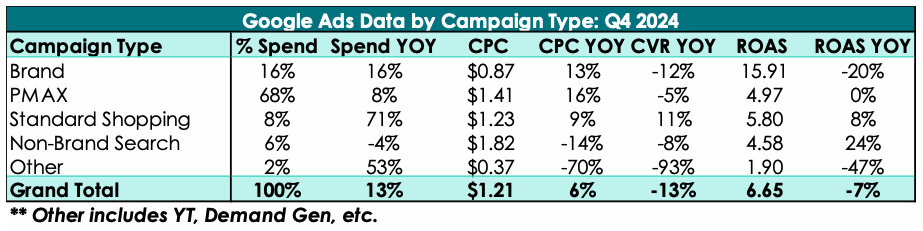

In Q4, Google Ads spend was up 13% YOY with platform ROAS down -7%. Brand Search was largely responsible for the loss of efficiency vs. 2023, as ROAS was down -20% YOY.

The avg. CPC across all campaign types was $1.21, which was up 6% YOY. PMAX CPCs saw the steepest increase, up 16% YOY, followed by Brand CPCs, which were up 13% YOY. Predictably, CPCs peaked over Cyber Five, reaching $1.72 in the first week of December, but they dropped back down to below $0.90 in Dec Wk 4 and 5.

As we have seen all year, CVR was the challenge in Google Ads, down -13% YOY. However, PMAX, which accounts for the bulk of Google spend, saw more mild declines, down only -5% YOY.

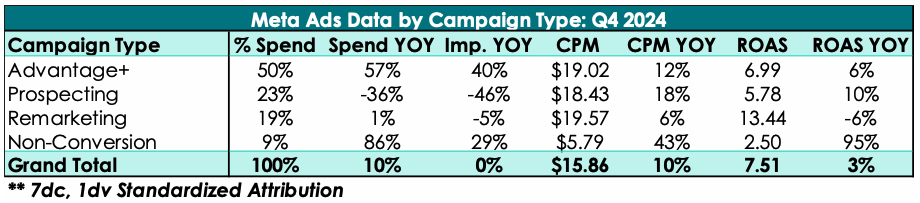

In Q4, Meta Ads spend was up 10% YOY with platform ROAS up 3%. It is positive that spend increased and we saw increased platform efficiency, as usually these metrics relate inversely.

The avg. CPM across all campaign types was $15.86 in Q4, which was up 10% YOY. Advantage+ and Prospecting saw the steepest increases, up 12% and 18% respectively. followed by Brand CPCs, which were up 13% YOY. Like in Google Ads, CPMs peaked during Cyber Five, reaching $23, but dropped below $12 in the final two weeks of December.

Advantage+ accounted for half of program spend in Q4 and generated a higher ROAS than traditional prospecting campaigns, demonstrating the success of this campaign type, particularly for NCA. It’s worth noting, many brands in this industry utilize ASC+ as a full-funnel campaign type, which could be inflating performance.