The holiday season is in full swing! To keep you up-to-date on the latest development, we’ve put together a recap of the best industry research.

The NRF expects growth this holiday season! The group predicts a sales increase of 3-4% over 2022.

Though economic headwinds such as the renewal of student loan repayments, diminished consumer confidence, inflation woes, and bleak headlines prove to be challenging, modest growth is in the industry’s future according to the NRF, Deloitte, Adobe, and Customer Growth Partners. Furthermore, growth trends appear to be in line with pre-pandemic results – the average holiday sales growth from 2010 to 2019 was 3.6%.

Holiday Trends and Predictions

Holiday Retail Sales Are Expected to Increase, but at a Slower Pace The New York Times, (11/02/23)

(Read more…)

- The NRF expects holiday sales to increase 3-4% from LY, to between $957.3B and $966.6B

- The group forecasts that ecommerce sales will grow faster than overall sales, jumping 7 to 9% – this estimate is in line with prepandemic results! In 2019, holiday spending increased 3.8% from the year before

- Despite the Fed’s efforts, an economic slowdown has remained elusive as shoppers spent heavily on seasonal items in the fall – the Fed has kept its benchmark interest rate steady at 5.23 to 5.5%, but it could still raise rates again

- Economic headwinds that consumers face heading into the holidays include: Student loan repayments resuming, consumer confidence falling as borrowing costs remain elevated, and heightened credit card balances

- This year’s estimate of holiday sales growth is lower than in previous years – in 2022, holiday sales increased 5.3% from the year before; in 2021, they rose 12.7%

- Average holiday sales growth from 2010 to 2019 (right before the pandemic) was 3.6%

Consumers feast on fun this holiday – Holiday Shopping Survey Report 2023 JLL, (09/27/2023)

(Read more…)

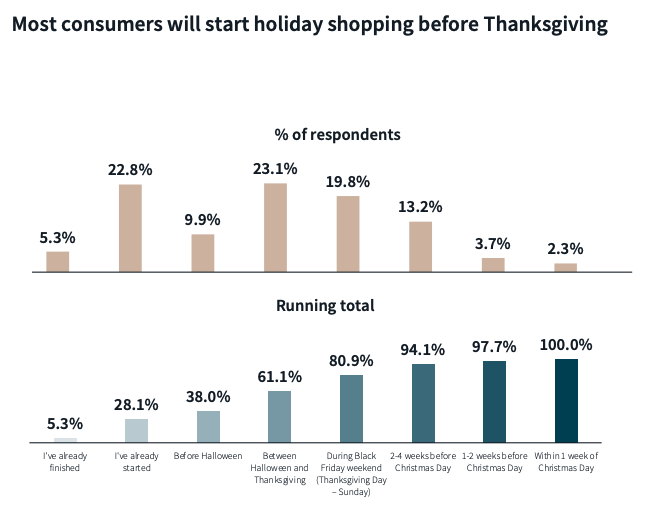

- More than one-quarter of consumers have started shopping for the holidays at the end of September – by the weekend after Thanksgiving, more than 80% of shoppers will have begun

- 40% of modest and moderate earners will start shopping before Halloween compared to only 28.9% of high earners

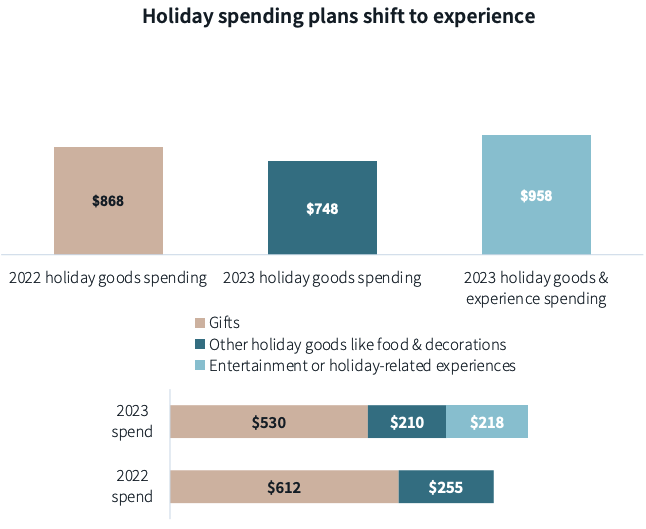

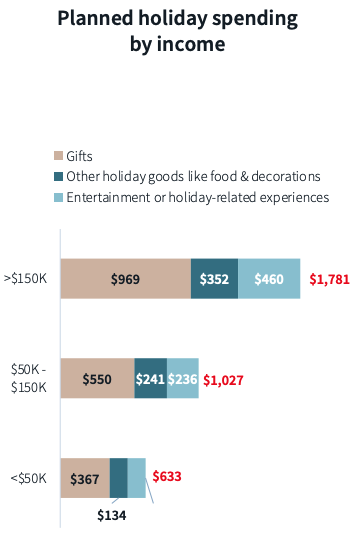

- Holiday shoppers plan to spend $958 per person this season – 22.8% of which will be used for holiday entertainment and experiences

- More than 90% of consumers plan to participate in at least one holiday-related experience – more than they did in 2022!

- Women will spend over 40% more on gifts than men this year. Unsurprisingly, older generations, particularly Boomers, will spend more on gifts than younger cohorts.

- Consumers will not limit themselves to one channel – 57% of shoppers will use two or more channels to cross off their holiday lists. Most consumers will visit a physical retail store this holiday, though more than three-fourths will order online for home delivery.

- Three of the top five gift categories on shoppers’ lists have a fun, interactive element – toys, games, and electronics. Rounding out the top five are clothing and gift cards.

- Continuing a trend of self-gifting, one-third of high-income earners plan to pick up at least three or more gifts for themselves. 76% of holiday shoppers plan to give themselves something this year, compared to 72.6% in 2022. However, nearly half of older shoppers (over 60) do not plan to self-gift, compared to younger consumers. Millennials (30-44) are more likely to spend money on services and experiences for themselves.

- As expected, most shoppers will look for creative ways to save money – taking advantage of sales and deal days, buying less expensive gifts, and shopping for fewer people.

- Consumer price index (CPI) growth has moderated to 3.7% above LY’s levels. Total CPI jumps over 21% since 2019, painting a clear picture: it takes more money to buy the same things now

- High earners (over $150,000) are more likely to cite holiday ambience and enjoying the shopping experience with friends and family as what they enjoy most about shopping in-store during the holidays

- More than one-third of shoppers will turn to Facebook for holiday shopping inspiration, followed by 32.7% on Instagram, 24.1% on Youtube, 23.4% on TikTok, and 16.2% on Pinterest

Research firm predicts sluggish holiday spending Digital Commerce 360, (10/23/2023)

(Read more…)

- Customer Growth Partners estimates holiday spending will increase by just 2.1% over 2022, to $928B from $909B the previous year; that would be the lowest holiday spending growth since 2012

- CGP’s prediction is lower than the estimate from Deloitte, who forecasts holiday spending to grow between 3.5% and 4.6% in 2023

- CGP estimates ecommerce spending will grow 5.1% this year, more than double the growth rate of overall spending, but still below Deloitte’s estimate of 10.8% to 12.8% ecommerce growth, and in line with Adobe’s 4.8% growth projection

- CGP projects the health and personal care category will experience the most significant growth in spending, up 5.2% thanks to growth in the beauty market this year

- Adult beverages, both alcoholic and non-alcoholic, will grow 3.1%

- Apparel will grow modestly at 2.5%, while general merchandise sales will remain stable with projected 1% growth

- CGP expects home retailers will likely see losses – a decrease of 6% in the home furnishings category and 4% in the home improvement category

- Toys and hobbies and consumer electronics will likely see more modest losses, at 2.8% and 2.5%, respectively

Web shoppers will prioritize their holiday spending Digital Commerce 360, (10/24/2023)

(Read more…)

- 87% of consumers will head to brick-and-mortar stores this holiday season

- Three-quarters of shoppers plan to make a purchase online and have the items shipped to them

- Expected shopping is evenly split between online and in-person shopping, with 41% of expenditures expected to happen at a physical store, compared with 42% online, and 17% click and collect

- Most consumers plan to pay with a debit (63%) or credit (59%) card. Nearly half (48%) expect to pay with cash, while 14% will leverage buy-now-pay-later options

American Consumers Gear Up for Festive Season Spending WWD, (11/13/2023)

(Read more…)

- Shopify found that nearly 75% of holiday shoppers will spend the same amount or more on holiday gifts this year compared to LY

- While there was a decline in mall foot traffic during back-to-school, Shopify found that Gen Z is embracing in-person retail opportunities. More than a third of shoppers between ages 18 to 29 said that having an in-person experience is a key factor when making purchases this season, compared to a maximum of 25% in other cohorts

- 80% of customers plan to shop at SMBs (Small and medium businesses) this year; 36% of consumers will be purchasing from SMBs on Small Business Saturday on November 25

- More than 60% of shoppers plan to buy something for themselves or for their household during Black Friday and Cyber Monday

This Holiday Season, Expect Consumers to Be More Frugal WWD, (11/06/2023)

(Read more…)

- 66% of retail executives said “their profit margin targets for the 2023 holiday season are higher than last year,” while 45% of retail executives said “increasing price cutting and promotional activities played a significant influencing factor in their plans for delivering the 2023 holiday season

- 48% of executives said they expect to increase markdowns and promotional activities to lure shoppers in – good news for the 78% of consumers saying price tops the list of most important deciding factors in how they will shop and what they will spend more on this holiday season, followed by value for money (60%)

- 58% of executives are planning loyalty programs and benefits for customers who spend a significant amount of money. Meanwhile, 50% plan to improve the in-store shopping experience.

- Accenture predicts a return to a “peak shopping season” this year – a reversal of prior years, where the holiday shopping season was more elongated. Just 26% of consumers already started holiday shopping by August, compared to 42% LY, and 65% of consumers plan to do their holiday shopping in October through December.

Black Friday and Cyber Week Remain a Major Push WWD, (11/09/2023)

(Read more…)

- 58% of retailers are focusing on Black Friday and Cyber Monday/Cyber Week to drive revenues in the fourth quarter. According to Coveo, top retailers are no longer viewing the time period to solely drive shopper foot traffic, but to also create buzz around their brands and maximize the event’s experience for consumers.

- Top retailer performers are slightly shifting their focus to other strategic marketing opportunities, such as the creation of relevant and personalized offers to increase average transaction value

- 90% of retailers view personalization as a transformative force to end annual special holiday sales within the next three years

- Other focus areas for retailers include strategically timing their inventory sell-through and making effective technology decisions

- More than 50% of retailers reported the implementation of generative artificial intelligence at their contact centers

Record Black Friday Predicted with 74% of Consumers Planning to Shop, as Cost-of-Living Crisis Drives Hunt for Bargains BCG, (11/09/2023)

(Read more…)

- 74% of consumers intend to take advantage of deals during November sales events this year – an increase of 7% versus LY

- Average spend over the course of this Black Friday, Cyber Monday, and Singles’ Day is expected to be $460

- More than 50% of shoppers reported that they have cut back on non-essential purchases in the past three months, 49% check and compare prices more frequently, and 41% buy more based on deals and promotions

Messaging Examples

Early Bird Messaging:

Gifting:

Please reach out to your account team if you have any questions – we are here as a resource and hope you found this helpful. We’re in this together!