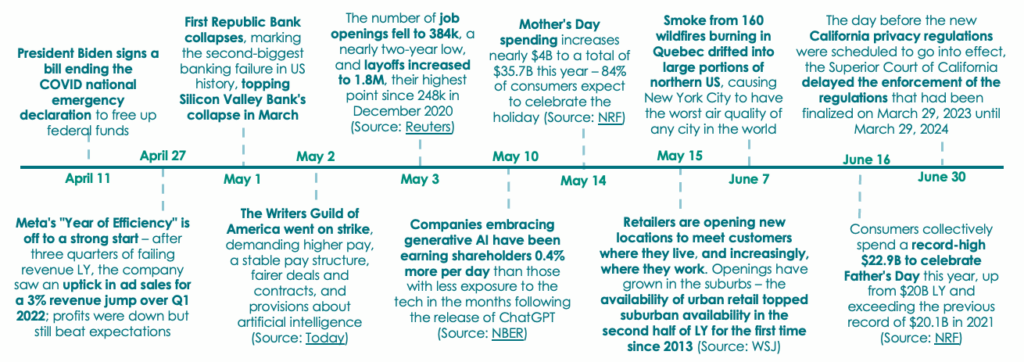

In the second quarter, the retail sector faced economic and environmental challenges as well as heightened competition for wallet share from travel and entertainment. Despite these hurdles, consumers displayed versatility, actively seeking promotional offers and maintaining confidence to spend on summer-related products and experiences.

Q2 began with some softness as retail sales dropped 1% in March month-over-month; consumers grappled with higher interest rates and the impact of a year-long bout of elevated inflation. (Source: Yahoo Finance)

Furthermore, we witnessed a slowing rate of growth across categories since the start of 2023, with demand dropping in April but mild strength in May 2023. Still, spending was up as consumers opted to trade down from their usual brands, switching to lower-cost alternatives, and searching for the best deals available. (Source: Modern Retail)

Despite longstanding predictions of a recession, the economy is holding up better than expected – personal consumption and personal income rose YOY.

Q2 Statistics

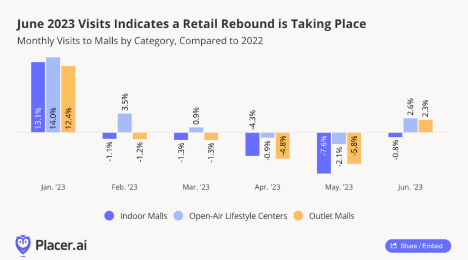

The latest mall foot traffic data suggests that a retail recovery is taking place! After four straight months of YOY visit declines, indoor malls, open-air lifestyle centers, and outlet malls all saw YOY visits rebound significantly in June 2023. (Source: Placer.ai)

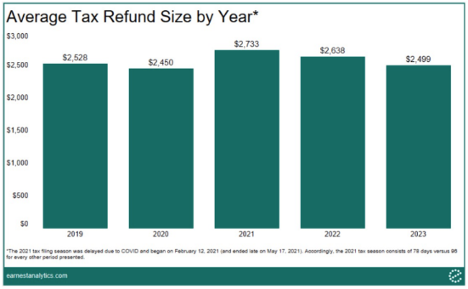

The average tax refund size this year – down 5% YOY to $2499 – was more in line with 2019 and 2020 amounts, following two years of inflated refunds due to the Advance Child Tax Credit and Recovery Rebate. (Source: Earnest Research)

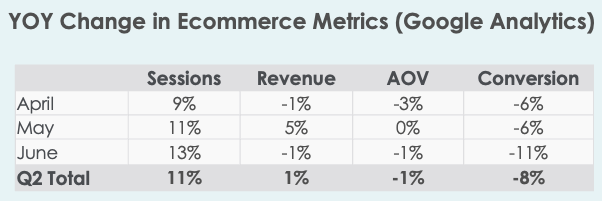

Q2 Ecommerce Results by Month – Belardi Wong Clients

Q2 was up 1% to LY – across our clients, we saw mild declines in revenue in April and June, down -1% each month. However, we saw May pick up +5%.

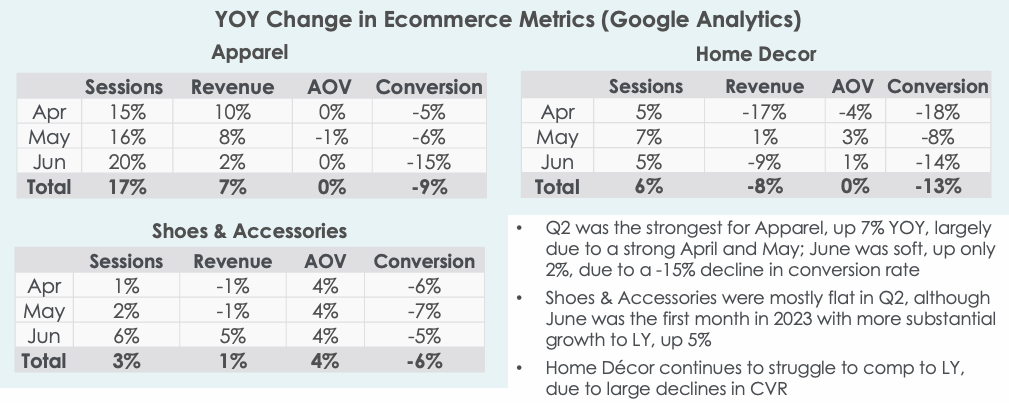

Q2 YOY Change in Ecommerce KPIs by Category – Belardi Wong Clients

Home Décor has seen 15-months of slowing growth and conversion declines, which continued into Q2. Apparel continues to outperform all other industries, while conversion rate continues to be a universal challenge for our clients across industries.

In Summary

Economic Data

- The slowing rate of growth has been ongoing across categories since January of this year, with demand dropping in April 2023 but mild strength in May 2023

- YOY, inflation slowed in May, the lowest 12-month figure in over two years and well below April’s 4.9% annual rise

- Despite longstanding predictions of a recession, the economy is holding up better than expected –personal consumption and personal income rose YOY

Key Trends

- Despite the rise in ecommerce in recent years, brick-and-mortar stores persist as the main sales channel for most goods and services

- Consumers continue to stretch their buying power – they are searching for the best deals, buying secondhand, or trading down where possible

- Marketers and consumers alike are gaining experience when it comes to AI and are utilizing available programs to research and enhance the retail experience

What’s Ahead

- Generative and predictive AI will influence digital sales

- The back-to-school challenge for retailers is predicting where parents will spend when the cost of necessities strains many households

- Personalization will increasingly play an important role in the customer journey

- $500B in excess savings built up during the pandemic and continued employment growth are a sign of optimism for consumers to keep the economy moving ahead