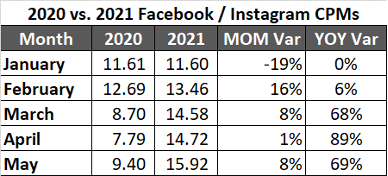

In early 2020, at the height of the pandemic, retail advertisers started to see a fluctuation in Cost per Impression (CPMs) across Facebook and Instagram as brands pulled back spend and impression availability increased as consumers sheltered in place. CPMs hit their lowest point in Spring 2020 – but now in 2021 we are seeing double-digit growth in costs, even compared to pre-pandemic 2020.

This increase in CPM’s is likely the result of increased competition for limited inventory. With states opening up across the country, brands are aggressively trying to take advantage of the pent-up demand as conditions continue to normalize. At the same time, impression availability is falling as consumers move back into the real world and off their devices. In April 2021, we saw Facebook and Instagram CPMs up almost 90% compared to last year! And in May 2021 they were at almost $16, which is up even from February 2020 levels of $13, making profitable acquisition and retention on paid social an increasing challenge.

CPM Changes Across Connected TV & Pinterest:

Connected TV

CTV continues to be one of the new channels that is sparking the interest of retail advertisers across categories. CTV kicked off the first quarter of 2021 strong, growing impressions 14% over the final quarter of 2020, and eMarketer is projecting spend to surpass $13 billion in 2021 and $17 billion in 2022. Programmatic advertising is seeing strong growth within the CTV universe, growing 42% in the first quarter of 2021 compared to the last quarter of 2020. (Source: Adweek)

One of the main reasons for the increased investment is that marketers are realizing the potential scale of this channel which is providing them with a new way to gain incremental reach and further engage with their audiences – especially as Apple iOS means less data and targeting capabilities across Facebook and Instagram.

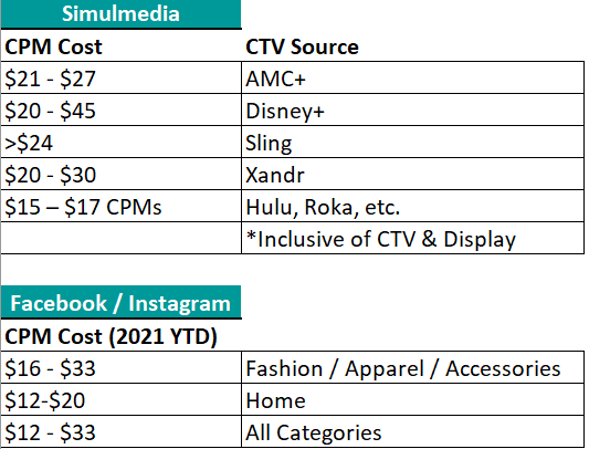

Yet, CTV is still not cheap. We’ve seen CPMs quoted in the high teens and low 20s across major CTV platforms which is comparable to Spring 2021 paid social costs. (Source: Simulmedia & Steelhouse).

Pinterest is another channel that is gaining investment share as brands look to avoid diminishing returns and over-reliance on a single channel. Although mostly used as an exploration tool and a place to gain inspiration, 50% of Pinterest users have made a purchase after seeing a promoted pin that aligned with their interests. (Source: MuteSix)

In terms of CPMs, advertisers could expect to pay between $2 to $5 per thousand impressions from a top of funnel brand awareness perspective – considerably lower than Facebook or CTV. If focusing on boosting online engagement or driving web traffic, advertisers could see CPMs anywhere from $0.10 – $1.50. Despite being a smaller platform with limited reach and reporting capabilities, it is still an effective and less expensive channel to drive impression share and inspire consumers when they are early on in their buying cycle.

Apple’s Latest iOS Updates:

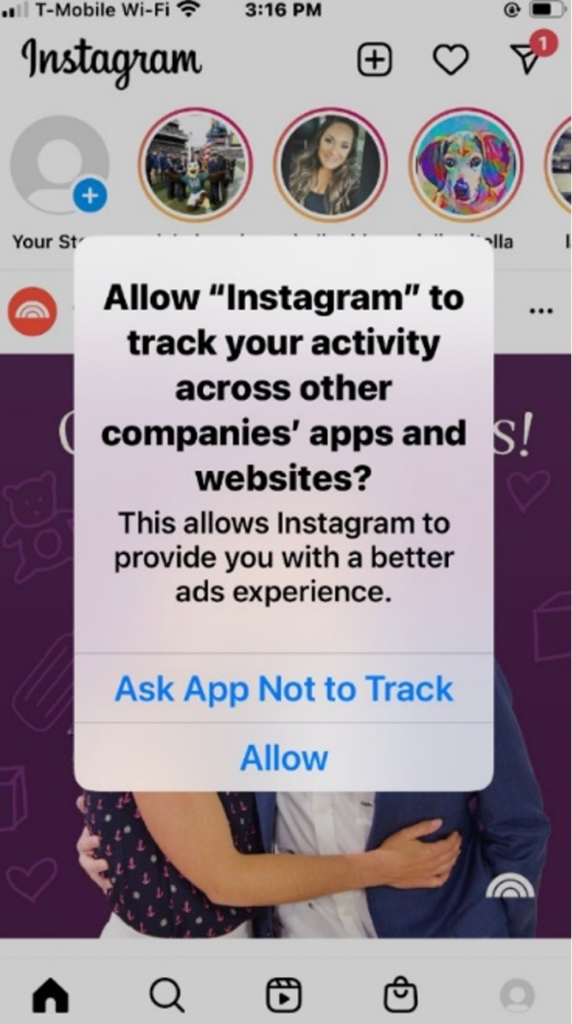

With Apple’s newest software update iOS 14.5, Instagram, Facebook, and most apps are providing users the ability to opt in or opt out. Currently, clients are seeing reporting issues not performance issues, but this could change quickly as Apple rolls out the privacy update. Facebook confirmed it will shape to Apple’s new App Tracking Transparency rules by showing a permission prompt when its iOS app is first opened. According to new data from app analytics firm Flurry, 96% of iPhone users have opted out of app tracking since iOS 14.5 launched which would mean only 4% of iPhone users in the United States have opted into app tracking. From a global standpoint, 89% of iPhone users have opted out of app tracking whereas only 11% of users worldwide have allowed apps to track them.

Those using the Apple email app to check emails will be able to see who their apps are sharing their data with. Brands sending emails will not be able to tell who has opened the emails and IP address will not be tracked. While losing this visibility will absolutely impact performance metrics, brands should continue using bottom-of-funnel email KPIs (e.g., conversions, revenue, clicks) to optimize the channel.

Apple privacy changes should not impact CTV in the same way it will limit paid social and email. Roku’s ID for Advertising (RIDA) – modeled on IDFA – and Amazon Fire’s Advertising ID (AFAI), both supported by DMPs like Salesforce Audience Studio and Adobe Audience Manager, are here to stay and Samsung’s Tizen Identifier for Advertising (TIFA), can mimic Roku’s success – which means no impact from Apple iOS. Other solutions use IP addresses or proprietary pixels and serve only on large screens which will not be impacted like mobile devices.

Looking Forward:

While the specifics of the future of digital marketing is uncertain, it is clear that companies cannot neglect the fundamentals of what makes for great advertising, marketing and consumer experiences while embracing new formats and practices. The fundamentals of digital ads (creative, messaging, product, targeting) will still play a crucial role in profitably converting existing and new customers. Brands will need to continue to find new ways and new channels to reach consumers and provide a stronger consumer experience while diversifying their marketing mix.

As always, we are available as a resource to our clients to discuss any of these trends in more detail!