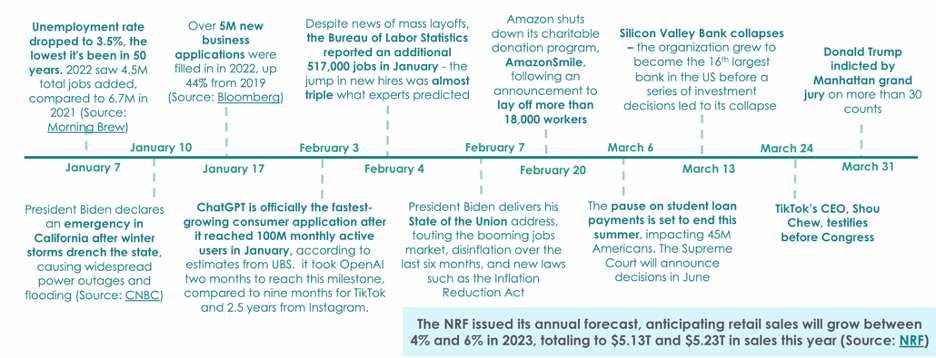

In the first few months of the new year, the retail industry faced a landscape of highly prudent consumers, environmental and economic obstacles, and innovations in the AI space.

The physical store continues to play a significant role in the shopping journey as consumers steadily return to pre-pandemic behavior – however, the NRF predicts full-year GDP growth of 1%, reflecting a slower economic pace and half of the 2.1% increase from 2022.

In the current economic environment, 38% of marketers are putting a bigger focus on building loyalty with existing customers over acquiring new ones. (Source: Marketing Dive)

Q1 Statistics

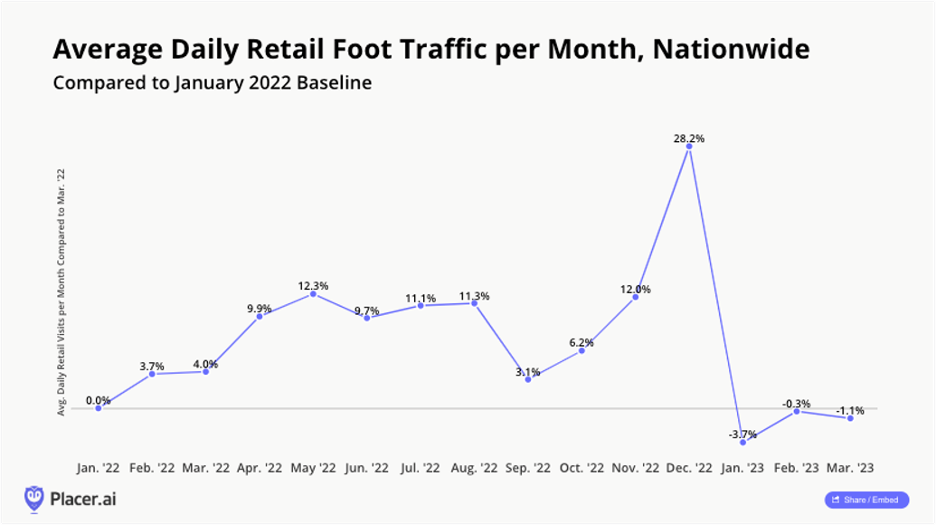

Foot traffic data from Placer.ai shows that monthly retail visits in Q1 2023 were consistently below the January 2022 baseline. This could potentially be due to higher interest rates – rather than the ongoing inflation – impacting consumer spending. (Source: Placer.ai)

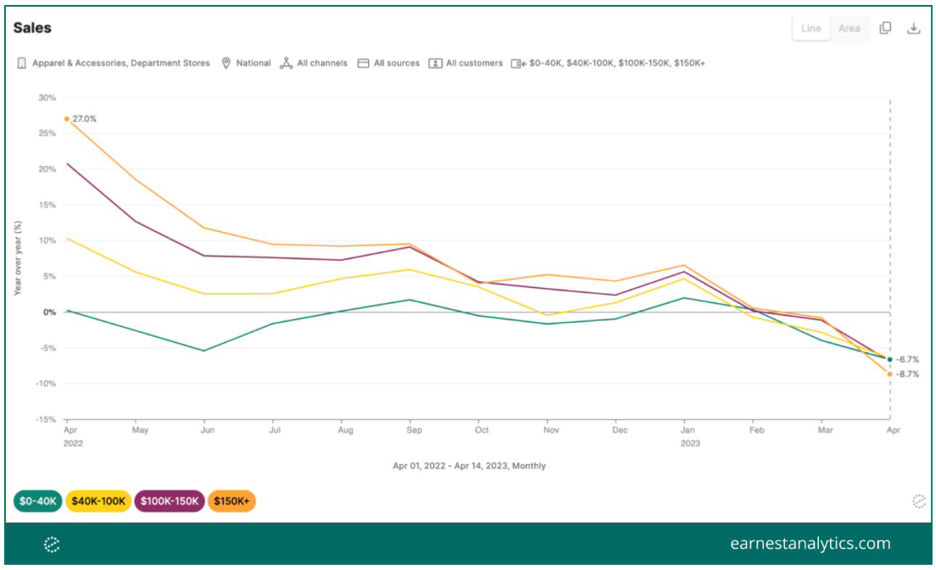

For the first time, we are also seeing high household income consumers driving softness in apparel this spring, as depicted in this chart from Earnest Research. (Source: Earnest Research)

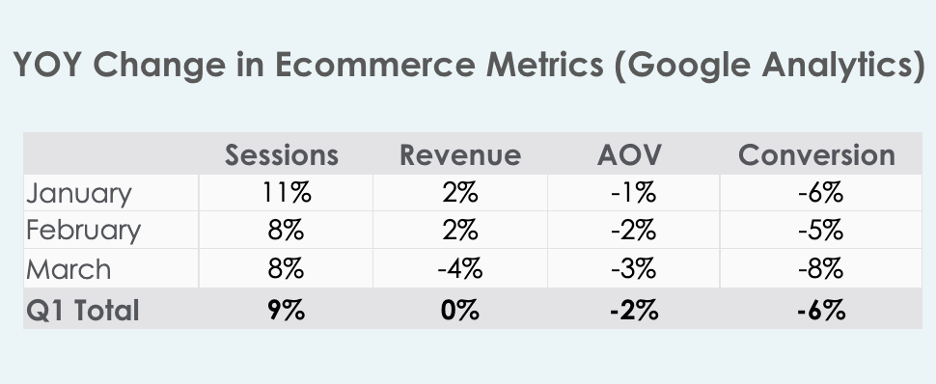

Q1 Ecommerce Results by Month – Belardi Wong Clients

The Q1 season was flat to last year; across our clients, we saw mild growth in January and February, up 2% each month, but March was soft, down -4%.

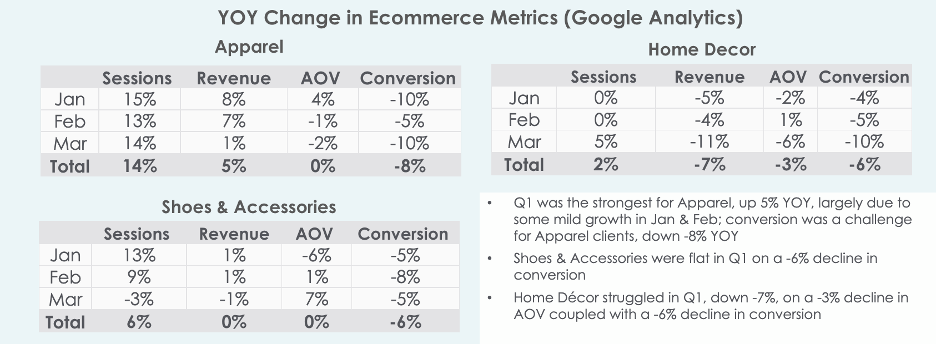

Q1 YOY Change in Ecommerce KPIs by Category – Belardi Wong Clients

Home Décor has seen 15-months of tough YOY comps and declines in conversion, which continued into Q1. Apparel, Shoes & Accessories saw some mild growth to start the year, largely due to increases in sessions. Conversion was a challenge for all industries.

In Summary

Economic Data

- The physical store is playing an increasingly significant role as consumers become more price-conscious and return to pre-pandemic behaviors

- Funding activity dropped YOY, but is still above 2020 levels – investors are more conservative

- Credit is climbing as consumers are stressed by inflationary pressures and a decrease in disposable income

Key Trends

- Conversion was a challenge across all industries – apparel, shoes and accessories saw some mild growth while home décor continued to struggle in Q1

- Consumers are looking for creative ways to stretch their buying power – some are trading down while others are turning to special offers

- High household income consumers are driving softness in apparel this spring

- Advancements in AI are expected to improve content creation, personalization, and product design

What’s Ahead

- It is imperative for brands to strike a balance between brick-and-mortar, online, and wholesale

- Consumers aren’t necessarily looking for cheaper options –brands will need to prioritize improving customer loyalty and establishing their value proposition

- Despite economic headwinds, the retail industry continues to display resilience as new technology matures and consumer behavior normalizes