In lieu of a crystal ball to predict exactly how Q4 will play out, we can leverage our exclusive insights from Summer 2024 and Q4 2023’s holiday performance, making data-led assumptions to better prepare for in the upcoming quarter.

In some ways, this year looks much like 2020, the first holiday season of the pandemic; it was also an election year and a shorter holiday season. In 2020, we saw a milder WOW decline post Cyber Week compared to other years, but by Dec Wk 4, the falloff was the same as prior years (shipping deadlines).

Keep in mind: Consumer attention has been (unsurprisingly) fragmented. We are coming off a summer filled with record-breaking travel, unprecedented political news, and the excitement of the Olympics. We can expect continued distractions as we approach November 5th, including shaky consumer confidence amid political and economic uncertainty and retailers that are not only dealing with economic factors, but also a shorter shopping window with fewer days between Black Friday and Christmas.

SUMMER HOLIDAY PERFORMANCE

After a soft July 4th promotional period, Labor Day improved for Apparel, Shoes & Accessories, but continued to be soft for Home Décor – these summer sale periods were critical for both retention and acquisition! Sale shoppers – regardless of seasonality – can be loyal, high-spending customers.

This is further supported by industry data from Earnest Analytics, which shows that brands can still acquire high-value customers in promotional moments. Sales such as friends and family events are great opportunities to drive both loyalty and NCA!

ELECTION YEAR HOLIDAY CURVE

Inevitably, the election will cause distraction, but it is unlikely to cause major declines in gross in-season consumer spending. Apparel in 2020 saw the lowest penetration of sales in Nov Wk 1, but quickly bounced back and held on longer into December. Meanwhile, Home Furnishings & Décor saw a similar curve in 2020 compared to 2021-2023, as it is not as gift-driven. She will convert, albeit later (or earlier) – so, keep marketing spend fluid.

THE 2023 HOLIDAY SEASON

The 2023 sales curve closely mirrored 2022. Apparel, Shoes & Accessories saw early-season growth, with some softness in late November and a peak fueled by promotions in late December. By December Wk 3, the consumer is determined to purchase, so present them with a compelling reason to buy from you.

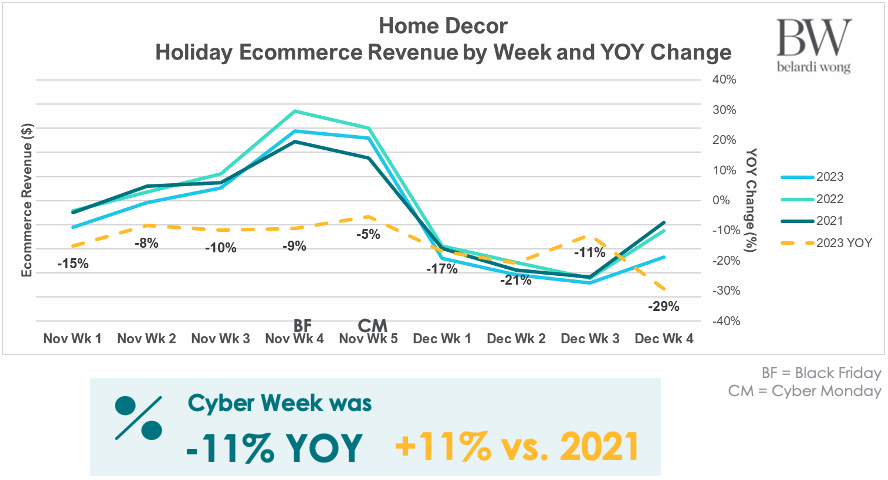

For Home Décor, this curve is even more pronounced, with consumers self-purchasing during the most promotional periods. While we saw milder YOY declines during Cyber Five, December was soft. Promo fatigue may have lessened the impact of end of season sales as the consumer shifted to gifting.

THE Q4 2024 TO-DO LIST

With fewer days between Black Friday and Christmas, this holiday will require winning over the season in its entirety, not just a handful of days. Here are Belardi Wong’s five actions to take now for holiday success:

- Review content plans for October through January ensuring that gift guides, shop-with-me, and haul-type content are ready for early shoppers. Where will this content land on-site? Test holiday landing pages early

- Plan for flexing spend across segments (along with months or weeks) –

Early holiday is a time for more spend in prospecting, with remarketing gaining importance later in the season. A higher penetration of spend in mid-funnel may be needed to cover higher costs - Review what worked last year in search to drive consumers to site –

What site links drove the highest click through rate? What products started driving strength in September and October? For example, for one client, seasonal accent rugs saw strength the last week of September – consider building a PMX campaign or asset group around it early this year - Review what messaging types or value propositions worked well in social – brand attributes, influencer content (including review overlays!), or functional? How did that change throughout the season? Test these messages and creative types now!

- Plan for late holiday and early 2025 with media costs falling and ROAS still healthy. Search conversion holds through December and social CTR peaked December Wk 4. Message to the devoted shopper and self-gifters post-holiday

We’re here to help! If you have any questions, please reach out to your account team. We’re committed to helping our clients succeed across all channels this holiday season and are here to support you.