In an economy facing compounding uncertainties around post-pandemic factors, a will they won’t they recession, inflation, and consumer confidence, the one thing we can be certain about is Spring & Summer holiday performance across our clients. We have used this data to make predictions and recommendations for the Q4 holiday season.

SPRING & SUMMER HOLIDAY PERFORMANCE

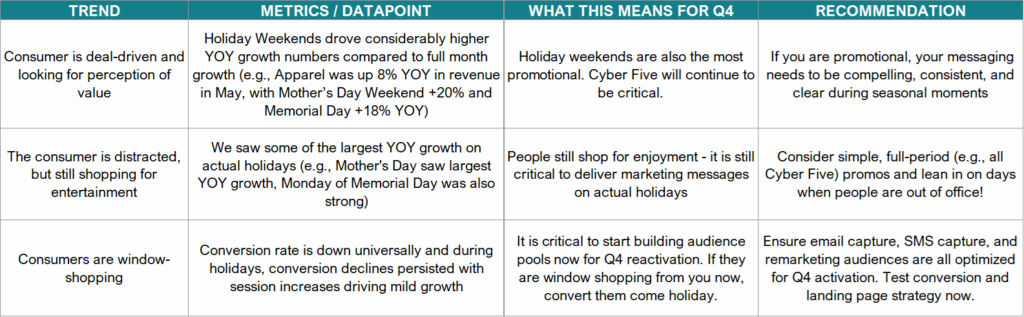

Through a look at the holiday weekends in May and June, we can make data-led assumptions around expectations for the Fall and Winter Holidays.

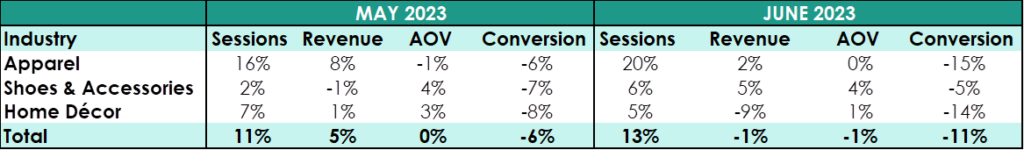

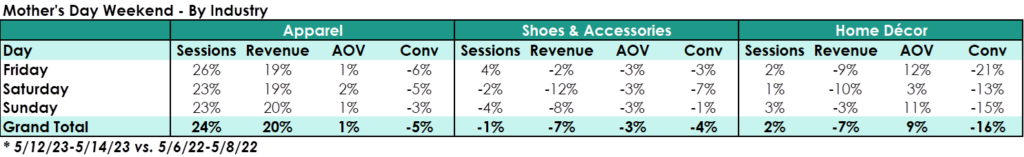

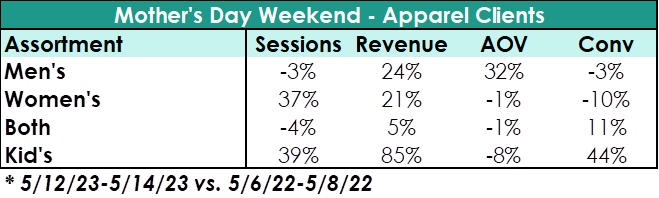

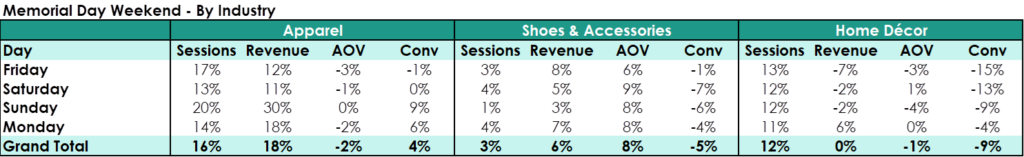

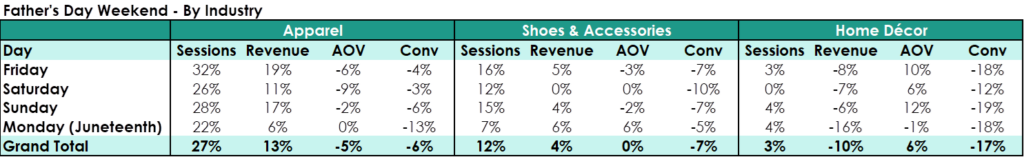

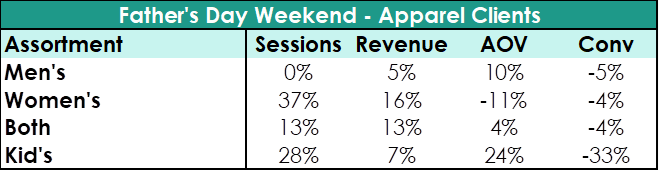

- Apparel saw significant strength over the holiday weekends, especially when compared to the rest of the month. Apparel revenue was up 8% YOY in May, with Mother’s Day Weekend +20% and Memorial Day +18%. Apparel revenue was up 2% YOY in June with Father’s Day Weekend +13%. The positivity was seen across Men’s brands during Mother’s Day and during Women’s brands during Father’s Day.

- KEY FINDING: The consumer is holding out on discretionary purchases, until there is a deal to be had. Promotional/holiday weekends have been driving the growth across brands willing to capitalize on an engaged and value-driven consumer- and we predict this trend will continue into the back half of the year.

- Shoes & Accessories, which consists of higher-ticket, less promotional brands, have not been as affected by the holiday weekends (likely due to less participation in promos).

- Home Décor is seeing universal softness driven by declines in conversion rate. May was positive for the category, up 1%, due to some strength leading up to Memorial Day Weekend. The holiday weekend itself was flat to last year, which we consider a positive given current trends.

- KEY FINDING: Home Décor is in for a tough back-half. Housing market activity is soft overall, which is leading to sluggish performance, so be sure Q4 planning is aligned with current sales trends.