We’re bringing you the latest roundup of recent industry news to help paint the picture of the retail landscape this holiday season!

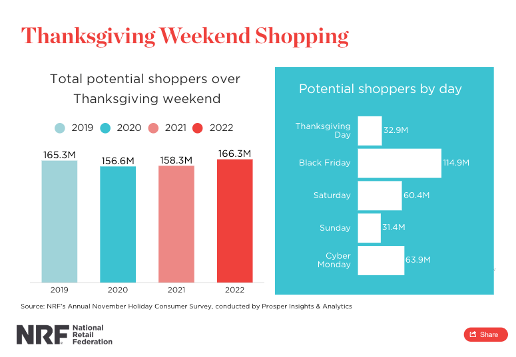

Black Friday is looking a lot more like Black November as retailers spread their promotions over a longer period (but total promotions are down to LY when adjusting for inflation.) While some consumers have taken advantage of early discounts, many are willing to wait for the best deals – still, the NRF estimates 166M people to shop over the Thanksgiving through Cyber Monday weekend this year, almost 8M more than 2021.

Promotions have taken over messaging, but this may shift as the year comes to an end, with marketers leaning into emotion and “feel-good” storytelling. Furthermore, we are witnessing the push for omnichannel as shoppers return to brick-and-mortar, citing a nostalgia for the in-store experience.

Black Friday / Cyber Monday Predictions

Deloitte: Shoppers to spend an average of $500 during Black Friday week, Retail Dive (11/21/2022)

(Read more…)

- Consumers will spend $500 on average during the week of Black Friday and Cyber Monday, a 12% bump from 2021

- Shoppers across income levels are spending more this season, but also relying more on financing – 48% are planning to use credit cards to pay for their holiday purchases and 37% foresee using buy now, pay later services

- 87% of shoppers have already bought gifts this year while they were discounted

No, Black Friday isn’t here quite yet, Retail Dive (11/7/2022)

(Read more…)

- Discounting is actually down compared to the same time last year and the decreased propensity to shop online, combined with the consumer’s desire to socialize again, makes Cyber Monday the most vulnerable shopping event of the season

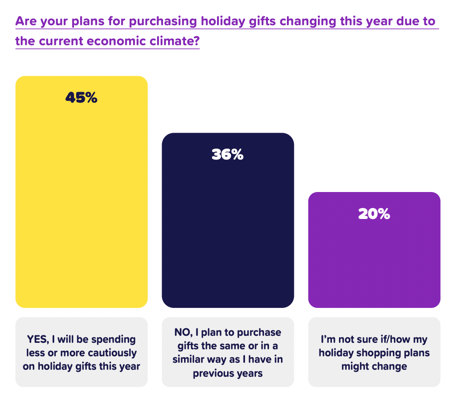

- One in five consumers planning to shop for the holidays say they’ll spend less because of their economic situation

- According to Credit Karma, more than a third of consumers can’t afford gifts this year due to inflation and higher costs of living, and nearly half plan to spend less this season

- Another reason shoppers may not have jumped at the early sales is that they’re saving their money to travel over the holidays – spending on travel, entertainment and dining out is still being boosted by pent-up demand

- 12% of consumers will spend less on gifts “so they can spend more on holiday entertaining-related expenses, like food, drink, and decorations”

- 55% are planning to go to someone else’s house, up from 47% last year, indicating a larger portion of holiday budgets will be going to travel expenses

- 63% of Black Friday shoppers consider in-store shopping a tradition, and 43% actually miss the “chaos of in-store Black Friday shopping”

- More than 40% say shopping in store is more important now than before the pandemic

Early Black Friday ‘deals’ abound, but actual bargains are scarce, Reuters (11/18/2022)

(Read more…)

- Although retailers such as Target and Kohls are slashing prices by as much as 50% on toys and other popular holiday gifts in early Black Friday deals, bargains aren’t what they seem

- Even with steeper discounts, consumers still have to spend more for popular products because prices have risen faster than promotions

- While some consumers have started holiday shopping early this year, many are still waiting to try their luck on better deals around Black Friday or Cyber Monday

- Clothing is the only category this year that is cheaper than last when accounting for both discounts and changes in manufacturer’s suggested price

- Shoppers may opt for cosmetics and beauty purchases this year over pricier shoes

- Retailers that hold off on competitive deals risk getting stuck with costly inventory – a dynamic that will likely lead to further discounts later this month and early next

- Prices on merchandise across many categories rose 14% and consumers have long been trained to wait for the best deals so we can expect even heavier discounting in the coming weeks

Record 166.3 Million Shoppers Expected During Thanksgiving Weekend, NRF (11/17/2022)

(Read more…)

- An estimated 166.3M people are expected to shop from Thanksgiving Day through Cyber Monday this year, almost 8M more people than last year

- The top reasons consumers plan to shop are because the deals are too good to pass up (59%), because of tradition (27%) or because it is something to do (22%) over the holiday

- Black Friday continues to be the most popular day to shop with 69% planning to shop then, followed by 38% on Cyber Monday

Study: 40% of consumers willing to pay extra for climate-conscious products this holiday, Retail Dive (11/15/2022)

(Read more…)

- 57% of shoppers will spend the same amount or more during this year’s Black Friday and Cyber Monday

- Adobe predicts that shoppers will spend $11.2B on Cyber Monday, up from 5.1% in 2021

- For Black Friday, shoppers are only expcted to spend $9B, a 1% bump over LY

- Signifyed released a report predicting that Cyber Week sales will rise by roughly 5%, but product volume will drop by 13%

- The same report also suggests consumers are looking for better quality as well as markdowns this holiday season – 76% of shoppers worldwide are searching for quality items that last

- Analysts say this year’s discounts are not as deep as last year’s and 17% of shoppers are waiting until after Thanksgiving for their holiday shopping

- 40% of shoppers are open to paying extra for eco-conscious products during the holiday season

- 43% are more willing to buy from brands with sustainability practices like carbon neutral shipping or low waste operations

- 63% of shoppers would recommend a product if they think it isn’t very harmful to the planet, the same share of respondents said they are researching more to find brands that are fulfilling their climate ambitions, prioritizing items with eco-friendly packaging and purchasing goods from local businesses to lessen the environmental impact

Overall Holiday Trends

Gift giving meets revenge living: Why experiences are so important this holiday season, Retail Dive (11/15/2022)

(Read more…)

- This is the first holiday season not dogged by pandemic restrictions since 2020 and much of shopper behavior reflects consumers entering a new phase of what some term “revenge living”

- Success this season is going to come down to the strength of emotional appeals – many are willing to shop, but are likely to purchase fewer gits; some are spending with enthusiasm while others pull back over economic concerns; many are returning to brick-and-mortar habits, but social commerce could reach new highs

- According to Deloitte, 37% of households report their financial situation is worse than last year and 73% believe product prices will be higher

- However, average consumer spending this year is projected to hit $1455, only a small drop from $1463 in 2021

- Overall retail spending is projected to grow 4-6% in the November to January period

- The way consumers spend is shifting, reflecting the experience-driven mindset many have adopted to make up for lost time

- The average number of gifts given per consumer is expected to drop from 16 in 2021 to nine this year, while total spend on experiences is expected to increase 7%

- Who is spending is also shifting – a 7% decrease is expected from higher-income shoppers (those making over $100K a year), while lower earners (those making under $50K a year) are expected to grow by 25%

- 32% of marketers have plans to increase their promotional efforts, up from 13% in 2021. While paid search continues to reign supreme, affiliates and partnerships are predicted to be the second most-used strategy, besting paid social

- Affiliate marketing has grown 50% over the last five years

- However, paid social could still play a role as 34% of consumers and 60% of Gen Z plan to use social media for their holiday shopping

With inflation and recession fears looming over the holidays, are retailers still able to market joy? Retail Dive (11/14/2022)

(Read more…)

- The theme of this year’s holiday season appears to be discounts and promotions – while customers are expected to spend 6.7% more during this holiday season over 2021, 43% are looking for deals and promotions and 65% plan to spend more time looking for discounts

- 71% of consumers are even considering store payment plans or other financing options to cover their purchases this holiday season; a quarter of those respondents have never used financing options in the past

- As the season progresses, deals will continue to be an important aspect of retailers’ messaging but brands may begin to lean more into the storytelling side of marketing as we get closer to the holiday – November is the expectation of value, December is more about that ‘warmth’ and ‘feels’

How Consumers Are Shopping This Holiday Season, Smartly (November 2022)

(Read more…)

- Nearly 1 in 4 consumers get gift ideas from creators and influencers

- 32% of consumers get gifting inspiration from social media ads and 28% from digital ads

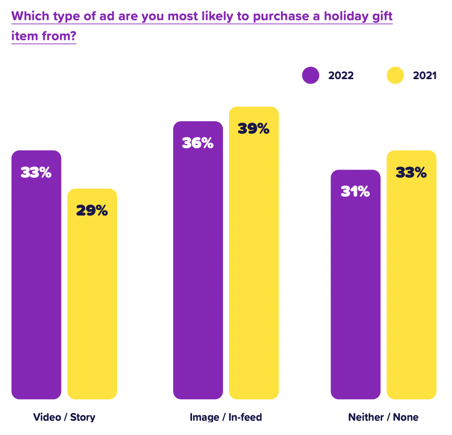

- Video and story-style ads are beginning to eclipse image or in-feed ads in popularity:

Retail Enters Its New Normal, Blending E-Commerce and Brick and Mortar, Business Insider (11/15/2022)

(Read more…)

- Nearly every major retailer is rushing to build an omnichannel strategy – unlike pre-pandemic times, consumers are now looking at brick-and-mortar as an extension of retailers’ online offerings, rather than a siloed part of the business

- Classic cookie-cutter store concepts may soon be a thing of the past. Nike Style stores, for example, aren’t broken down by gender. They also include digital experiences such as QR codes linked to augmented-reality features and content studios for creatives

- While most purchases are still made in person, e-commerce continues to be a larger percentage of retail sales

Store openings running ahead of a strong 2021, NRF (11/9/2022)

(Read more…)

- Retail sales (excluding auto dealers, gas stations, and restaurants) grew 7.2% YOY in September and have been running in the high-single-digit area since the spring of 2022, on top of double-digit gains LY

- Continued strength in the labor market, solid wage growth of around 5% YOY, and excess savings built up during the pandemic support healthy consumer spending

- Forecasts for the holiday season are mixed – Amazon’s recent caution on Q4 shouldn’t be taken lightly, but most on Wall Street and across the retail industry and looking for holiday sales to grow this year, even if growth only keeps pace with inflation

- Stores could see stronger sales growth this holiday season than ecommerce for the first time in years as consumers enthusiastically return to store for in-person experiences with the pandemic further easing

- The NRF forecasts 6-8% YOY growth in holiday sales

- Non-store and online sales are expected to grow between 11-13% YOY

- In the first nine months of 2022, major retailers announced plans to open about 5870 stores, up from 5725 from the same period LY. Many retailers opening stores are digital natives, and store closing announcements were down substantially in the first nine months of 2022

More DTC brands are pushing bundles this holiday season, Modern Retail (11/15/2022)

(Read more…)

- As price-conscious customers carefully watch their spending this year, companies are hoping to entice them and DTC brands are increasingly leaning on product bundles this holiday season as opposed to generic site-wide discount codes

- Historically, beauty brands have used bundled gift sets to drive sales during high-traffic period, but now we’re seeing other categories testing bundling. For example, DTC brand Italic released a new bedding bundle geared toward gifting

- Brands pushing bundles are hoping they not only convert hesitant shoppers and appeal to existing customers, but also increase average order value and lead to more gifting opportunities

Personalization has changed the face of e-commerce, SmartBrief (11/14/2022)

(Read more…)

- Online sales have jumped 40% YOY with 75% of consumers relying on brick and mortar and online channels to research and purchase products

- Brands should prioritize investments in their digital experience but should also focus on making that experience a personal one

- A brand’s ability to deliver personalized content increases customer loyalty, lead conversion, average order values and revenue growth

- 78% of consumers chose, recommended, or paid more for brands offering personalized services or experiences

- 60% of consumers experiencing personalized shopping with a specific brand indicate a likelihood of becoming repeat buyers

- 80% of consumers indicate a greater likelihood of buying from a company offering personalized experiences

- Personalization completes the customer experience – it increases sales by an average of 20% when used effectively

New PSCU Report Looks at Holiday Spend, PYMNTS (11/15/2022)

(Read more…)

- Consumer purchasing growth for credit cards in October was the lowest of 2022, while growth for debit remained where it had been throughout the year

- The 12-month inflation rate now stands at 7.7% – Thanksgiving dinner is expected to be more expensive this year, with costs predicted to be 13.5% higher compared to LY

- Holiday success for retailers will likely come from four key areas:

- Enticing in-store experiences

- Meeting consumer demands for virtual goods and services

- Effectively processing returns in the face of ongoing supply chain and delivery partner challenges

- Attracting and retaining additional workers for the busy holiday shopping season

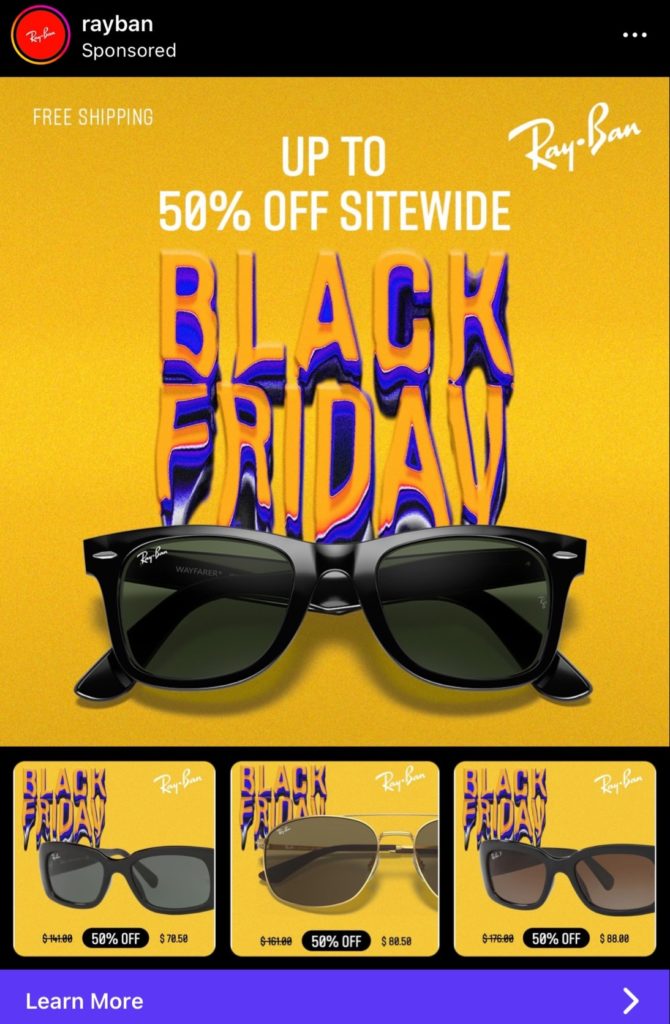

Messaging Examples

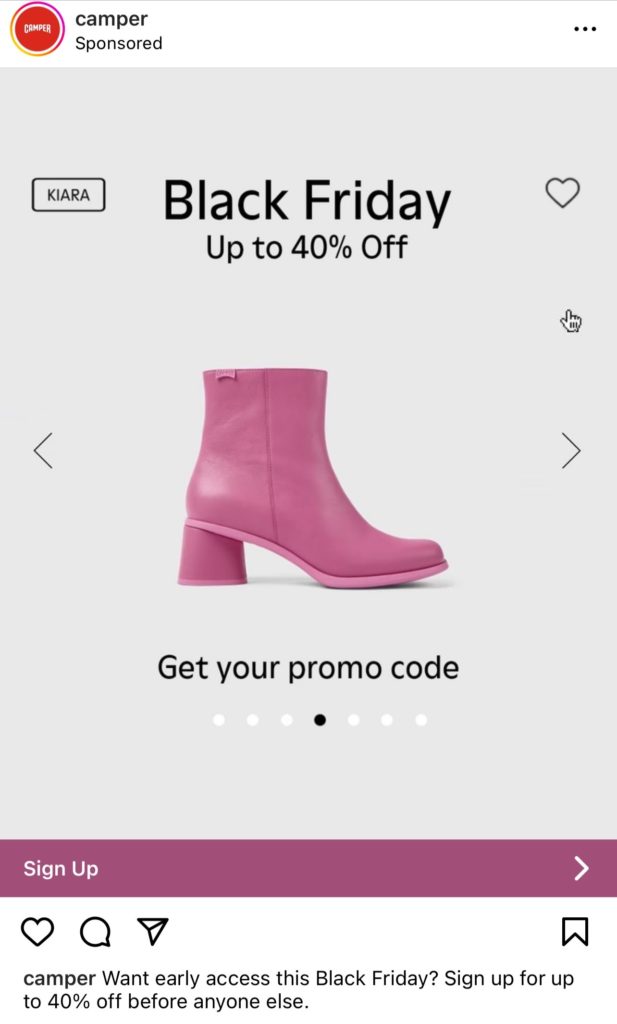

Sales Take Over

Please reach out to your account team if you have any questions – we are here as a resource and hope you found this helpful.

We’re in this together and wish you a great start to the 2022 holiday season!