Below is a compilation of industry research in the blog below to help you better understand the 2022 holiday season.

In the thick of the holiday season, consumers have been taking advantage of high promotional offerings, and despite looming inflation worries, they continue to spend! Shoppers are reported to have completed only 53% of their holiday shopping thus far, with even more spend expected to occur on Super Saturday (which falls just eight days before the Christmas holiday this year). (Source: Forbes)

So far, the 2022 holiday season has marked a return to pre-pandemic shopping behavior, unlike 2021, which was defined by supply chain constraints, high demand, and high potential to purchase.

2022 Holiday Season Trends

November retail sales show the holidays mean heavy promotions this year, Retail Dive (12/16/2022)

(Read more…)

- Retail sales across sectors rose 4.5% in November; November showed a consumer slow to spend on goods from every non-grocery or food category unless there was a deal

- This was driven in part by aggressive discounting as retailers pushed to move inventory and capture spending from price-sensitive shoppers

- Retailers pushed post-Black Friday deals – Target offered 30% off clothing, accessories, shoes and seasonal décor and Amazon, Best Buy, J.C. Penney, Macy’s, Ulta, and Walmart also offered deep last-minute discounts

- Promotional activity this holiday season has been greater than LY given higher levels of inventory and experts expect a noisy promotional environment to continue through the remainder of the holidays and into early 2023

Consumers rely more on cash and debit cards to pay for holiday purchases: report, Retail Dive (12/15/2022)

- More than half (51%) of holiday shoppers are planning to purchase fewer gifts for everyone on their list this year in response to inflation concerns

- 45% of shoppers are buying cheaper presents

- 76% of shoppers are using cash or debit cards to pay for their holiday goods, 20% are using gift cards, and 13% are using credit card rewards and 10% will use buy now, pay later loans

- Nearly three-quarters of consumers said they will buy traditional physical presents, but 25% are making homemade presents and 21% are gifting experiences

NRF expects nearly 160M holiday shoppers to turn out for Super Saturday, Retail Dive (12/14/2022)

(Read more…)

- More than 158M consumers are expected to shop on Super Saturday (the last full weekend before Christmas Day) – 10M more than what the NRF expected

- Consumers said they completed half their holiday shopping in early December, and 47% planning to finish up online, 37% at department stores, 27% at discounters, 24% at clothing and accessories stores

- The top gifts so far are clothing (50%), toys (34%), gift cards (28%), books and other media (26%), and food or candy (23%)

- Giving experiences (e.g., concert or sporting event tickets, gym memberships or art classes) is up 23% from LY

- Super Saturday falls eight days before Christmas this year and retailers are prepared to help shoppers fulfill last-minute purchases – the holiday shopping season is expected to extend beyond Super Saturday for 70% of holiday shoppers

- Prosper Insights & Analytics predicts consumers maximizing holiday sales and promotions, using gift cards, and returning or exchanging gifts in the week following Christmas Day

NRF: Retailers Expect More Than $816 Billion Worth of Returns In 2022, Footwear News (12/14/2022)

(Read more…)

- The average rate of return has remained flat at 16.5% compared with 16.6% in 2021 – for every $1B in sales, the average retailer incurs $165M in merchandise returns

- Even with 29 continuous months of retail sales growth, consumers have remained steady with the overall rate of merchandise returned to retailers this year

- For every $100 in returned merchandise accepted, retailers lose $10.40 to return fraud

- Online return rates are consistent with the overall rate of return. Online return rates decreased from 20.8% in 2021 to 16.5% in 2022

- In terms of holiday sales, retailers can expect to see an average of 17.9% of merchandise returned, equating to nearly $171B

U.S. retail sales fall after hefty gains; labor market still tight, Reuters (12/15/2022)

(Read more…)

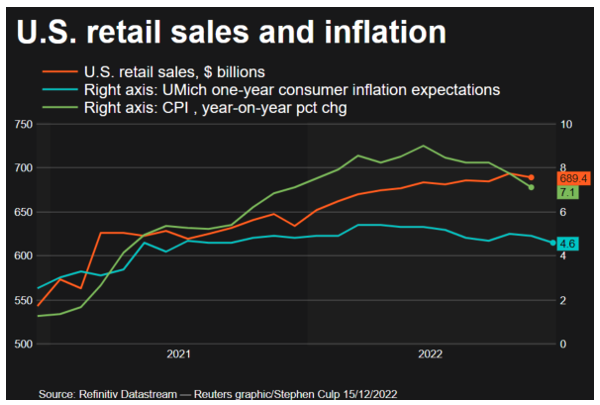

- Retail sales fell more than expected in November, but consumer spending remains supported by a tight labor market

- The number of Americans filing for unemployment benefits decreased by the most in five months last week

- The biggest decrease in retail sales in 11 months was likely payback after sales surged in October as consumers started holiday shopping early to take advantage of discounts by businesses eager to clear excess inventory

- Goods prices tumbled in November, which could have factored into sales performance last month

- Savings, which have helped to cushion consumers against inflation, are dwindling – the saving rate was at 2.3% in October, the lowest since July 2005, however economists expect slowing inflation to support spending

Black Friday sales grow 4% as online slows, Earnest Analytics (12/06/2022)

(Read more…)

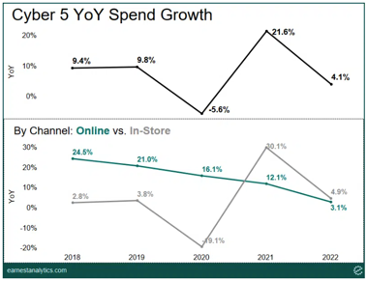

- Cyber-5 sales grew 4% YOY. Spending grew at a much more muted pace than 2021, +22% YOY comping pandemic challenges

- Online and in-store spending continued to converge after years of high ecommerce growth

- Overall spending decelerated to 5% YOY in the first 32 days of the holiday shopping season, notably slower than early holiday 2020 and 2021 shopping season levels at 7% YOY and 22% YOY, respectively

DTC holiday pop-ups make a splashy return, Modern Retail (12/13/2022)

(Read more…)

- Holiday pop-ups are back as physical shopping continues to recover. DTC brands are bringing back experiential pop-ups to drive holiday purchases and reach new customers in-person

- 2022’s pop-ups aren’t just about putting on creative concepts, but fully diving back into robust in-store programming, events that bring the community together, and create immersive and engaging experiences

- With much uncertainty in the air, customers want something to escape to and feel good about. A pop-up gives people a way to step into ‘retail therapy’ again and have an experience with a brand that feels deeper than something that’s just transactional

Report: Seasonal hires in November hit lowest level since 2008, Retail Dive (12/08/2022)

(Read more…)

- Despite being the busiest time of the year, the retail industry highered for 256,700 seasonal jobs in November, the lowest level since 2008 and a decline of 26% from 2021

- During this holiday season, retailers hired for 418,700 seasonal jobs so far, a 27% drop compared to October and November LY when hires numbered 573,000

- Transportation and warehousing seasonal hires declined 30% YOY

- Overall, however, the retail sector’s employment numbers are high. The industry employed 16,076,400 workers in November, the highest level of employment since Nov 2018. Transportation and warehousing sectors employed a record 6,714,800 workers, higher than its previous peak in December 2021

Macy’s, Nordstrom see holiday shoppers pulling back, Retail Dive (12/08/2022)

(Read more…)

- Overall discounting was actually down in those early weeks before Black Friday compared to LY

- Some people seem to be in less of a hurry to tend to their lists, possibly because there’s more weekend time before major holidays this year

- “There is a sense of customers holding back, and some of that is the way the calendar falls this year,” Nordstrom said. There is an extra Saturday before Christmas and Hanukkah is later this year.

- The urgency around shopping is different this year as 2021 was marked by supply chain constraints, tremendous demand, tremendous potential and capacity to purchase, while in 2022 we’re seeing shopping behavior reflect pre-pandemic patterns

- One of the biggest drivers of hesitancy for consumer shopping is their level of worry about near-term employment. While there were stellar sales over Black Friday, negative news around mass layoffs has also influenced the consumer mindset

Looking Ahead to 2023

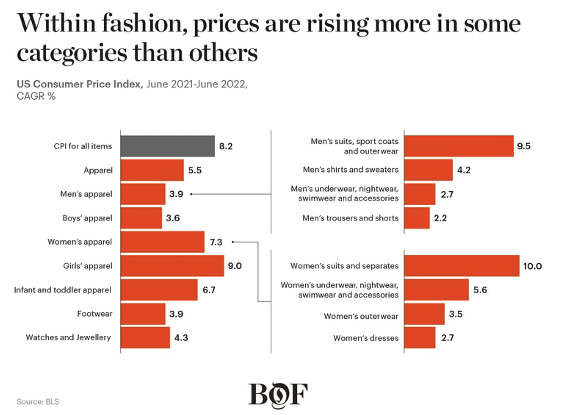

How Fashion Can Weather Economic Turbulence, Business of Fashion (12/09/2022)

(Read more…)

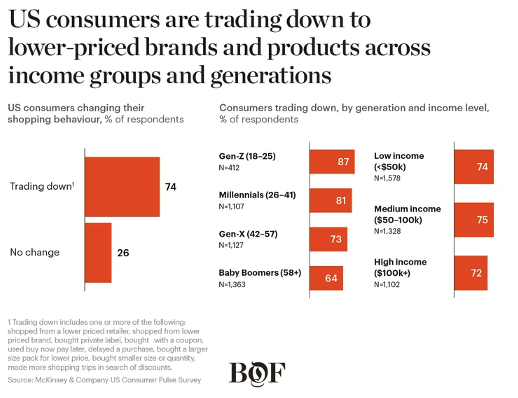

- Value-conscious consumers are trading down into value, off-price and private label brands, while higher-income consumers are less likely to switch

- We expect to see increasingly value-driven and selective consumers in the months to come. In the early months of 2022, 67% of consumers that tried a new brand cited value as a reason for switching, an increase of 9% from October 2020

- About a third of consumers have switched to a private label brand over the past year

Retail Trends to Watch for 2023, Insider Intelligence (12/08/2022)

(Read more…)

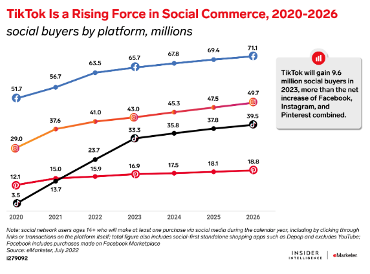

- TikTok Shop is in the testing stages with select merchants, building on the #TikTokMadeMeBuyIt phenomenon

- TikTok’s share of users who are social buyers will surpass Facebook’s in 2024

Retail Trends and Predictions 2023: What to Expect in the Year Ahead, Lightspeed HQ (12/13/2022)

(Read more…)

- Consumers will continue to shop offline – As the world opened up, consumers flocked back to brick-and-mortar stores, proving there is still a strong demand for physical retail

- Physical retail stores need to support sales and fulfilment – For the most part, consumers have returned to in-store shopping. However, certain pandemic behaviors—i.e., the reliance on BOPIS and speedy delivery—are here to stay

- Omnichannel marketing will be table stakes – With shoppers using a blend of devices and platforms in their shopping journeys, it’s vital to be present on multiple channels

- Consumers will increasingly expect payment flexibility – Inflation remains a major concern for shoppers, and it will continue to be top of mind; 7 in 10 consumers expect costs to rise in the coming year. Shoppers are likely to consider alternative payment methods to support purchases in 2023

- Retailers will continue to grapple with labour shortages – roughly 70% of job openings in retail are unfilled and this will likely continue until at least early 2023

- The demand for experiential retail will grow – 59% of consumers expect retailers to dedicate more space to experiences; 81% of shoppers are willing to spend more in retail stores that offer rich shopping experiences

- Expect a bigger focus on sustainability and corporate social responsibility – Consumers are more inclined to support companies that invest in CSR (corporate social responsibilities); 77% of shopperes are motivated to buy from businesses that are committed to make the world a better place and 55% believe companies should take a stand on key environmental, political and social issues

- Livestream shopping will continue making inroads – Coresight Research is estimating livestream ecommerce penetration to grow from $20 billion in 2022 to $57 billion in 2025

- Retail will permeate other industries and vice versa – In 2023, we’ll see more retailers go from being purists (i.e., retail-only stores) to become hybrid locations that have other offerings beyond inventory. At the same time, companies in other industries are adding retail components to their businesses

- Nimble and flexible retailers will flourish

DTC Brands Are Moving Ad Budgets to Amazon, Business Insider (12/08/2022)

(Read more…)

- DTC brands’ ad spend is moving from Meta to Amazon with new urgency, however DTC brands are posed with a challenge as they are unable to collect data about their customers and sales on Amazon

- DTC brands used to expect that every ad dollar put into Meta would drive $7 to $8 in sales, but performance is now closer to $1 or $2 in sales for every ad dollar

- Amazon’s ads have gotten cheaper because there is less competition as fewer brands buy ads due to softening e-commerce sales

- 75% of brands find that it’s cheaper to acquire customers on Amazon than any other media channel

Messaging Examples

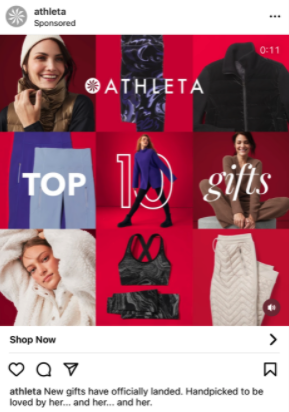

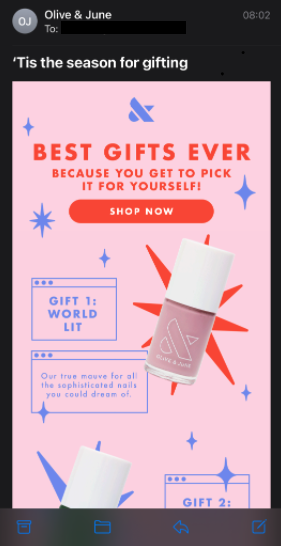

Gift Giving

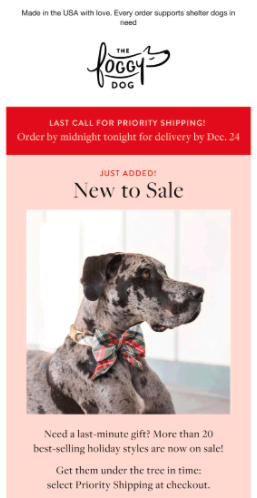

Last Call for On-Time Arrivals

Please reach out to your account team if you have any questions – we are here as a resource and hope you found this helpful.

We’re in this together and wish you success as we approach the end of 2022!