While we shared our Cyber Week results here, we have compiled additional industry research in the blog below to help piece together the highlights of the year’s biggest shopping event.

According to the NRF this year, Cyber Week saw a total of 196.7M people shopping online and in stores, an increase of 17M compared to 2021. The 2022 event was defined by a budget-conscious consumer, and with holiday shopping already underway, retailers offered bullish discounts compared to previous years to overcome an inventory glut and entice hyper-selective customers.

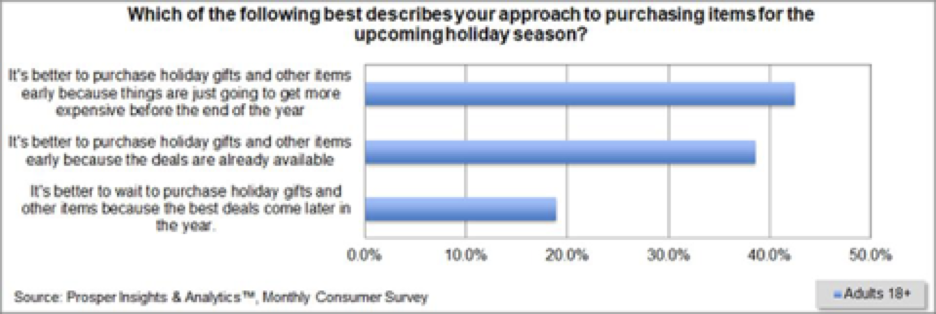

Cyber Week saw the rise of in-store shopping – more than 122.7M people visited stores, up 17% from 2021. Despite the shadow of inflation, consumers took advantage of the deals offered, and increasingly used Buy Now, Pay Later services. Many deal-driven consumers are still holding out, anticipating better promotions as we approach the end of the year.

Reflecting on Cyber Week

Three surprises from Cyber Week 2022, Chain Store Age (12/02/2022)

(Read more…)

- Over the five-day period, more than 122.7M people visited brick-and-mortar stores, up 17% from 2021

- E-commerce sales performed better-than-expected – Cyber Week brought in $35.27B overall, up 4% YOY. The results were bolstered by record online spending during Black Friday ($9.12B, up 2.3% YOY) and Thanksgiving ($5.29B, up 2.9% YOY)

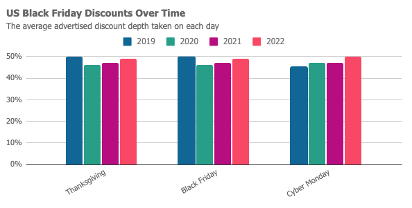

- Average discount rates spiked during Cyber Week, topping pre-pandemic levels at and 30%

- 76% of Cyber Week e-commerce traffic was mobile

Black Friday 2022: Online sales surpass $9.1 billion for new record, USA Today (11/26/2022)

(Read more…)

- Consumers spent a record 9.12B online shopping on Black Friday, an increase of 2.3% over LY, surpassing the previous online Black Friday sales high mark of $9.03B in 2020

- The NRF expects holiday sales including online sales to be up 6-8% this year, compared to 13.5% a year ago, however those estimates aren’t adjusted for inflation so spending could potentially be lower

NRF: Record 197M consumers shopped from Thanksgiving to Cyber Monday, Retail Dive (11/30/2022)

(Read more…)

- 196.7M people shopped online and in stores during Cyber Week – an increase of 17M people compared to 2021

- Black Friday saw 72.9M shoppers in stores, an increase from 66.5M in 2021

- 77% of shoppers said they were supporting Small Business Saturday

- In-store visits on Black Friday were down YOY for most categories. Visits to indoor malls fell 2.3% and big box retailers like Walmart, Costco and Target saw multi-percentage-point declines compared to 2021

- Meanwhile, discount and dollar stores saw a 1.1% increase and the beauty and spa industry saw a 14.6% jump YOY

- Shoppers spent an average of $325.44 on holiday-retailed purchases during the weekend, compared to $301.27 LY

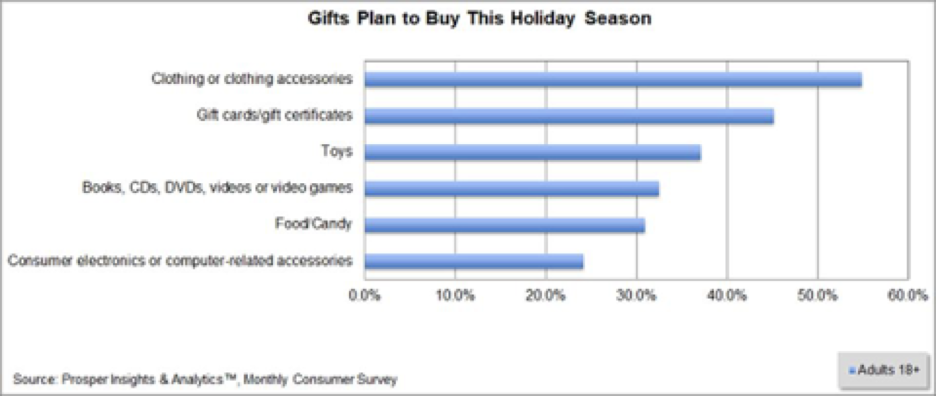

- Clothing, toys, and gift cards were among the top gifts purchased

- Online shoppers grew at a slower pace YOY (an increase of 2%) compared to in-store retail (up 17%)

- Top destinations for shoppers included online (42%), department stores (42%), grocery stores and supermarkets (40%), as well as clothing and accessories stores (36%)

- Over half (56%) of consumers took advantage of early holiday deals prior to Thanksgiving, with 24% doing so before Nov 16

Cyber Monday spend reaches $11.3B with a surge in BNPL usage: report, Retail Dive (11/29/2022)

(Read more…)

- Cyber Monday brought in a record $11.3B in total spend, marking 5.8% growth YOY

- At the peak hour of 8pm to 9pm, consumers were spending $12.8M per minute

- Toys, electronics, and computers drove online spend. The toys category saw a 684% jump in sales compared to an average day in October. These categories also saw record high discounts – electronics price cuts peaked at 25% off compared to 8% in 2021.

- Mobile shopping was strong with 43% of online sales coming from a smartphone

- Buy now, pay later saw a surge in use that continued into Cyber Monday. During Cyber Week (Thanksgiving to Cyber Monday), BNPL orders increased by 85% compared to the week before and revenue from it increased 88%

- From Black Friday to Cyber Monday, BNPL service provider Afterpay saw transactions rise by 120% compared to before the holiday

- Curbside pickup usage was down during Cyber Week – for retailers who offer the service, use on Thanksgiving and Black Friday was down to 13% from 21% LY

Retail Employment Dropped in November; Leisure and Hospitality Rose, Wall Street Journal (12/2/2022)

(Read more…)

- Retail employment dropped by 30,000, with losses of 32,000 in general merchandise stores and 3,000 in home furnishing stores

- Leisure and hospitality added 88,000 jobs in November, powered by a gain of 62,000 in food services and drinking places

- Employment in leisure and hospitality is about 5.8% below its pre-pandemic level

Winners and losers of Black Friday 2022, Retail Dive (11/26/2022)

(Read more…)

- On Thanksgiving Day, online BNPL revenue increased by 1.3% YOY and orders were up 0.7%

- Some shoppers are using BNPL for lower-priced goods instead of high-ticket items, with the AOV for BNPL purchases decreasing in by 6% on Thanksgiving day

- Orders using BNPL rose by 78% the week of Nov 19 to Nov 25 compared to the week before

- In-store shopping was more in focus this year, but the lines have yet to match the pre-pandemic long queues

- The avoidance of such lines on Black Friday may have contributed to the use of BOPIS (Buy Online, Pick Up In-Store), which trended 20% higher on Black Friday compared to other days this season

- Despite consumer interest in categories with increased inventory levels, inventory may remain high into the near future

- Mobile commerce saw gains this year, especially around Thanksgiving when mobile shopping accounted for 55% of online retail sales, an increase of 8.3% YOY

- On Black Friday, mobile hit another record, reaching 48% of all online sales compared to 44% in 2021

Gift Cards Popular This Holiday Season Kickoff Weekend, WWD (11/30/2022)

(Read more…)

- The top industries for gift card sales were food and beverage, beauty and personal care, and health care and fitness

- Consumers who purchased physical gifts saw an average Black Friday/Cyber Monday discount of 21%

- Trending online products purchased with Afterpay included beauty advent calendars, fluffy slides, perfume, sneakers and tracksuits

What Black Friday Results Spell for Retail, Business of Fashion (11/30/2022)

(Read more…)

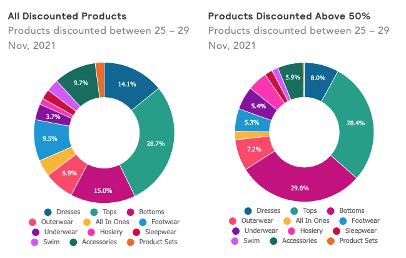

- Online discounts for apparel averaged 18%, up from 13% in 2021

- Some retailers started holiday discounting as early as October, and in early November, 58% of styles were on sale – up from 35% LY and 51% in 2019

How Cyber Sales Shaped Up, EDITED (12/1/2022)

(Read more…)

- Out of the main sales days, Black Friday was the most successful for retailers, boasting the highest average selling prices. However, profitability for the day dipped 10% YOY

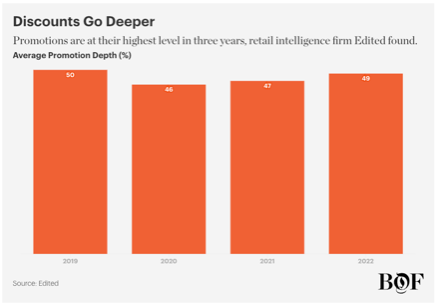

- Nearly half of retailers’ assortments were advertised as marked down on Black Friday, with an average reduction of 49%, higher than the past two years

- Deepest discounts were saved for Cyber Monday, which saw an average promotions of 50% off, a four-year high for the event

How Consumers Are Tackling the 2022 Holiday Shopping Season, My Total Retail (11/22/2022)

(Read more…)

- Gift categories at the top of consumers’ lists include clothing and accessories (26%), candy/food/gift baskets (24%), toys (23%), and electronics (21%)

- Shoppers are making a shift toward self-care and their homes – 61% of consumers plan to spend more or the same on shopping for themselves and their homes for the holidays

Holiday Shopping Is More Intentional This Year: Here’s How And Why. Forbes (12/02/2022)

(Read more…)

- Intentional gifting is on the rise. Traditions like ‘Secret Santa’ gift swaps and presents for coworkers are less prioritized as consumers focus on gifting for their loved ones – unsurprising, as shoppers look to improve or maintain their financial health

- Half of consumers plan to spend $100 or more on significant others and immediate family members, an increase from LY

- In 2021, more than half of shoppers began to go out to dinner more, attend events, and prioritize spending on experiences. The top gift consumers planned on giving to their loved ones in 2021 was a memorable experience

- In contrast, 85% of shoppers in 2022 plan to buy physical gifts that their loved ones can unwrap

Looking Ahead to 2023

Retail Trends Forecast 2023, Placer.ai (12/06/2022)

(Read more…)

- Retailers across segments are maximizing the potential of their locations. Target, Kohl’s, and Lowes have jumped into the world of shop-in-shop concepts to drive visits, increase basket size, and create engagement with new audiences

- Many retailers are seeing locations with shops-in-shop benefit from greater YOY and year-over-three-year visit boosts than those without. These physical locations serve as a platform for brands to maximize their reach, presenting an opportunity for digitally native brands, product-oriented companies, or even struggling retailers

- Format flexibility is key. Small-format stores enable retailers to maximize impact in a given market, reach core audiences, and improve the marketing value of a store with a focus on keeping costs down. On the other hand, larger locations can enable retailers to test experiential concepts and improve distribution capabilities

- The changing role of the office means location will no longer be a primary concern. Office recovery patterns are stabilizing but visit recovery has yet to reach 2019 levels – we can better understand the long-term effects of the shift to hybrid and remote work in 2023

4 Trends Driving Digital Marketing In 2023, AdExchanger (12/05/2022)

(Read more…)

- Focus will shift from branding to performance. While large-name retailers will continue to spend a lot on brand advertising, challenger brands, those in crowded spaces, and DTC brands will restructure and focus shift to measurable results

- Hyper-targeting to drive efficiency. More brands will focus on smaller groups using targeted audience data to efficiently drive returns. Media buyers will use more customized data instead of off-the-shelf data

- End-to-end reporting is going to move to an essential must-have

- Email is expected to undergo a resurgence as an acquisition marketing channel. More brands will use email in conjunction with connected TV, AdWords, etc. to drive reliable responses

Messaging Examples

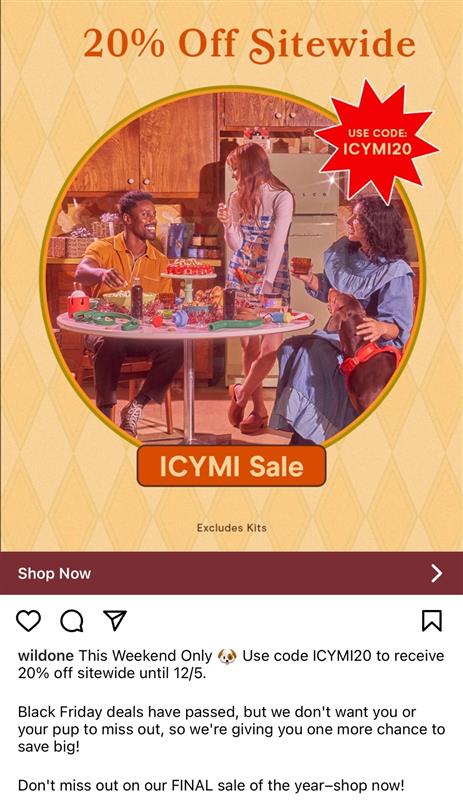

Last Chance!

Back to Gift Giving

Friends and Family

Please reach out to your account team if you have any questions – we are here as a resource and hope you found this helpful.

We’re in this together and wish you success as we approach the end of 2022!