In Q2, we witnessed a momentary return to normalcy as the nation made strides toward recovery and reopening. Lockdown restrictions were lifted and retailers enjoyed a boost as consumers started to venture out for the summer.

After over a year of lockdown, consumers not only had a pent-up demand for products, but also for human interaction. As of June, the economy had fully recovered from the pandemic and grew at an annual rate of 6.5% through the Q2 period. Consumers were still cautious, with 59% saying they expect to cut back on spending compared to before the pandemic, but retail sales are still expected to jump between 10.5% and 13.5% totaling $4.44T this year compared with last year at $4.02T.

Savings from the third round of stimulus payments, improving economic conditions, and an audience hungry for experiences outside their homes, mean that retailers can look forward to pre-pandemic levels of spending sooner than expected.

In-Store Shopping Dominates

Foot traffic took off as consumers are hungry for experiences outside their homes. Nearly 50% of consumers planned to immediately start shopping in stores as soon as Covid-19 restrictions are lifted. Three in four shoppers still went to stores during the crisis and almost 80% of shoppers made traditional in-store purchases (versus curbside pickup or buy online, pick up in store)). Consumers are growing more confident with purchasing in-store with 64% indicating feeling comfortable or very comfortable entering a physical store when compared to 58% in the fall of 2020.

Although the rise in foot traffic was expected, it is important to note that shoppers have also become accustomed to new conveniences such as contactless shopping, curated assortments and auto-replenishment, and high levels of service and sanitation.

Supply Chain Disruptions Continue

Across the world, shortages continued to be of increasing concern as the pandemic highlighted the need for greater flexibility, diversity, and a reimagining of supply chains. During the worst of the pandemic in 2020, cargo volume at major retail container ports fell to its lowest level in four years as the economy largely shut down. Ecommerce rose 33% in 2020, accounting for $792B or 14% of all retail sales, putting more stress on shippers to satisfy consumers. Furthermore, natural disasters pose additional pressures to supply chains.

Despite these challenges, consumers are less understanding of disruptions and delays caused by Covid-19 than they were in 2020 and 78% expect shipping issues to be figured out, making it imperative for retailers to develop risk and contingency plans.

The Rise of Hybrid Shopping

Retail sales are expected to continue growing as consumer look forward to returning to aspects of pre-pandemic life – with new upgrades. The National Retail Federation boosted their outlook for the year, saying it anticipates the “fastest growth we’ve seen in this country since 1984.” Several retailers, including Walmart, Levi’s, and Macy’s reported strong first quarters and raised their own forecasts for the year, citing optimism as consumers are getting out of the house and planning social gatherings.

Brick-and-mortar locations have gone from simple a “place to purchase,” evolving into product showrooms, distribution hubs, customer service centers, places to engage in community, and more entertainment-oriented venues. Digitally influenced brick-and-mortar purchases surpassed 50% in many categories prior to the pandemic and grew to 70% in 2021. Retailers like Walmart, Target, Best Buy and Tractor Supply Co., as well as newer disruptive digitally native brands like UnTUCKit and Warby Parker, have embraced the blur of modern shopping well before the pandemic, putting them in a good position to respond to retail’s new era of hybridization.

Q2 Digital Creative Trends

Digital creative carried a positive tone heading into the summer as restrictions ended and the US reached 50%+ vaccinations. Brands took on a celebratory approach as optimism blossomed across the country and consumers were able to spend holidays such as Mother’s Day and Father’s Day with their loved ones.

Mother’s Day

Anthropologie directed their Mother’s Day offering toward first mothers, gifts for grandma and for mom from daughter.

Anthropologie

Free People followed suit with many similar brands in their space for Mother’s Day by offering beauty and accessory items for Mom.

Free People

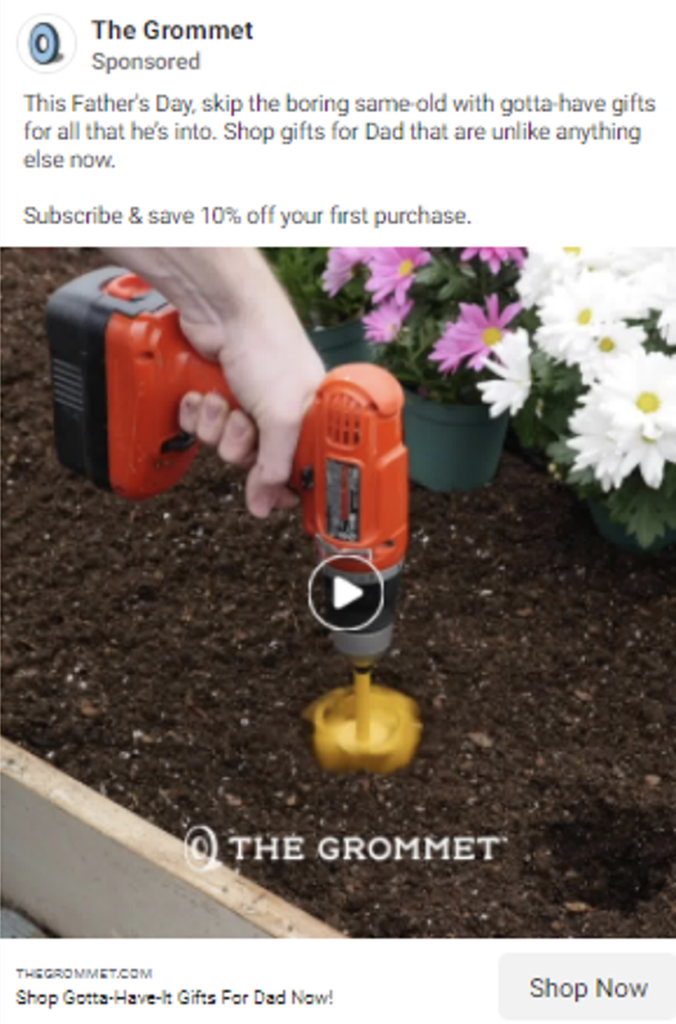

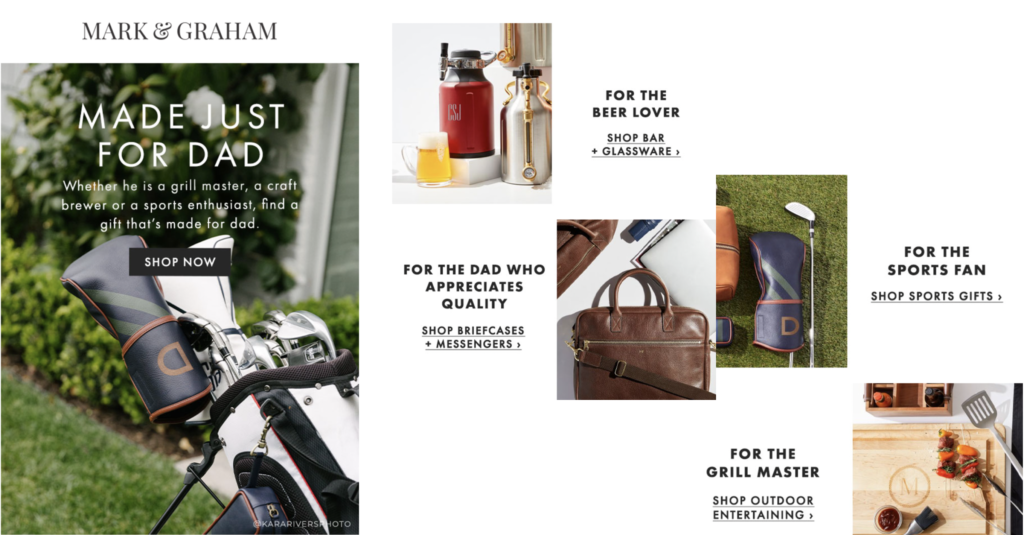

Father‘s Day

By Father’s Day, local governments officially announced the end of most pandemic restrictions and retailers shifted messaging to consumers eager to celebrate the holiday.

The Grommet

Mark & Graham

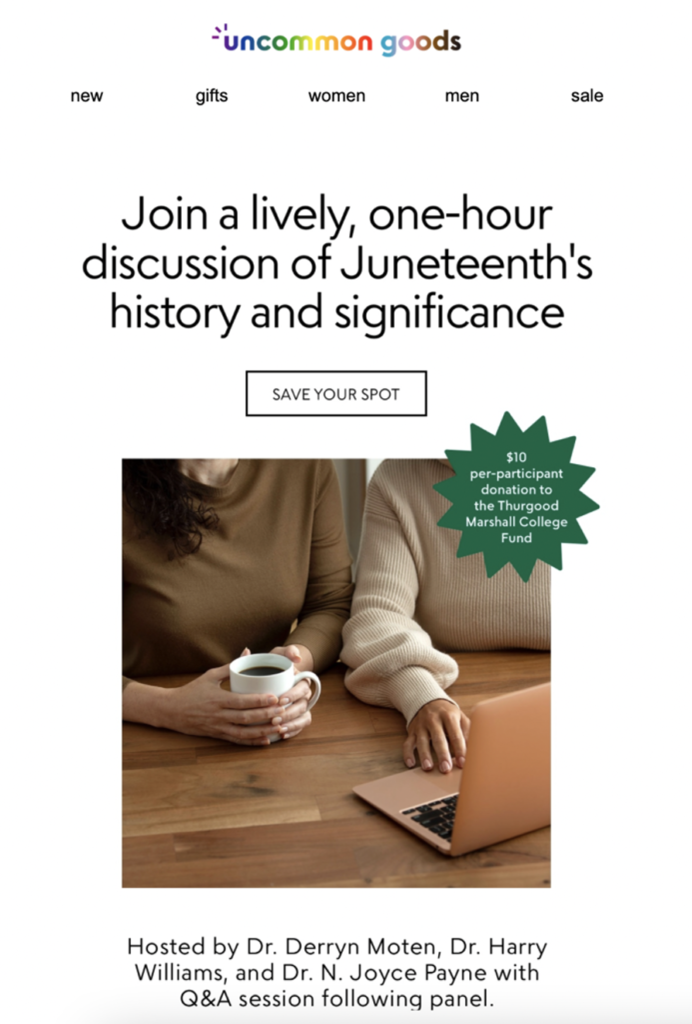

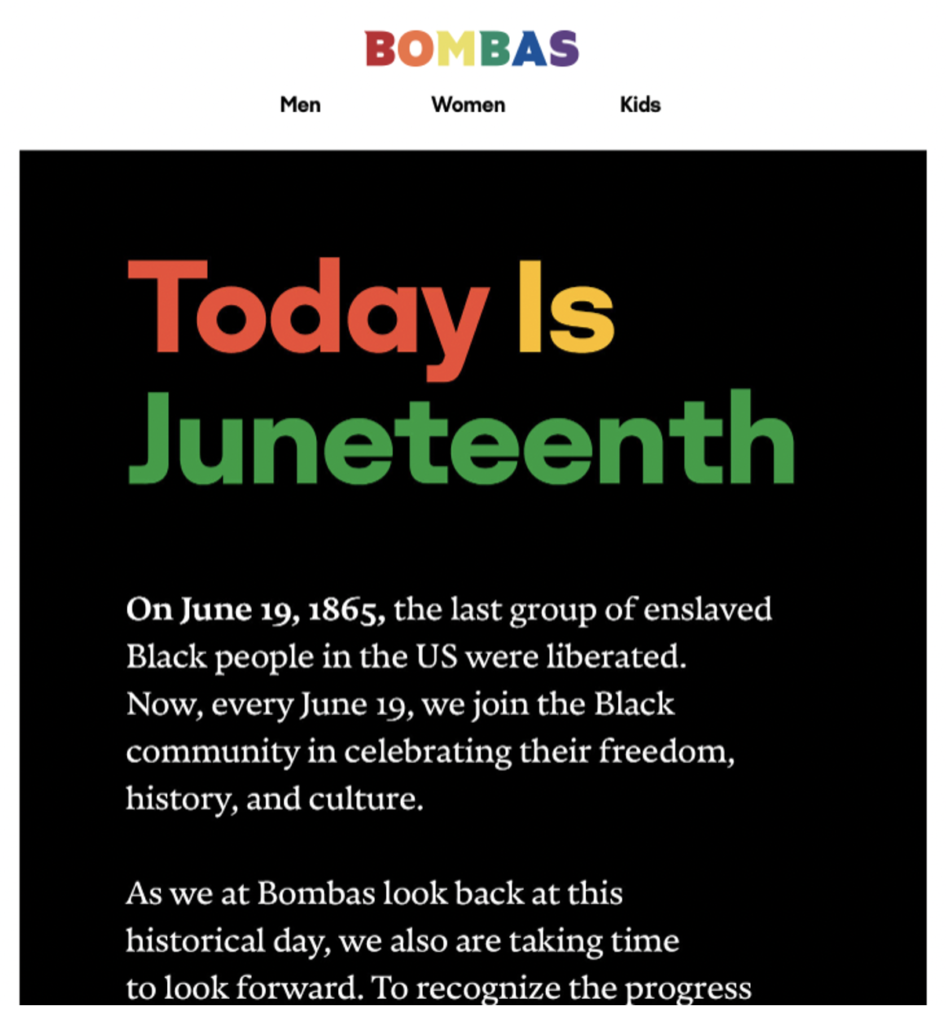

Juneteenth

Uncommon Goods and Bombas brought attention to Juneteenth by offering opportunities for consumers to participate in educational events and support their communities.

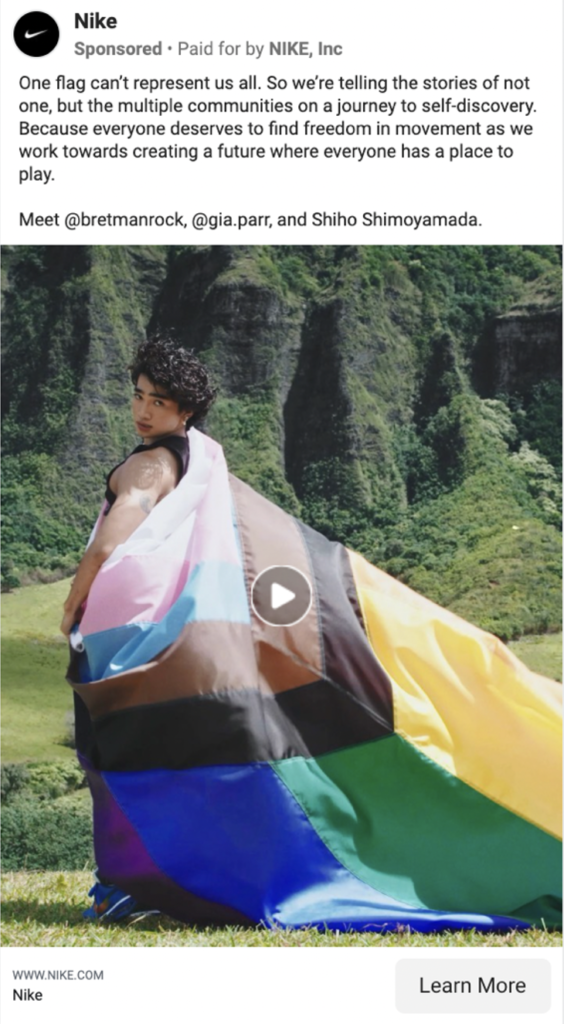

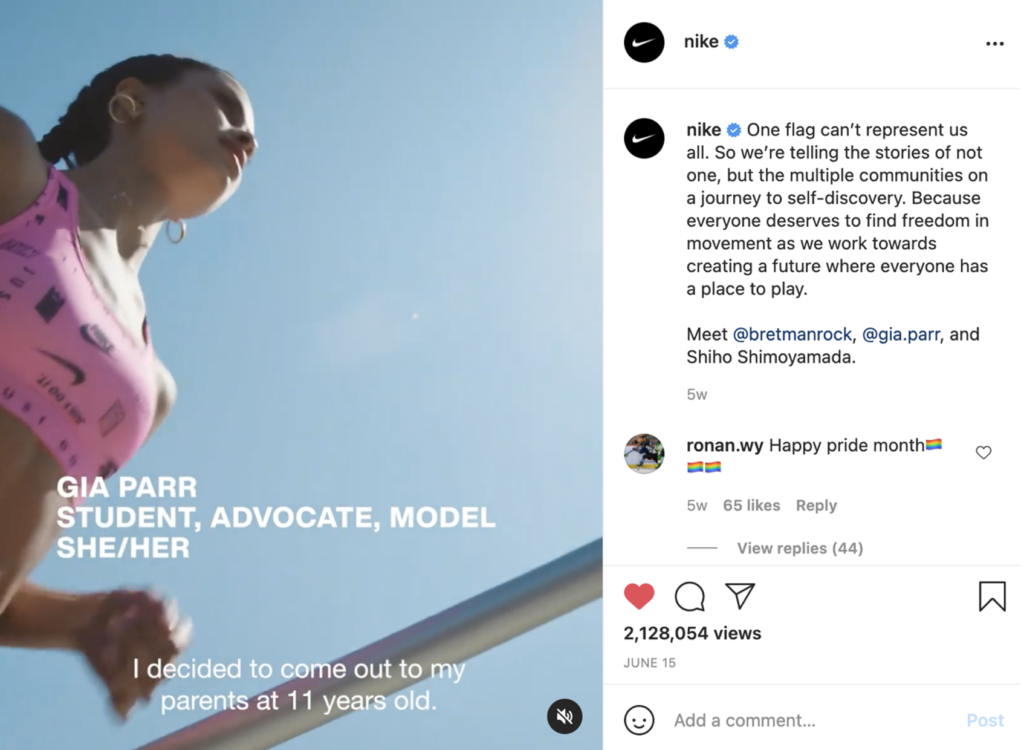

Celebrating Pride Month

Nike celebrated Pride Month with their 2021 Be True collection, featuring Human Rights Campaign activist Gia Parr, influencer Bretman Rock, and soccer player Shiho Shimoyamada.

Nike

Ready for Summer Sun

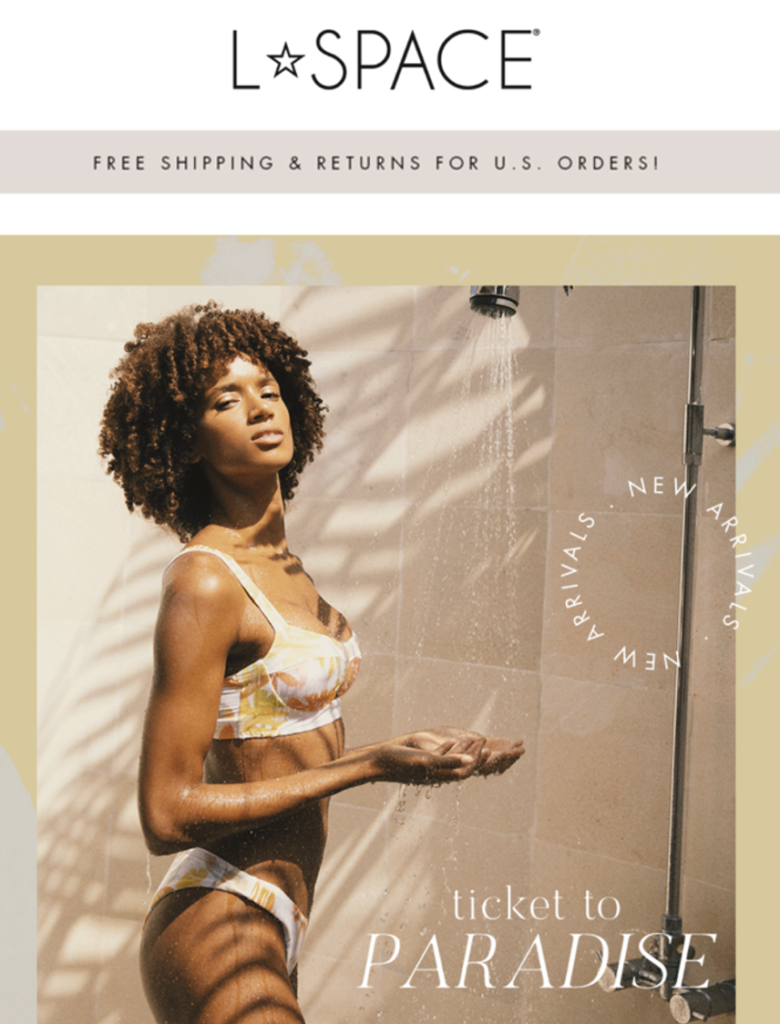

After a year of lockdowns, it looks like there are brighter days ahead as brands took on an exuberant tone to celebrate the return to normalcy and summer plans back on track.

The Inside

Madewell

L*Space

Pottery Barn Kids

In the past, retailers could point to a clear distinction between high-touch physical and high-tech digital retail, but the gap between physical and digital channels is narrowing. Omnichannel is fast becoming a basic expectation for retailers who want to thrive in the future.

In retrospect, Q2 was characterized by optimism as spending was driven by reduced restrictions, increased foot traffic, and an eagerness to return to pre-pandemic habits. Despite this, the remainder of the year is still uncertain as the resurgence of Covid-19 and supply chain issues heavily impact consumer behavior. Going into the second half of the year, it is imperative to keep an ear close to the ground and monitor conditions carefully.