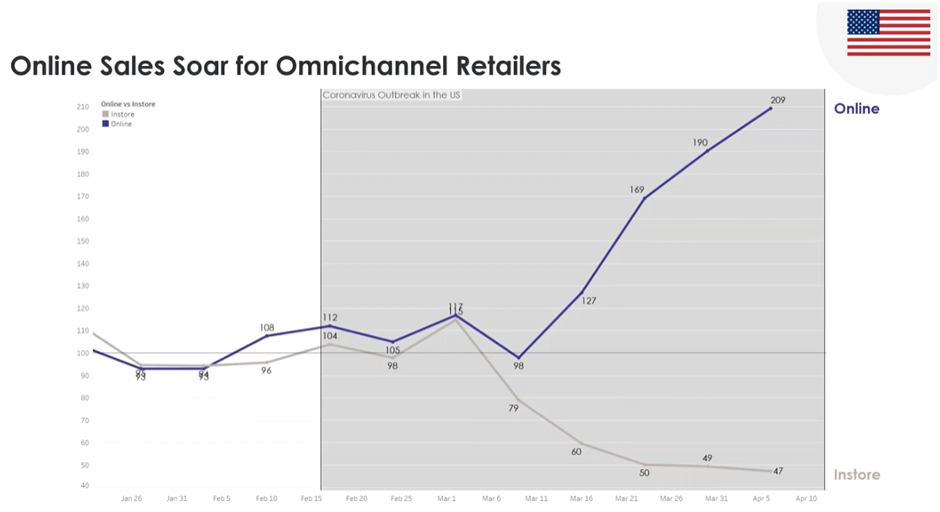

Since early March, omnichannel retailers saw stores lose almost 50% of their transactions; but for those same retailers, the online business has more than doubled (200%), according to Criteo data.

Here’s what this means: it is incredible news for retailers who already have been doing most of their business online. But, retailers who rely on stores for 50% of their business are likely struggling, despite the shifting behavior towards online shopping.

Attribution platform, RockerBox, reports that between April 22 – May 3 there were considerable spikes in revenue across e-commerce clients with a minimal shift in ad spend. This is potentially a result of stimulus checks hitting bank accounts. Even for brands that target high HHI customers (who likely did not receive a stimulus check), it may be having a halo effect, much like black Friday does even if a brand is non-promotional, consumers simply have their wallets out.

Performance was unique to industries, but most online retailers saw a rebound in late March with a few specific categories experiencing strong growth.

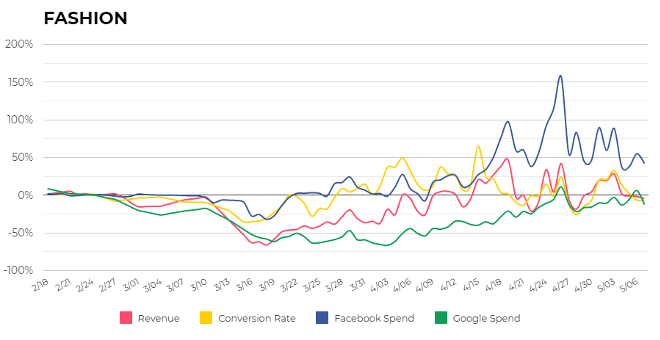

Fashion and apparel brands continue to hover around pre-COVID benchmarks, but we’re seeing strength in some seasonal categories (e.g., shorts, skorts) as well as categories such as baby and kids clothing.

Many of our home décor clients are showing optimal results through featuring outdoor items, pieces to seamlessly freshen the home (e.g., door mats) and offering promotions on key categories.

As advertisers pulled spend and consumers spent more time on social media, CPMs decreased…but are bouncing back to pre-COVID levels.

While this can be good news for customer acquisition costs, it is essential to be measuring CPMs at the placement level (e.g., Facebook Desktop versus Instagram) to be able to quickly understand performance. We recommend being mindful of any shifts in conversion by watching Return on Ad Spend (ROAS).

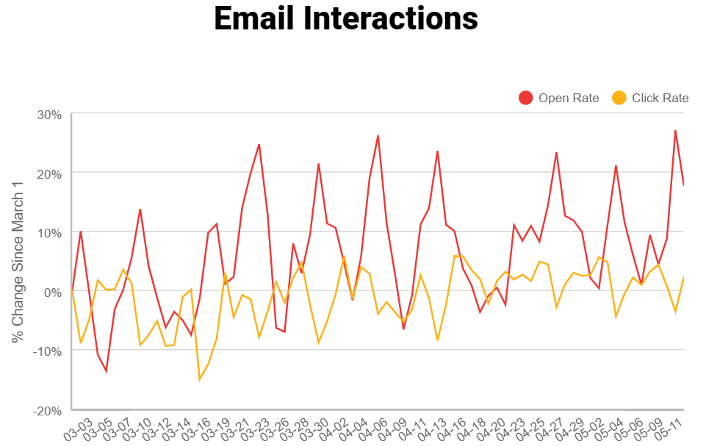

Email continues to be a strong channel for engaging best customers.

As compared to pre-COVID benchmarks, open rates are up 20% and click through rates are up 5%. This is an incredible opportunity to build your relationship with best customers!

10 OPTIMIZATIONS TO MAKE NOW

How can you apply these insights to your digital strategy? Here are 10 immediate recommendations to ensure you are weathering the lows and taking advantage of the highs:

- Get ready to be promotional – it is not about the discount, it is about the perception of value

- Update your merchandise strategy and on-site language for the New Normal

- Add CPM and CPC reporting by ad placement to internal reports and monitor for quick shifts

- If investing in a new product category (e.g., masks) break retargeting windows into pre and post new category launch or segment by browse category

- Build a local strategy across paid search, customized to specific store markets, and ensure Google store listings are updated by location

- Optimize email for mobile and desktop

- Watch for opportunities in terms of send day and time for email – throughout “shelter-in-place,” Mondays and Tuesdays have become stronger days for engagement as consumers log back on for the week

- Update content across all triggered series with consistent messaging (e.g., cart abandon, order confirmation)

- Use segmentation to identify email subscribers who are currently engaging with specific content to create segments for paid social

- Move previously in-person experiences online (e.g., personal styling, online Q&A features)