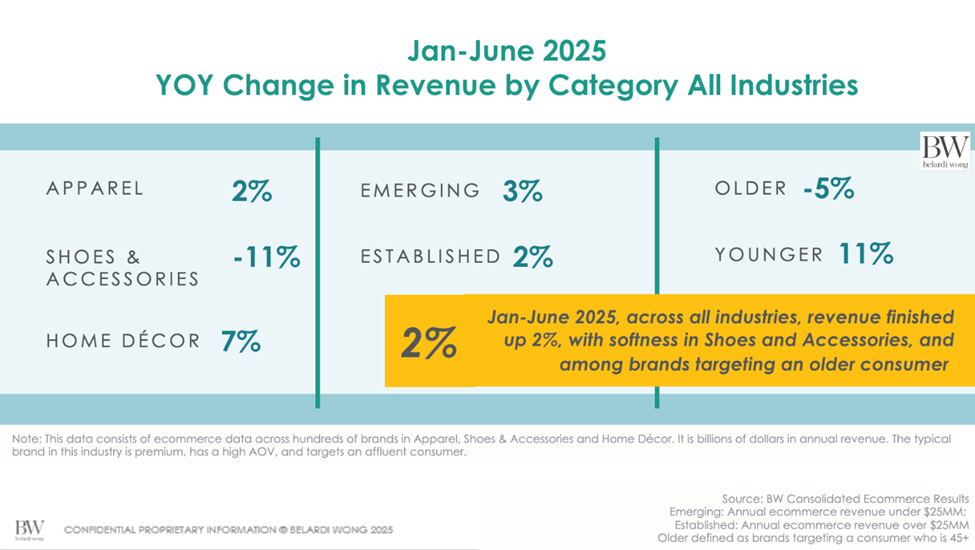

Despite prolonged economic instability, including ongoing tariff and trade policy debates, retailers closed out the second quarter of 2025 with cautious optimism. June marked a modest bright spot, with revenue up 2% year-to-date (YTD) across all categories, even as sales lagged in Shoes & Accessories and brands focused on older consumers.

Shopper Behavior: A Delicate Balancing Act

Consumer confidence remained fragile, influenced by inflation, unpredictable weather, and continued economic uncertainty. Many shoppers took a “wait-and-see” approach, weighing value-for-money more heavily than ever. On a scale of one to ten, consumers rated their tariff concerns at eight or higher, underscoring the role of economic pressure in shaping buying behavior.

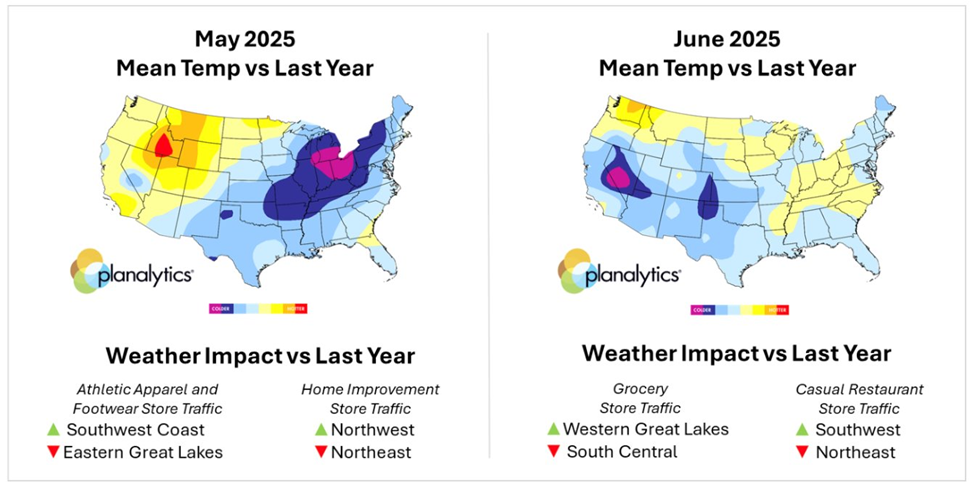

The Weather Effect

Weather proved a defining factor in Q2 performance. The coolest May since 2023 and the wettest June since 2021 drove significant shifts in consumer activity, influencing both in-store and online traffic patterns.

Loyalty and Experience Take Center Stage

Today’s consumers are redefining what loyalty programs mean to them. More than discounts, they seek speed, flexibility, and a sense of belonging that integrates seamlessly into their daily lives. Retailers able to deliver this personalized, value-driven experience will strengthen long-term customer connections.

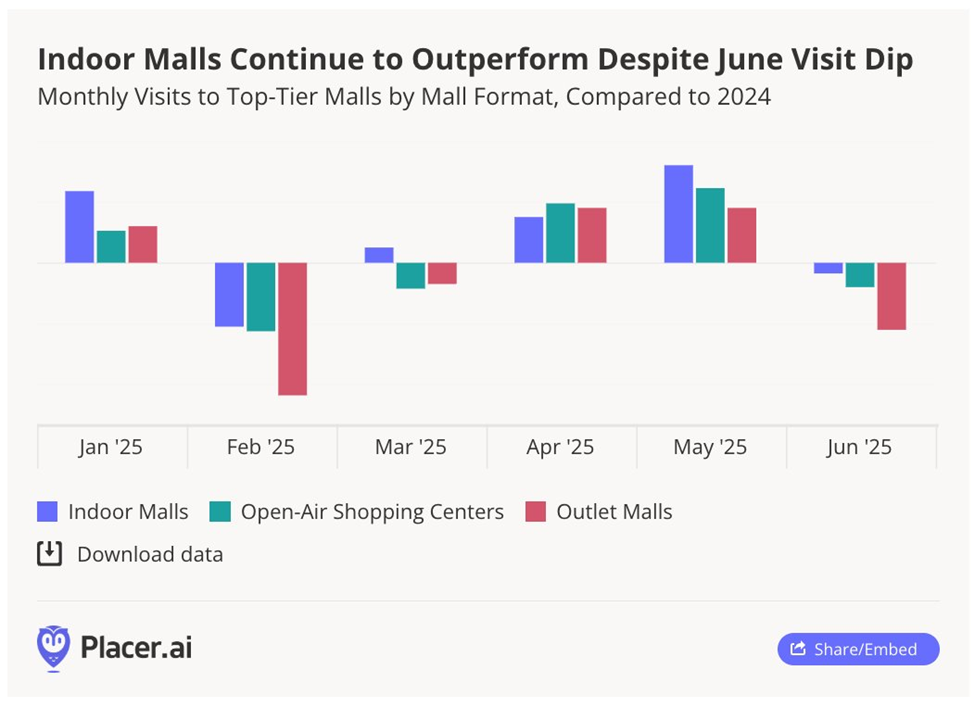

Retail Foot Traffic and Digital Acceleration

Encouragingly, retail foot traffic was mostly positive in the first half of the year, with indoor malls seeing a 1.8% year-over-year (YoY) increase in visits. At the same time, retailers leaned into digital strategies, with Google Shopping Ad clicks up 18% YoY in Q2, highlighting the growing importance of search in driving discovery and conversion.

Holiday 2025: Purposeful, Value-Driven Shopping

CPCs on Google are up 5%, while Meta is up 14%. About a week before the TikTok ban, Meta CPMs jumped 40% as advertisers shifted their dollars. We’ll continue to watch it closely as we watch the next deadline on TikTok.

According to eMarketer:

- Value is more important than ever – Consumers aren’t abandoning holiday spending, but they are making more deliberate choices. 82% plan to save on essentials like groceries to budget for gifts, meals, and experiences. Deliver value where it counts with a mix of incentives and personalization.

- Holiday shopper conversion requires omnichannel presence – While over 70% of consumers will shop online and 65% in-store this season, many will do both. With consumers looking for inspiration across physical and digital touchpoints, consistency is critical. Target peak moments and deliver personalized messages across digital, social, and in-store channels.

- Wellness and weight-loss will transform holiday shopping – Over 60% of consumers plan to buy healthier products this holiday season. With heightened price-consciousness, 95% will seek ways to fit better-for-you options into their budget. Retailers can engage these wellness-driven shoppers by offering budget-friendly alternatives and compelling messages around health and well-being

Bottom line: Prepare for a more purposeful holiday shopper—one who is cautious yet committed, value-driven, and seeking both inspiration and practicality.

LOOKING AHEAD

Consumer spending is expected to rise 1.4% in 2025 and accelerate slightly to 1.5% in 2026, according to Deloitte. With hybrid shopping firmly established, retailers who prioritize value, flexibility, and omnichannel connection will be best positioned to capture growth in the months ahead.

Want deeper insights tailored to your business? Our team has you covered. Get in touch with us HERE.