Following a period of optimism, Q3 was defined by unpredictability as consumer sentiment faced several challenges including the delta variant, continued supply issues, and extreme weather caused by climate change.

At the end of Q2, retail earnings had improved and were better than ever, but the rise in delta cases proved to be a wild card. However, consumers have never had more disposable cash or more leisure time than in the past year.

Despite the commodity inflation, consumers were less resistant to higher prices, so retailers were able to sell more goods at full price. Furthermore, vaccine availability had improved consumer sentiment, as six out of ten consumers (58%) were more comfortable shopping in stores.

Sales are holding up even as spending is shifting back from goods to services like travel and entertainment. While concerns surrounding the delta variant and inflation persist, experts are optimistic about the industry’s road to recovery.

Back-to-School Spending

According to the National Retail Federation (NRF), the total planned back-to-school spending for 2021 is $37.1B, a YOY increase of 9% from 2020’s $33.9B. As expected, parents are planning to spend record amounts on back-to-school as students return to in-person learning.

44% of back-to-school shoppers will be purchasing from discount stores this year, followed by 41% at clothing stores, and 27% at office supply stores. Back-to-college is also setting records with total spending expected to reach $71B, up from $67.7B in 2020.

The Rise of Omni-Channel

This upcoming holiday shopping season will test merchandising strategies and omni-channel capabilities in the constantly changing retail environment. In the current retail market, brands and merchants face the challenge of an accelerated shift to digitalization and ecommerce.

We’re seeing that many shopping and distribution channels are beginning to blur, and retailers are focused on the new definition of convenience. Retailers must thoughtfully strategize to keep up with evolving consumer expectations. Many are rethinking how to recreate a seamless experience across their physical locations and ecommerce experiences, requiring changes to both online and offline channels to introduce and fulfill on the hybrid online/offline models.

Supply Issues and Labor Shortages

Retailers not only have to face supply chain issues, but also labor shortages, which are contributing to the challenges in Q3. Shipping chains remain badly tangled, causing costs to soar and increasing concerns of empty shelves and shortages of in-demand products, particularly for the holiday season.

The surprise success in retail sales was tempered slightly with a disappointing read on jobless claims. In September, weekly jobless claims increased to 332,000 versus the estimate for 320,000.

Retailers will try to get around these concerns by offering earlier holiday promotions in-store and online – particularly for electronics and apparel.

Looking Forward to the Holidays

The holiday season will give brands a chance to practice being flexible to market changes by adjusting strategies and tactics in real time. Retailers head into the holiday season with important tailwinds, including boosts from inflation, rebounding employment, and healthy savings rates and wage growth.

Expect to see a holiday season defined by early shopping – more than 51% of consumers plan to start their holiday shopping before Thanksgiving, compared to 49% in 2020.

Deloitte estimates holiday sales between $1.28T and $1.3T, suggesting an increase of 7%-9% during the November-January period. The NPD Group predicts that 29% of consumers plan to spend more on holiday shopping this year than in 2020.

While a gradual pick-up in economic activities is expected, it is still imperative to bear in mind the delta variant, supply chain bottlenecks, rising freight charges, and labor shortages.

Consumer behaviors and trends are evolving quickly and many of the new shopping habits and expectations are here to stay in a post-pandemic world. The pandemic opened new ways to shop that will likely stick, and merchants are increasingly offering an omni-channel experience.

Planning ahead is essential as supply chain concerns continue to plague the economy, particularly over manufacturing capacity, logistics costs, and labor shortages.

As we approach the end of 2022, businesses will need to adapt and strategize creatively by leveraging data, offering greater personalization, and fostering a deeper and more human connection to shoppers.

Q3 Digital Creative Trends

This quarter’s digital creative followed the transition of summer into fall. Retailers put forward a range of promotions and shoppers adapted to the changing seasons.

Independence Day

As the vaccination roll-out continued, retailer took on a celebratory tone for Independence Day in anticipation of in-person gatherings.

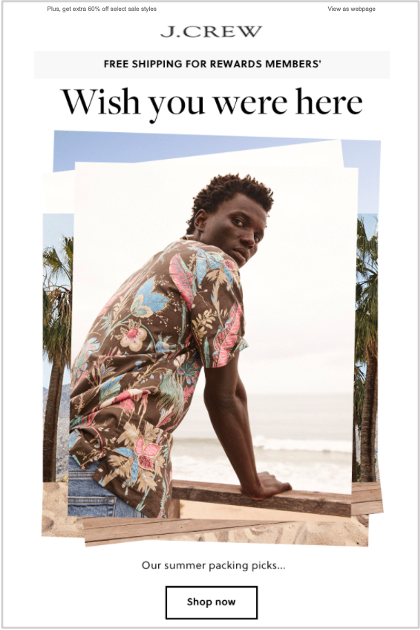

Last Days of Summer

Messaging in Q3 also capitalized on the excitement of traveling, with curated guides to maximize summer fun.

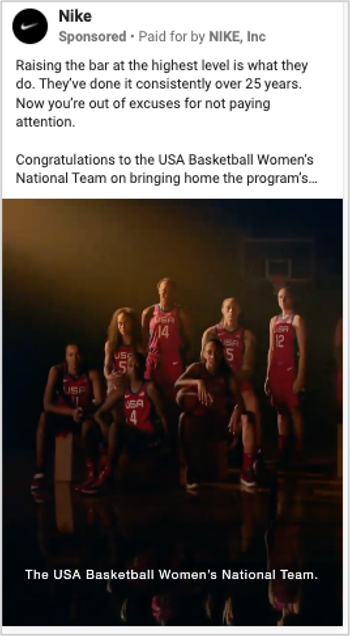

Olympics and Empowerment

Due to the pandemic, the Tokyo 2020 Olympics were moved to summer 2021, and brands such as Nike drew attention to female empowerment.

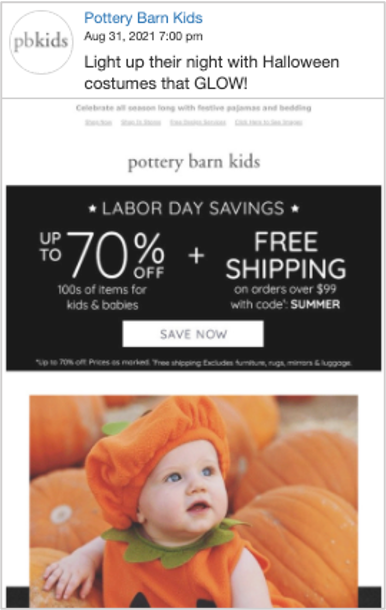

Labor Day

Labor Day Weekend presented a range of offers, from end-of-summer promotions, fall discounts, and Halloween-themed savings.

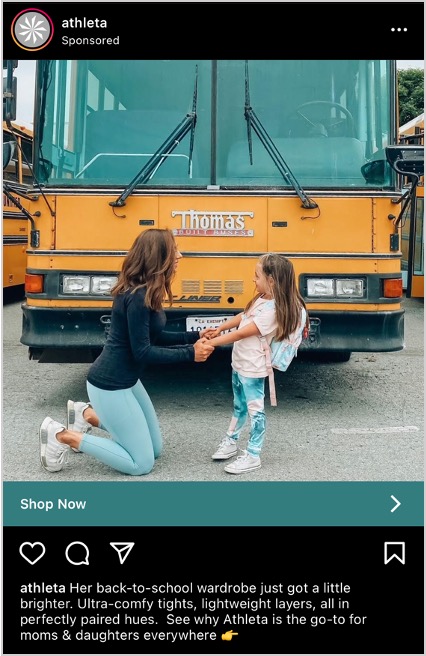

Back-to-School Season

Following a year of lockdown, brands responded to the return of in-person learning and parents preparing for back-to-school shopping.

Pottery Barn Kids

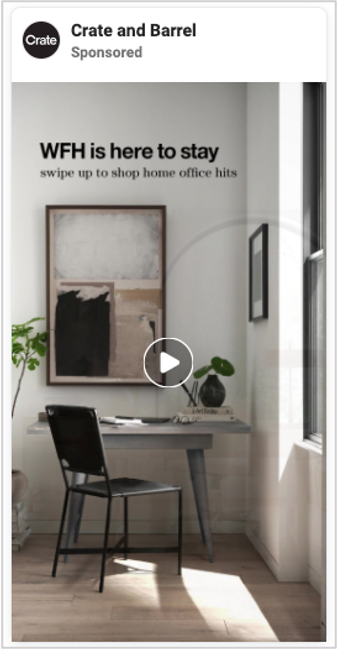

Work from Home

Brands like Pottery Barn and Crate & Barrel continue to cater to the consumer working from home, as some companies have converted to a fully hybrid or remote model.

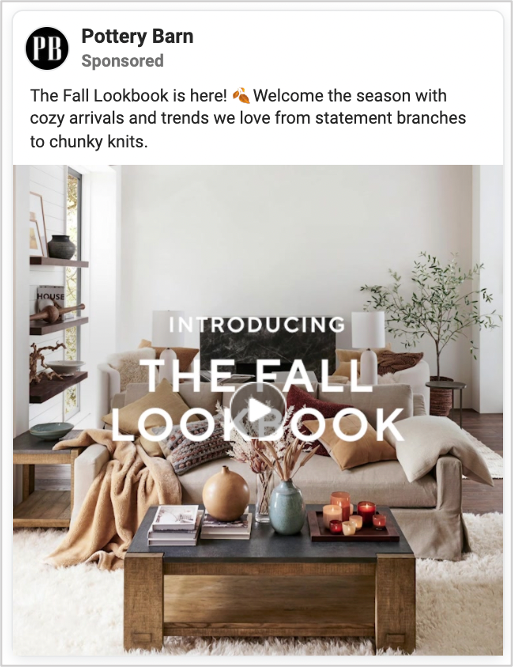

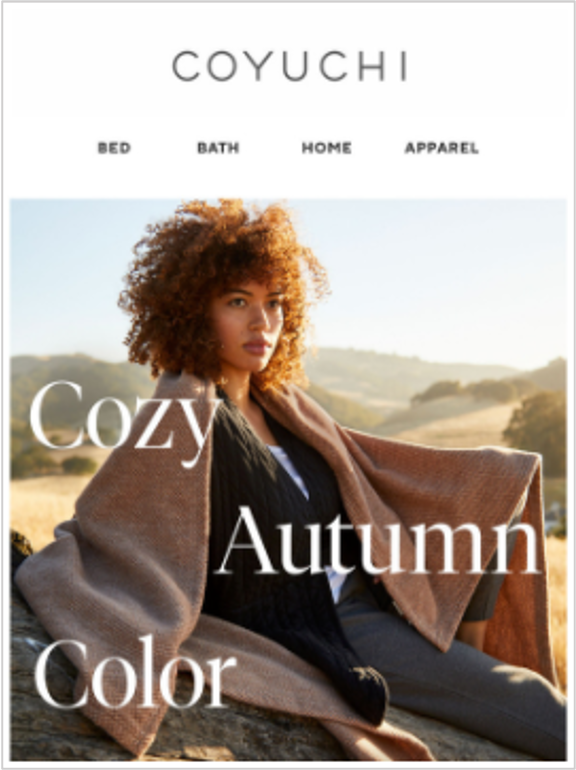

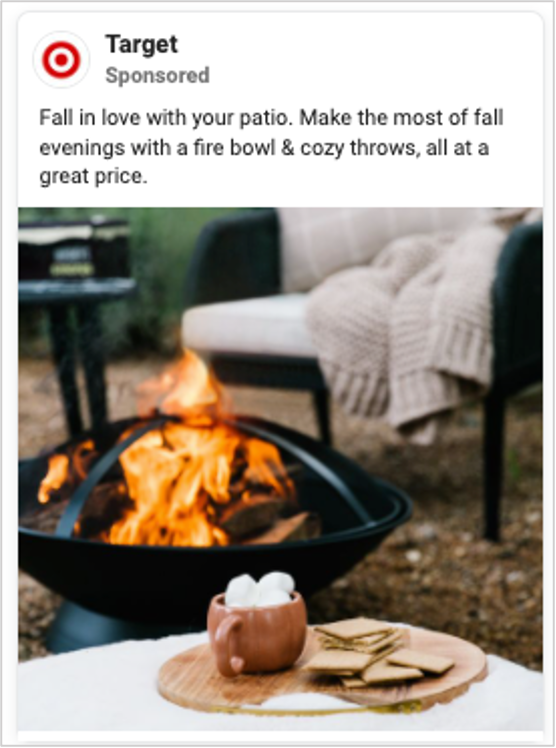

The Fall Transition

Later in the quarter, messaging began to focus on the upcoming fall season, encouraging consumers to prepare for cooler weather and holiday shopping.

Target