To kick off the holiday season, we’ve put together a recap of the best industry research, keeping you up-to-date on the latest developments!

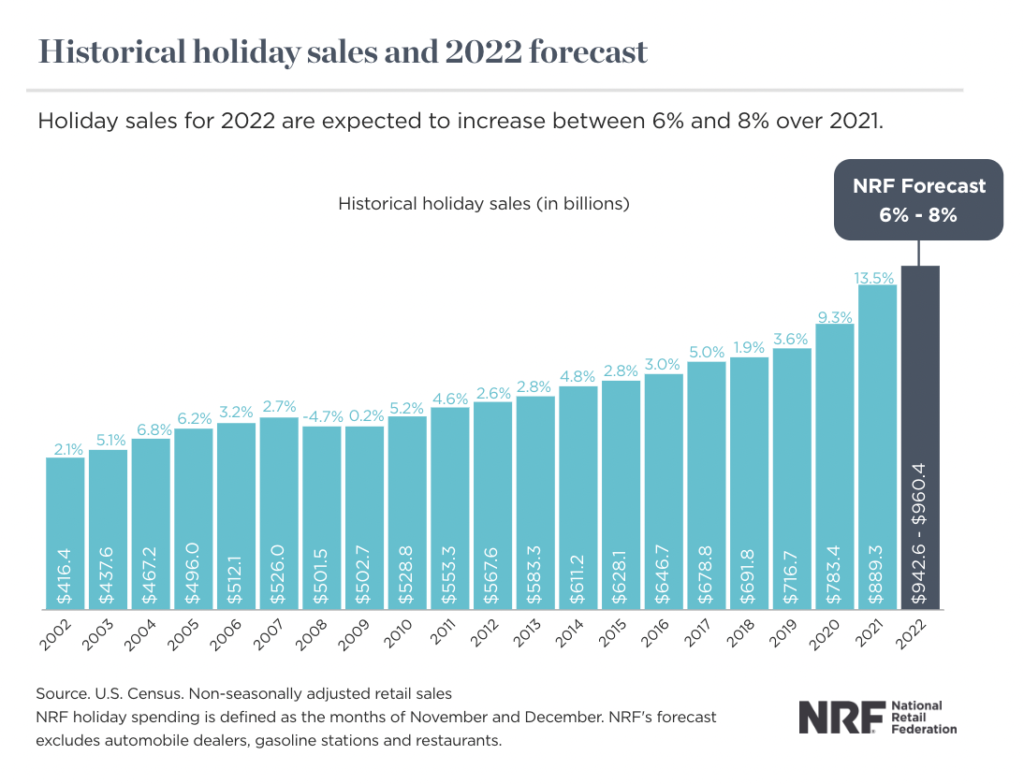

The NRF is optimistic as shoppers are not wavering their emotional investment in the holidays. However, inflationary pressures are expected to pose a challenge to consumer confidence and spending.

How this plays out will be up for debate, but sales are predicted to be healthy and grow 6-8% over 2021, with more than half of shoppers completing at least half of their holiday shopping by Black Friday or Cyber Monday.

Holiday Trends and Predictions

NRF Predicts Healthy Holiday Sales as Consumers Navigate Economic Headwinds NRF, (11/03/2022)

(Read more…)

- Holiday spending is expected to be healthy even with inflationary challenges – holiday retail sales for 2022 during November and December will grow between 6% and 8% over 2021 to between $942.6B and $960.4B

- Holiday retail sales have averaged an increase of 4.9% over the past 10 years, with pandemic spending in recent years accounting for considerable gains

- NRF expects online and other non-store sales to increase between 10% and 12% to between $262.8B and $267.6B

- Ecommerce will remain important but households are also expected to shift back to in-store shopping and a more traditional holiday experience

- Some sales may be pulled forward as retailers are responding to shopper concerns on inflation and product availability – there were several major scheduled buying events in October and the NRF expects to see continued deals and promotions throughout the remaining months

- 46% of holiday shoppers said they planned to browse or buy before November

- Consumers plan to spend $832.84 on average on gifts and holiday items such as decorations and food, in line with the average for the last 10 years

- NRF predicts retailers will hire between 450K and 600K seasonal workers, compared to 669,800 seasonal hires in 2021. Some hiring may have been pulled into October as retailers meet increased consumer demand in the earlier half of the season

How to Approach Promotions This Holiday Season, Business of Fashion (11/04/2022)

(Read more…)

- Discounts on apparel, footwear, and accessories are at their deepest level in at least three years, averaging 49%

- Overall, 58% of fashion categories are on sale now – up from 35% last year and 51% in 2019

- Adobe predicted that online apparel sales will fall 7% from LY, despite overall retail sales growing. Consumers are expected to spend less on the category this holiday season amid inflation and anxiety over a possible recession

- Young and high-income consumers say they expect to do plenty of shopping for the holidays – 40%, regardless of age group, said they’d “splurge for themselves or for others,” while 55% said they are excited about holiday shopping (up from 34% LY)

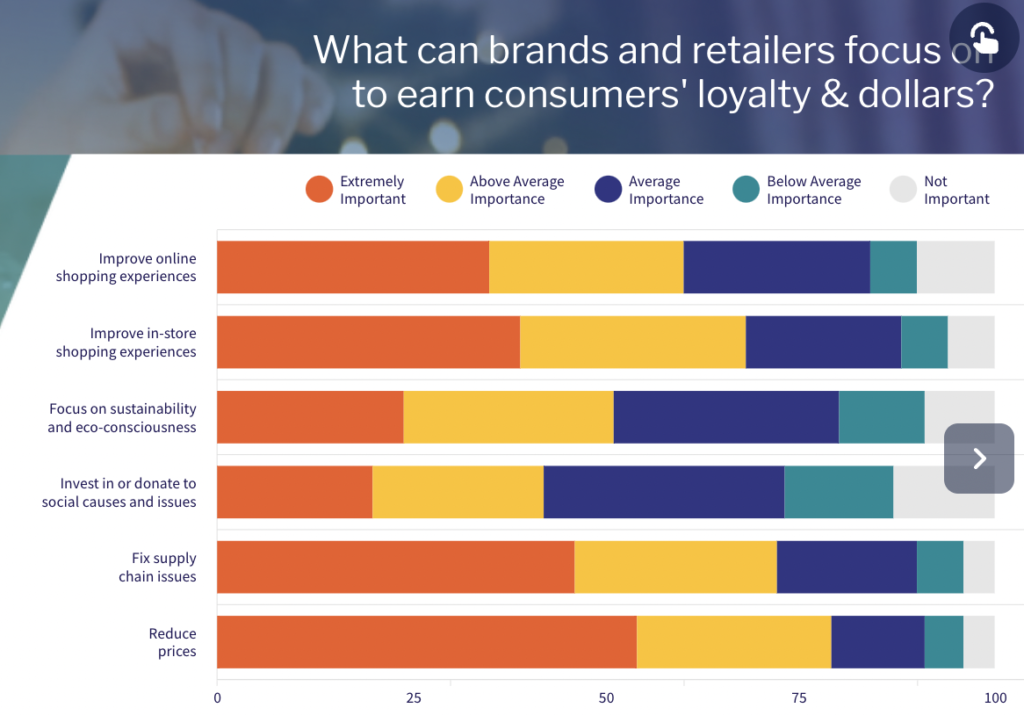

- Retailers should be selective about what they put on sale – in practice, this looks like private sales for loyalty program members and personalized promotions

Deals, promotions drive increased holiday spending: report, Retail Dive (10/24/2022)

(Read more…)

- ICSC estimates that consumers will spend 6.7% more during this holiday season than LY

- 75% of shoppers said they planned to begin shopping for the holidays earlier this year

- 48% said they wanted to shop earlier to secure the products they wanted

- 43% said they’re seeking deals and promotions

- 73% expect retailers to introduce sales similar to Black Friday deals earlier in the fall

- Nearly two-thirds (65%) said they are going to spend significantly more time looking for discounts

Over 70% of shoppers consider holiday financing as inflation bites: report, Retail Dive (10/27/2022)

(Read more…)

- Nearly 60% of consumers said the current economic uncertainty has prompted them to spend less

- 71% of shoppers said they would consider a store payment plan or financing option to cover the cost of their purchases. A quarter said they had never used financing options before

- 62% said they were willing to pay more for faster or guaranteed deliveries

- Less than half (47%) of shoppers said the speed of delivery can influence where they order gifts from

- 47% of consumers are looking at prices to comparison shop between retailers

- Among the top items shoppers are planning to purchase this holiday season are experiences for friends and family (34%), fashion and apparel (30%), gift cards (29%), beauty and personal care products (29%), and footwear (28%)

- According to JLL, less than two-thirds of shoppers are spending their holiday budgets in stores, a slight increase from 58% in 2021

Holiday 2022 Outlook: Inflation & shoppers trading down, ibotta (10/03/2022)

(Read more…)

2022 Holiday Trends Guide – Complete Guide, Inmar (10/2022)

(Read more…)

- Between Thanksgiving and New Year’s, 25% of consumers plan to shop Black Friday this year, 49% on Cyber Monday, 43% post-holiday the week after December 25th, and 40% Super Saturday (the last Saturday before Christmas)

- 69% of consumers expect supply chain issues to continue into winter, making the products they need or want hard to find

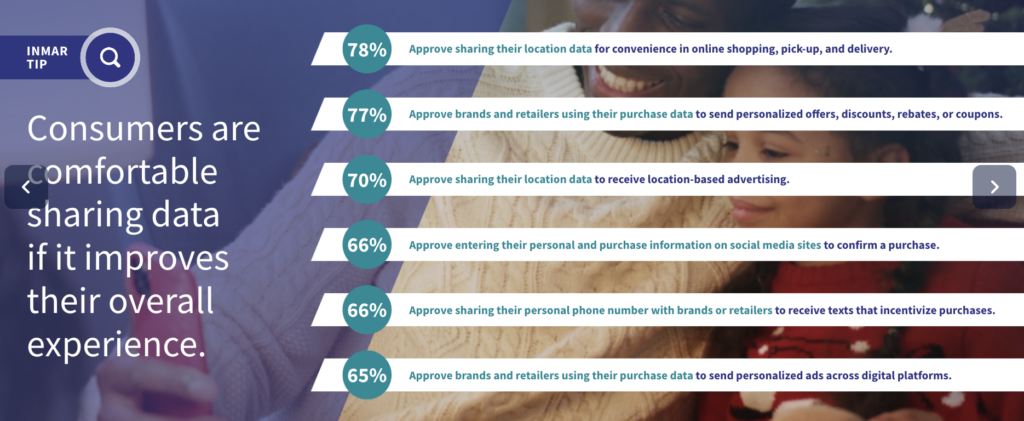

- 20% of consumers are inspired to purchase for the holidays through incentives, rebates, offers, and/or coupons, in contrast to 10% through ads on a brand or retailer’s website, and 9% through branded advertising on apps or websites

- 72% of people have been inspired to purchase because of a post on social media

- 63% of holiday shoppers are comfortable sharing their personal data with brands and retailers in exchange for personalization and other benefits

- This year, 78% of consumers plan to shop for their family, 44% for friends, 43% for children, and 42% for themselves

- 64% of shoppers will complete half or more of their holiday shopping on Black Friday or Cyber Monday

- 17% will complete all of their holiday shopping on Black Friday and 10% will complete all of their holiday shopping on Cyber Monday

2022 Holiday Shopping Trends You Need To Know, Forbes (10/17/2022)

(Read more…)

- Although many brands look to scale customer service during the holiday season with chatbots and other technology, human interaction still sets brands apart. When given the choice of how to communicate with a brand, majority of consumers chose to speak with a live agent

Retailers Should Expect A ‘Ho-Ho-Hum’ Holiday 2022, Forbes (11/06/2022)

(Read more…)

- Higher-income households will make up for losses by middle and lower-income households and are expected to spend “significantly more” on discretionary holiday-related purchases

- Consumers will supplement spending with savings and credit to provide a cushion and result in a positive holiday experience

- Concerns about inflation – which had been receding since July – have picked up again, with both gas and food serving as main drivers

Marketing Pulse | WITHIN, WITHIN (2022)

(Read more…)

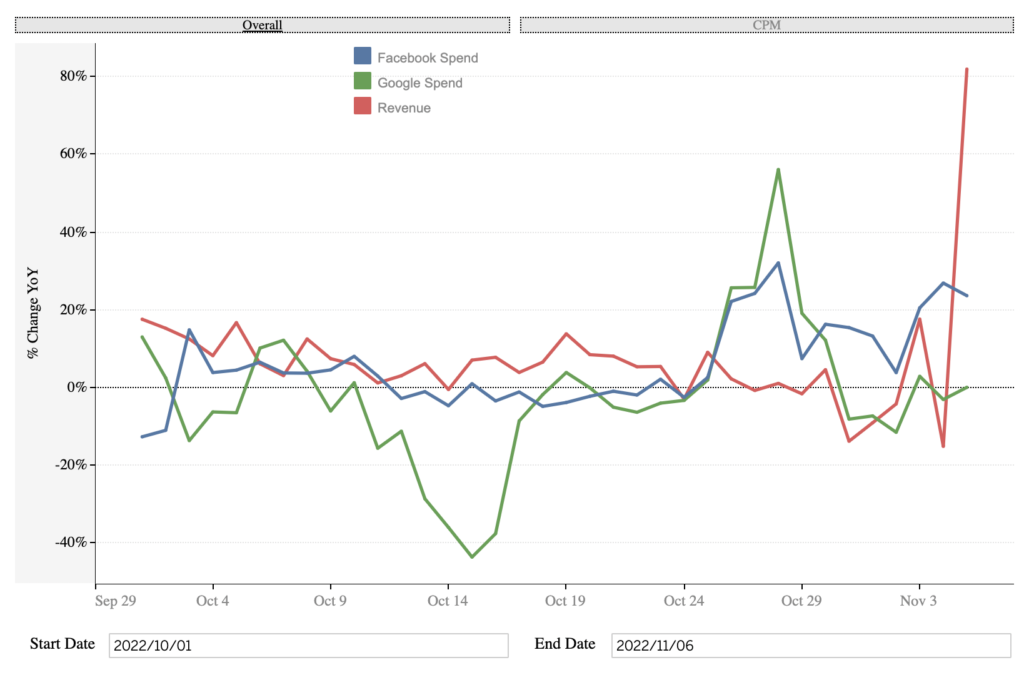

Overall, WITHIN is reporting that majority of their clients’ Facebook spend is up compared to LY, Google spend has fluctuated but is down in the past week, and revenue saw a sudden uptick starting November compared to LY (Note: this is contrary to our own data where Meta spend is still trailing LY.)

Messaging Examples

Early Sales:

Gifting:

2023 Forecasting

Forrester: Five retail predictions for 2023, Chain Store Age (10/26/2022)

(Read more…)

- Forrester’s five retail predictions for 2023:

- Retail’s “e-pocalypse” will bankrupt online-only brands that lack a physical strategy. As consumers revert to pre-pandemic behaviors, the YOY change in online retail penetration in 2023 will settle back at 1.5% (down from 3.5% in 2020), meaning that 76% of total sales will still occur offline.

- Retailers will choose one of two supply chain paths: own it or outsource it. Firms such as American Eagle Outfitters and Gap Inc. now offer supply chain as a service.

- Automation will be the savior for continued retail labor shortages

- Paid membership programs will boom – but most will be so-so programs that fizzle fast. Unless a retailer can clearly articulate to customers why they should sign up for – and then stick with – their program, the ROI on that spend will tank.

- Retail media strategies will yield far more conversation for most than actual revenue

- The retail market is expected to double to $62B by 2024, up from $29B in 2021. Amazon alone will account for 69% of the market in 2024, down from 74% in 2021

Mobile Commerce Trends to Watch for in 2023, Shopify (10/20/2022)

(Read more…)

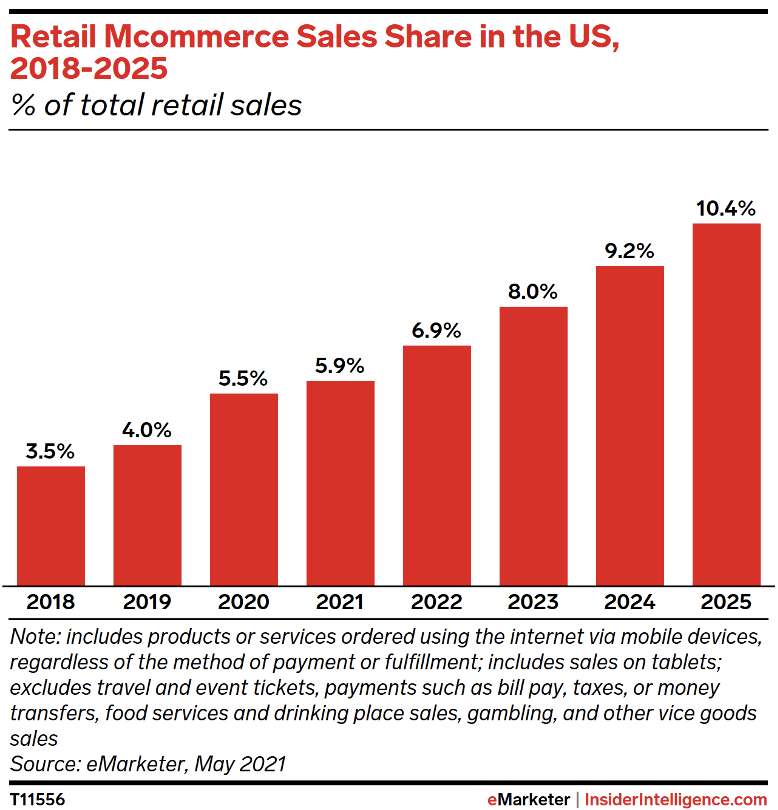

- By 2025, retail m-commerce sales should more than double from 2021’s sales ($359.32B) to reach $728.28B and account for 44.2% of retail ecommerce sales

- More than half of mobile shoppers downloaded at least one new shopping app before the 2021 holiday season – this m-commerce trend looks likely to continue into the 2022 holiday season

- 46% of retailers planned to spend more time on their custom mobile app in 2022 and are expected to continue to do so well into 2023

- TikTok, the most downloaded app in Apple’s App store with almost 85M users, triggers users to spend $50.4M a year

- eMarketer forecasts that retail sales through social media will rise by 5.2% in 2023, reaching $101.1B

- 57% of customers won’t recommend a business with a poorly designed mobile website

Please reach out to your account team if you have any questions – we are here as a resource and hope you found this helpful.

We’re in this together and wish you a great start to the 2022 holiday season!